Stock Market SPX & Crude Oil at Critical Juncture

Stock-Markets / Stock Markets 2016 Mar 26, 2016 - 04:57 PM GMTBy: Chris_Vermeulen

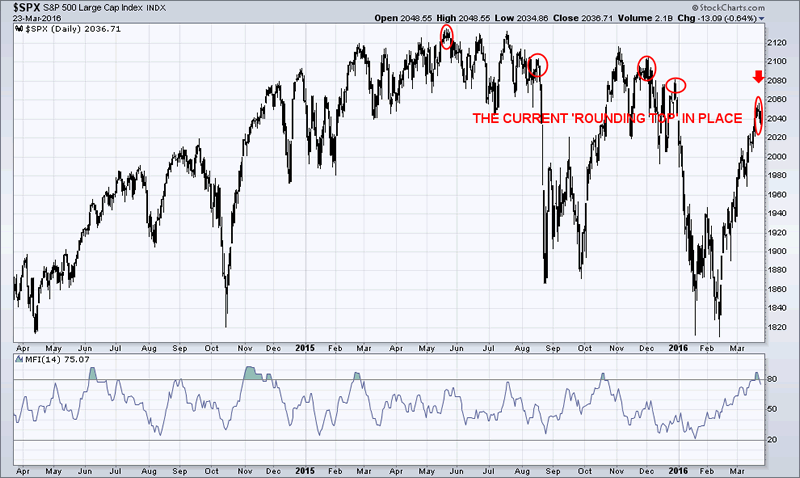

The SPX at the 2050 level looks like a great place for a ‘pullback’ to begin as indicated in the chart below. There is a potential “distribution topping phase” in which the SPX may pull back to 2000. I see a potential target at 1890.

The SPX at the 2050 level looks like a great place for a ‘pullback’ to begin as indicated in the chart below. There is a potential “distribution topping phase” in which the SPX may pull back to 2000. I see a potential target at 1890.

The price has made a series of lower swing highs and lower swing lows since topping in 2015. There was a big August 2015 sell-off, followed by a rally to a lower high in November 2015, then a sell-off to a lower low in January 2016. The rally currently is still at a lower high than the November 2015 high.

Based on data, provided by Investor Intelligence, the bulls are up to 47.4% and the bears are down to 27.8%. This data has been collected from a survey of newsletter writers and investor advisors. This sentiment has changed very quickly and now points to an ‘exhaustion inflection point’ in the SPX. This is a rare and excess ‘swing’ of sentiment within a very brief period of time. It is reflecting that this move upwards is ‘unsustainable’!

A topping phase has now started, but know we could see slightly higher highs during this choppy process.

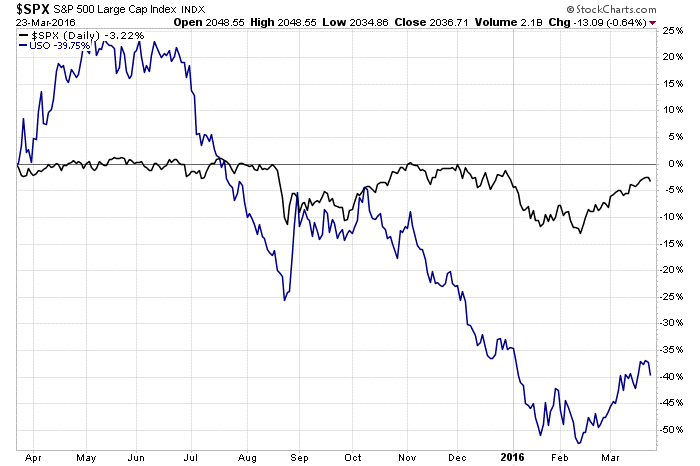

Crude Oil and SPX Comparison Chart:

As long as the WTI Oil does not rally, the SPX will continue its’ decline.

SPX and Oil Trading Conclusion:

I feel oil will hold up and bounce for a couple more weeks and help support the stock market. But once stocks lose their upward momentum and oil starts to fall again – look out below!

Find out when to buy and sell the key indexes, sectors and commodities with my ETF trade alert newsletter: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.