Gold, the Misery Index, and Insanity

Commodities / Gold and Silver 2016 Mar 29, 2016 - 08:46 AM GMTBy: DeviantInvestor

In 1980 Ronald Reagan spoke about the Misery Index. An economist had added the inflation rate to the unemployment rate, called it the Misery Index, and used it to indicate the social costs and economic difficulty for the middle class.

In 1980 Ronald Reagan spoke about the Misery Index. An economist had added the inflation rate to the unemployment rate, called it the Misery Index, and used it to indicate the social costs and economic difficulty for the middle class.

Today the Misery Index is much smaller than in 1980, thanks to … intelligent fiscal management, economically beneficial monetary policy from the Federal Reserve, and wise political policy from the White House. If you believe any of those, read no further.

Most people will agree that the Misery Index is much smaller today because the numbers have been gimmicked. Does anyone believe a few percent for inflation or around 5% unemployment? Massage (torture) the numbers and the Misery Index declines, incumbent politicians are re-elected, while far too many people remain out of work, earning practically nothing on their savings, and paying too much for food, clothing, drugs, medical care, college, transportation and so on.

What we need for this decade, instead of a Misery Index, is an Insanity Index based on measures than indicate how out of balance, crazy, unsustainable, and dangerous our current fiscal and monetary world has become. Consider a few examples:

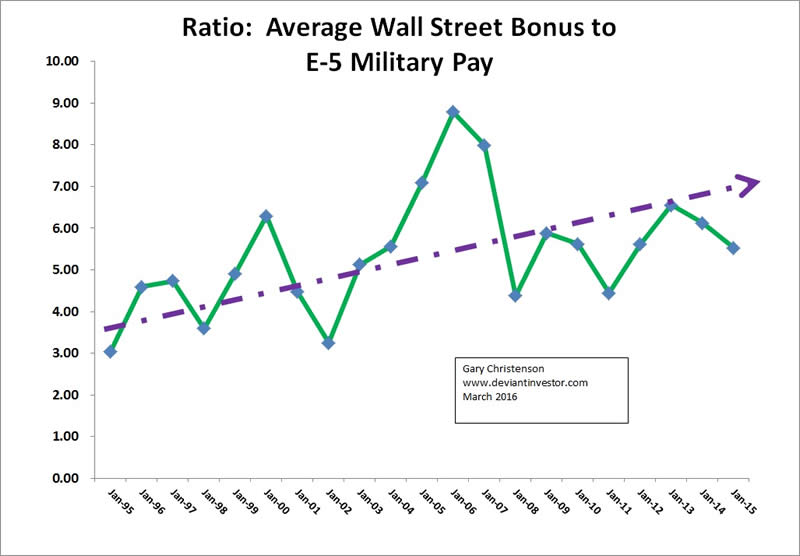

- Wall Street bonuses (in excess of base pay) average around $150,000 per person per year. Obviously some receive significantly more than average. Finance, trading, and “paper pushing” have become incredibly profitable. Compare the average Wall Street bonus to the base annual wage for an E-5 U.S. military soldier. See graph below.

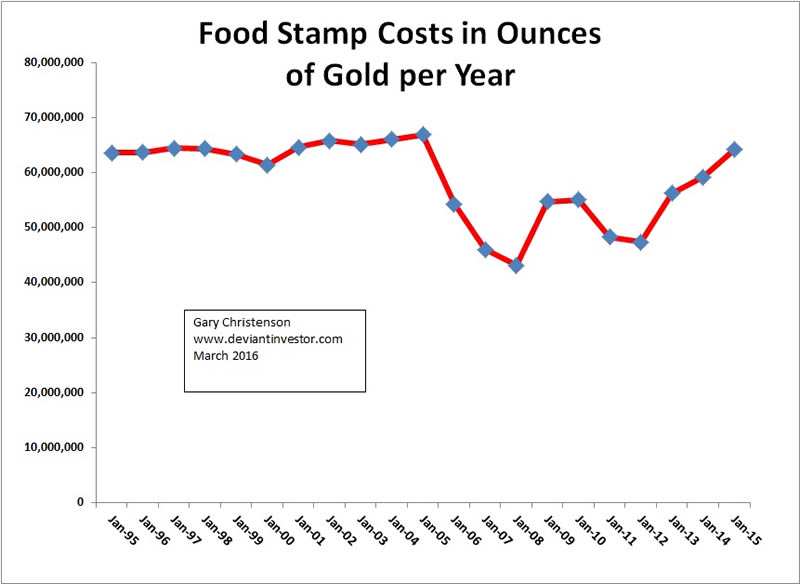

- The SNAP (food stamps) program has escalated from a cost of $15 billion in 1990 to about $74 billion in 2015. Measure the program costs in ounces of gold each year and then try to convince yourself that 60 million ounces of gold each year do not matter. See graph below. Gold is real and can’t be printed like most currencies. The program would “eat up” all the gold in Fort Knox about every three years. Insane!

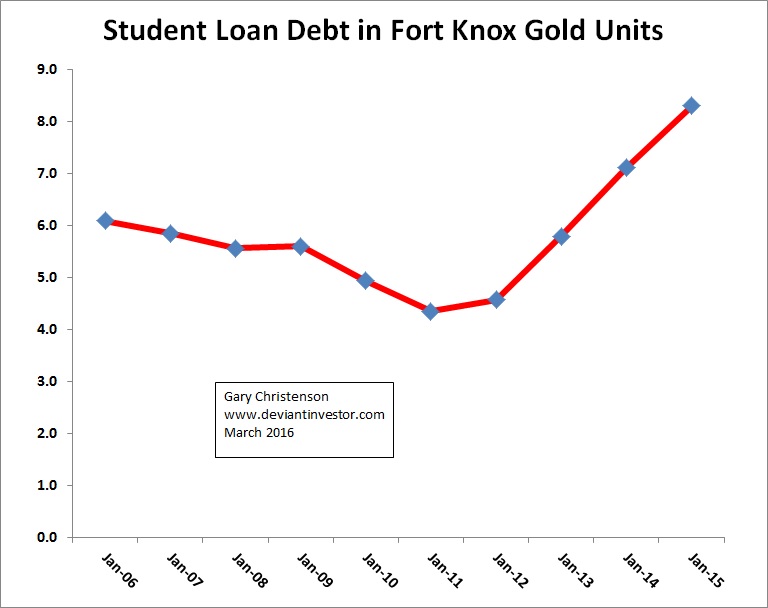

- Student loan debt is approaching $1.4 trillion, climbing rapidly, and has increased about 11.5% per year, ever year, since 2006. The student loan debt, measured in gold, is over 1.1 billion ounces – about 8 times the gold supposedly stored in Fort Knox. See graph below of student loan debt measured in Fort Knox Gold Units – the 147,300,000 ounces of gold that supposedly are vaulted in Fort Knox.

- National Debt (official only – not including unfunded liabilities) currently exceeds $19 trillion, and that debt has increased, and increased, and … increased about 9% per year, ever year, since 1971. The official national debt of $19 trillion, measured in gold, is about 15 billion ounces – around 100 times the quantity of gold supposedly stored in Fort Knox. In 1937 the Fort Knox gold was an asset and a national treasure. Today the U.S. government OWES that national treasure about 100 times … and has what to show for those expenditures and $19 trillion in debt? Insane!

My thoughts:

- The average Wall Street bonus is about five times the annual wage of an E-5 soldier, and the ratio is increasing. Perhaps the economy overemphasizes the value of the Wall Street casino and paper money, and does not appreciate the soldier enough. Short term insanity!

- The Food Stamps program is expensive. How crazy is running a program that spends the equivalent of 60 million ounces of gold each year when the supposed total gold savings of the U.S. is about 260 million ounces, of which 147 million are supposedly stored in Fort Knox? Insane!

- Student loan debt is obviously out of control, increasing rapidly, and may not be repaid unless the Fed and politicians devalue the dollar to near worthlessness. How insane is a program that substantially increases the cost of a college education, creates increasingly unpayable debt, and saddles graduates with a crushing debt load before they are employed?

- National debt, over $19 Trillion, doubles every eight years on average. Given the “spend, spend, spend” mentality of our politicians, military, and entitlement programs, the national debt will probably double even more rapidly in the next two decades. In round numbers the debt will be $20 trillion by the end of 2016. Can you imagine $80 trillion in debt by the year 2032 (two doubles in 16 years)? Borrow and spend may buy votes and military conquests in the short term but in the longer term expect this insanity to bring dire consequences to the people, country, U.S. economy, and the world.

The Insanity Index:

An index could be created – but what is the point? The United States fiscal and monetary policies passed “crazy” long ago, and now are pushing deeper into insanity with negative interest rates, a war on cash, out of touch Federal Reserve policy, insane debt, QE, uncontrolled deficit spending, and a “what could go wrong” attitude. Clearly the “paper game” has a limited life expectancy, Wall Street is due for a reset, government spending programs and pension plans are on life support, food stamps and student loans are two of many programs aggressively pushing the U.S. government into insolvency – and the solution is … negative interest rates, more QE, and a war on cash! Desperate and delusional!

Suppose the U.S. national debt in 2032 exceeds $80 trillion and the system has not yet imploded … what will be a fair price for an ounce of gold or an average house? What will that 30 year T-bond you bought in 2016 be worth in purchasing power in 2032? What will be the purchasing power of your saving account or retirement account or Social Security check? Debt, desperation and delusional thinking do not buy groceries, shelter, and health, or create a vibrant economy.

Bubbles always pop. Delusions can persist for years or decades, but they eventually crash on the rocky shores of reality. Gold and silver were valuable 3,000 years before the first central bank and I submit they will be valuable 3,000 after the world regains monetary sanity.

Given the insanity of endless borrow and spend programs, ever increasing debt, overpriced stocks and bonds, desperation and delusions, and … so much more … have you stacked physical gold in preparation for the inevitable consequences of all the above?

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.