What to Watch For in Gold Price and Gold Stocks

Commodities / Gold and Silver Stocks 2016 Mar 26, 2016 - 05:04 PM GMTBy: Jordan_Roy_Byrne

Gold and gold stocks finally showed a bit of weakness during the holiday shortened week. Gold had its biggest weekly loss in months, losing 3% to $1217/oz while the miners (GDX, GDXJ) declined about 5%. Silver lost 4%. If weakness in Gold and gold stocks continues then we should turn our attention to technical support and see if it will hold. Gold and gold stocks are trading above the 400-day moving average which has been key resistance since 2011. Holding that support in the days or weeks ahead would offer confirmation that a new bull has started.

Gold and gold stocks finally showed a bit of weakness during the holiday shortened week. Gold had its biggest weekly loss in months, losing 3% to $1217/oz while the miners (GDX, GDXJ) declined about 5%. Silver lost 4%. If weakness in Gold and gold stocks continues then we should turn our attention to technical support and see if it will hold. Gold and gold stocks are trading above the 400-day moving average which has been key resistance since 2011. Holding that support in the days or weeks ahead would offer confirmation that a new bull has started.

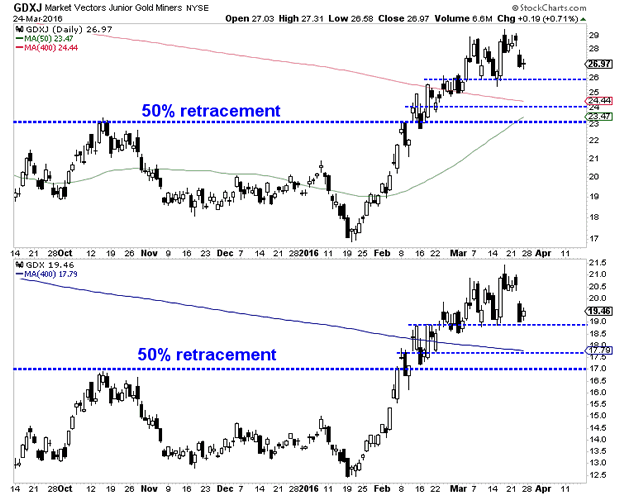

The following chart plots the daily candles for GDXJ and GDX. GDXJ, which is showing more strength has initial support at $26 followed by strong support near $24 and $23. Note that the 50-day moving average, 400-day moving average and 38% retracement of the rebound figure to coincide in the low $24s. Meanwhile, GDX has initial support at $19 with strong support in mid $17s and at $17. The confluence of support in GDX is in the mid $17s.

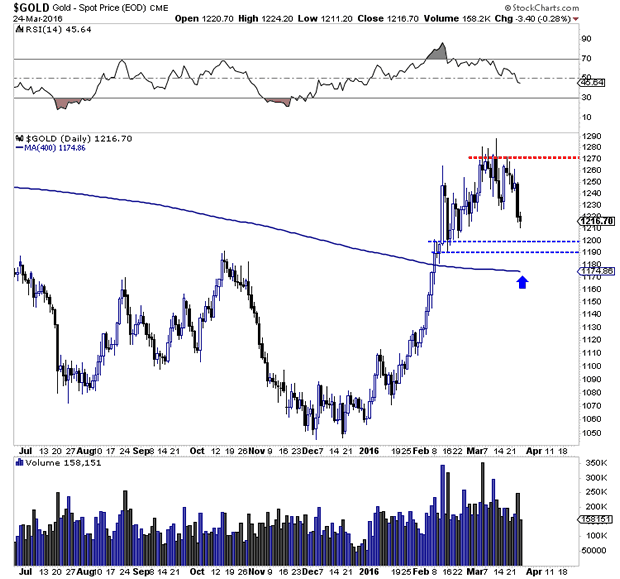

Gold's support is at $1190 to $1200/oz followed by the 400-day moving average at $1175/oz.

The 400-day moving average is important because it contained every rally in the precious metals complex from 2012 to 2015. During that period GDX tested and failed at the 400-day moving average three times. GDXJ tested and failed there once (in summer 2014). Gold spent a few days above its 400-day moving average in early 2015 but that proved to be an aberration. Silver, which has remained below its 400-day moving average since late 2012 failed to exceed it in recent days.

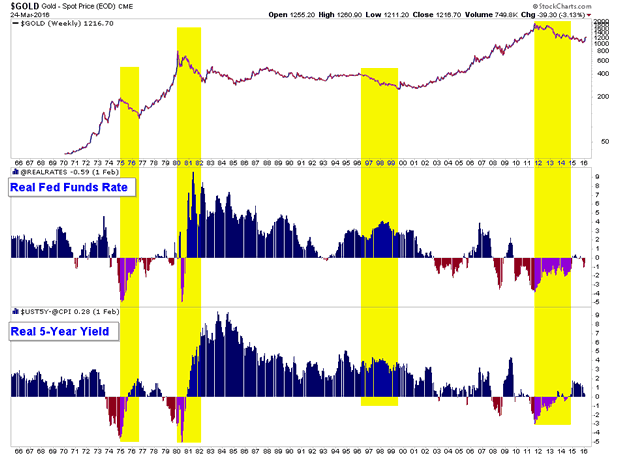

Turning to the fundamental picture, real interest rates (the major driver for Gold) have recently turned in favor of precious metals. As the picture shows, the real fed funds rate is negative again while the real 5-year yield has declined from nearly 2% to near 0%. The fundamental underpinning that precious metals lacked in recent years is now in place.

With respect to the miners, their fundamentals have been improving for over a year. The energy crash has reduced operating costs for many miners by a considerable margin. Furthermore, weakness in many local currencies has also reduced operating costs.

If Gold and gold stocks are in a new bull market then they will hold above their 400-day moving averages and rebound in the weeks ahead. Meanwhile, Silver would vault above its 400-day moving average. Given the forever bear of 2011-2015, there is now widespread fear and consternation about a correction or major rollover in precious metals. It is only natural to feel that after a sharp and persistent downtrend. We would be buyers on pullbacks to the 400-day moving average.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.