Fiscal and Monetary Madness

Currencies / Fiat Currency Mar 25, 2016 - 01:48 PM GMTBy: DeviantInvestor

Global Currencies Madness:

Global Currencies Madness:

When central banks and politicians “manage” global currencies, we can expect:

- Exponentially increasing debt and currency devaluations

- Massive inflations and deflationary crashes.

- Transfer of wealth from the many to the few.

- Derivatives exceeding $1,000 Trillion and eventually a crash.

- A mathematically inevitable financial collapse.

- Monetary and fiscal madness.

- Booms and busts.

- Much higher gold and silver prices.

It has happened before and it will happen again…

Last Century Madness:

- Weimar inflation in Germany 1921-1923: The exchange rate for Marks changed from 90 Marks to the US dollar in 1921 to over 4 Trillion Marks to the US dollar in about 2 years.

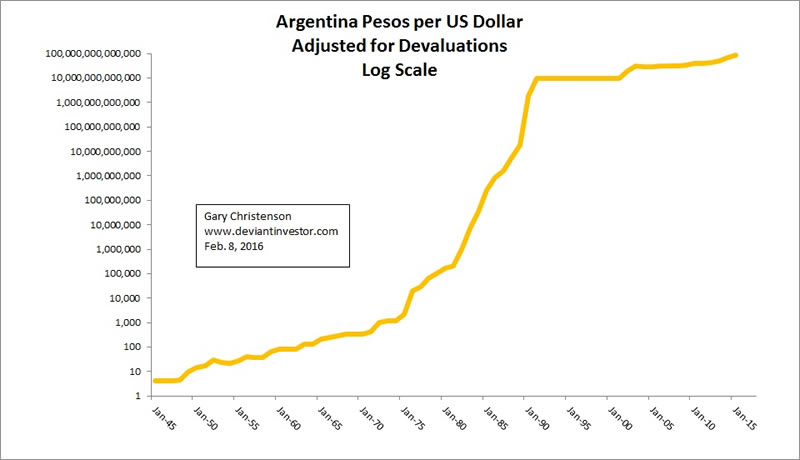

- Argentina devalued their peso and exponentially expanded the currency in circulation so rapidly that Argentina lopped off 13 zeros since 1950.

- Zimbabwe printed so many trillions of Z-dollars that inflation, according to Wikipedia, exceeded 200 million percent in 2008.

Current Monetary Madness:

Japan has created a national debt that exceeds 1,000 Trillion yen, about 250% of their GDP. According to the IMF, Japan’s debt is “unsustainable.”

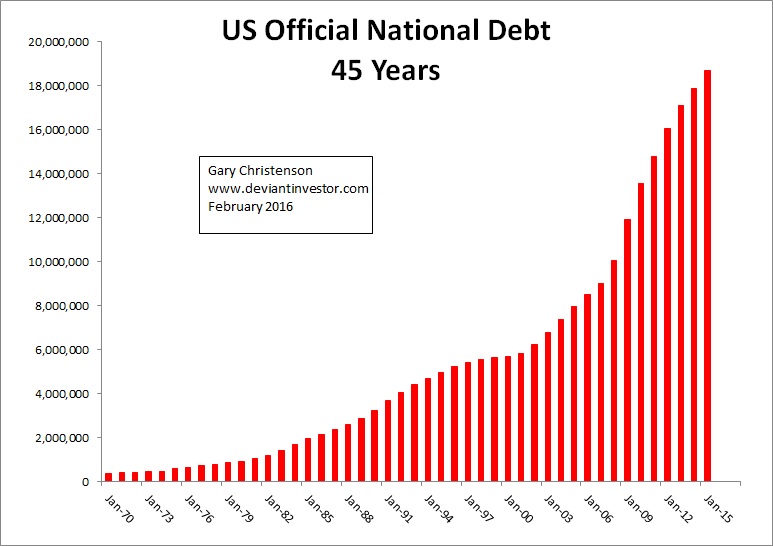

The US national debt (official only) currently exceeds $19 Trillion, up from $398 Billion in 1971, $5.6 Trillion in 2000, and $10.1 Trillion in October 2008. National debt has increased at a compounded (exponential) annual rate of about 9% per year since 1971.

Does anyone expect the debt will be repaid, reduced, or even stabilized? I think it is clear that the debt will be rolled over and increased until it must be inflated away or defaulted. This is political and central bank supported monetary madness. Exponential increases inevitably end badly.

(The U.S. version of monetary madness.)

(The Argentina version of monetary madness.)

Central Bank Monetary Madness:

Exponential debt increases appear normal in a central bank controlled financial world that benefits the political and financial elite at the expense of the middle and lower classes. QE, ZIRP, and NIRP (negative interest rates) are recent examples of central bank responses to their self-created problems of debt based fiat currencies, exponential increases in debt, and uncontrolled deficit spending by governments. Fiscal and monetary madness prevails!

Ambrose Evans-Pritchard on the DANGERS of negative interest rates:

“Huw Van Seenis, from Morgan Stanley, calls negative rates (NIRP) a “dangerous experiment” that undermines the mechanism of quantitative easing rather than enforcing it…”

“Narayana Kocherlakota, ex-head of the Minneapolis federal Reserve, reluctantly backs NIRP as deep as -3% but calls it a “gigantic fiscal policy failure” that central banks must resort to such absurdities.”

“Morgan Stanley said that once negative rates fall below 0.2%, the damage to bank earnings goes “exponential” and ultimately endangers the whole system of free banking in Europe that we take for granted.”

My comment: The financial world is descending into an abyss of monetary madness as indicated by:

- Negative interest rates are a “dangerous experiment” and NOT a solution. ($7 Trillion and counting…)

- “gigantic fiscal policy failure” – (They address the consequences of bad policy with worse policy!)

- “damage to bank earnings goes exponential” – (And then what? Bail-ins and bail-outs? More QE and even more negative interest rates? Banking collapse?)

- the debt will never be repaid – (It looks like a safe bet.)

- “helicopter money” – (When all else fails…)

CONCLUSIONS:

- A world of fiat currencies “managed” by central banks descends into the trap of exponentially increasing debt that leads, slowly or rapidly, toward monetary madness and … Train wreck ahead!

- QE has morphed into $7 Trillion of global sovereign debt “paying” negative interest rates. Think “gigantic fiscal policy failure.” At almost any other time in history negative interest rates would have been viewed as insane policy. Monetary madness or … desperate to do something?

- Gold and silver are better solutions and are antidotes to central bank devaluations. One might object to gold for many reasons but those reasons seem minor or irrelevant in the face of exponentially increasing (unpayable) debt, negative interest rates, and ongoing monetary madness.

We have been warned!

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail. My books on Amazon

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.