Inflation and Oil Ratio Bullish for Precious Metals

Commodities / Gold & Silver Jul 14, 2008 - 11:18 AM GMTBy: Captain_Hook

Don't tell this to the price fixers though. Apparently it's fine and dandy to let all other ‘commodities' rise in allowing this inflation thingy blow-off, but not gold, and especially not silver since it's so easily controlled. What kind of a message would that send to the investment world? If silver were allowed to rise, well, then it wouldn't make a lot of sense for gold to be odd man out considering its vital role in the economy, that being the ultimate measure of currency. In fact, if other vital commodities are rising sharply, already it makes little sense gold has not risen further, especially with the world's present ‘reserve currency' the fiat dollar in decline. So again, it would be especially troubling if silver were to begin rising impulsively and gold was left behind from this perspective.

Don't tell this to the price fixers though. Apparently it's fine and dandy to let all other ‘commodities' rise in allowing this inflation thingy blow-off, but not gold, and especially not silver since it's so easily controlled. What kind of a message would that send to the investment world? If silver were allowed to rise, well, then it wouldn't make a lot of sense for gold to be odd man out considering its vital role in the economy, that being the ultimate measure of currency. In fact, if other vital commodities are rising sharply, already it makes little sense gold has not risen further, especially with the world's present ‘reserve currency' the fiat dollar in decline. So again, it would be especially troubling if silver were to begin rising impulsively and gold was left behind from this perspective.

The following is an excerpt from commentary that originally appeared at Treasure Chests for the benefit of subscribers on Friday, June 27 th , 2008.

Of course gold and silver are not commodities, but instead currencies. This has been gold's roll for since before Christ, that being the primary store of wealth and medium of exchange amongst the human race. From time to time in man's history gold's role as money has been minimized however, with the present episode most profound ever. Since Nixon closed the gold window in 1971, the fiat currency based party started slow, but has now grown into a surreal misadventure in bubble-economics that is sure to end in hyperinflation – and then collapse. Some think the present stagflation condition is enough to engender collapse, and who knows, maybe they are right.

In the meantime however, we still have accelerating inflation to deal with, where at some point gold and silver will be called on to properly reflect this as alternative currency to fiat dollars. As implied above, the populous has become sleepy on this issue, continually placated by a corrupt bureaucracy with what appear to be free gifts . Things are about to change in this regard however, as it will soon become evident such measures are not enough to stem the tide of a collapsing credit cycle . And while it's true broad money supply measures remain well contained at this time, change is inevitable here once the bureaucracy panics once again, where precious metals will sniff this out immediately as a discounting mechanism in this regard. The last time such an episode was witnessed was between 1997 and 2002, and we are still dealing with its effects on prices.

And as alluded to above, it might just be silver that leads the way in this process considering the shenanigans going on in this market, where under the guise of serving the public's interest, our self-serving bureaucracy has aggressively suppressed its pricing. Here, with the extent of the situation well documented , and increasing numbers of the public being angrily awakened from slumber with what can only be described as rude price increases on a standard of living previously taken for granted, process should unfold rapidly as well. The public will need somebody to blame for this mess, and enough of them will figure out it's the bureaucracy that's at fault and retaliate. This will come in not only calls for reduced spending, but also in the abandonment of a failing system.

As the ultimate measure of a nation's health, it's the currency that will be attacked on the most profound level, and then the real estate, stock, and bond markets. And as you undoubtedly know, process has been unfolding in this regard for some time already, with a collapsed real estate market, and now stock market with a penetration of 1300 (the large round number) on the S&P 500 (SPX) , as per our comments on the subject the other day . And while a testing process in July could delay an acceleration lower because several key index related open interest put / call ratios have ticked back up post the June expiry, it's important to understand this will only delay the inevitable, even if it takes until next year to follow through in earnest as per the Martin Armstrong Pi Cycle .

I don't think it will take that long however, as the US consumer / economy is collapsing far too quickly for this to be dragged out that long. How do we know this for sure? Believe it or not, this can be forecast by looking at Chinese stocks. Here, you may remember it's been our view for some time that the chart of the Chinese stock market resembles that of the South Sea Trading Company , and that a 100-percent retrace of the bubble that took less than 2-years to build (like the South Sea Bubble), would signal that on a global basis, we are dealing with a Grand Super-Cycle Degree economic / market debacle at present. And sure enough, as you can see in the attached above, Chinese stocks continue to deflate, making one wonder whether authorities will be able to stem the tide prior to the Beijing Olympics.

Be that as it may, one thing is for sure, if Chinese stocks do indeed continue to deflate in counter-bubble like fashion (crash), one could only come to one conclusion based on such a result – that being the global economy is contracting / crashing. (i.e. if the Chinese economy is contracting / crashing, this means consumers around the world are demanding less cheap manufactured goods in similar degree.) So, this is why I am suggesting such an outcome would likely be a far better indication of future business conditions not just in China , but also in the US , than just looking at domestic factors / variables. What's more, stocks are future discounting mechanisms, providing a ‘heads up' about future business conditions.

Along these lines, and in relation to the ‘big picture', you should know the primary reason Chinese stocks are declining is because of the effects of inflation on prices, and the things officials must now do to slow these rising prices. This of course calls for higher interest rates, which is a global condition even if Administered rates in the US are on hold indefinitely . Of course this will not prevent market rates from rising further, at the wrong time. Here, if US market rates are dragged higher by global arbitrage, not only will this put pressure on the Fed to be responsible, it will also put a great deal more pressure on already fragile credit markets in the States, potentially causing a ‘house of cards effect' spreading to other markets. With any luck, this will be when gold and silver will be seen as alternative currency on a broader scale.

And based on the speed at which things are happening these days, this is it's bound to happen sooner than later, especially when the Fed is fully defrocked in terms of its ability to lie. When will this be? Answer: When it's broke, which will be when it runs out of assets. At the current rate of depletion, where the Fed is now committed to swap its portfolio of Treasuries for all the bad paper its fraudulent agents have been passing off to the public, the Fed's Portfolio will be gone by Christmas, or early 2009. This of course will mean the only means the Fed will have to continue playing the game will involve the printing press, which will be a ‘death-knell' for the dollar. Gold and silver should begin discounting such a development well before it becomes a reality however, which means even if price managers are able to keep a lid on things through summer, typical seasonal strength should occur this fall and winter.

That is to say while price managers may be able to keep precious metals contained a few more weeks, eventually such efforts will fail along with the dollar ($), as described above. In this regard, and as mentioned numerous times of late, financial markets are largely influenced by hedge funds these days, where they tend to trade in predatory packs on a quarter-to-quarter basis. And for the present quarter, dominant groups have thrown in their quarter with the bureaucracy in a counter-trend trade – that being long the $ / stocks and short commodities / precious metals. Due to the fact this trade configuration has been unsuccessful however, where a collapsing credit cycle will simply not allow for meaningful corrections in secular trends, at quarter's end next week, a good number of participants will likely be quick to reverse course, which would bring an impulsive tone back into precious metals trade as out-performance is sought.

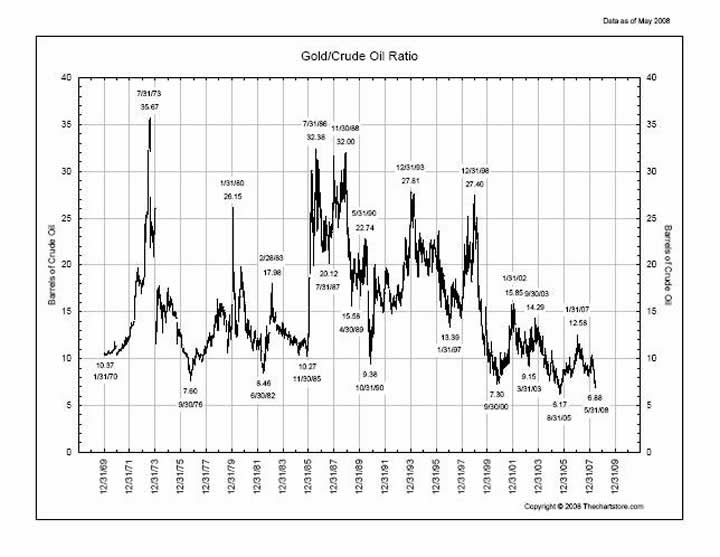

How can we be sure precious metals are poised for out-performance? There is definitely no rocket science involved here, with Tuesday's observations regarding the Gold / Crude Oil Ratio as good a place to start as any. Based on the title of this piece, that being ‘Precious Metal's Relativity Insurmountable Issue', you might have already surmised where the primary message behind this commentary was heading. And certainly there is no better example of why gold and silver prices are well supported at current proximities than their relationship with crude oil. Here, it should be noted we are at historic / all-time lows, with the structural configurations discussed Tuesday suggestive a turnaround in imminent. This is a long-term chart of the Gold / Crude Oil Ratio showing the trade throughout the entire post gold window epoch. (See Figure 1)

Figure 1

As you can see above, gold is indeed poised to outperform crude based on historical precedent, which will invariably lead to positive nominal returns given oil prices are well supported at current prices considering peak oil, speculation, and currency considerations. One must remember crude oil has been rising while the $ has had its correction higher. And while a declining $ in the second half of this year may not necessarily lead to substantive gains in crude oil given the run already witnessed, simply having a firm tone should do wonders for gold (and silver). It's the relativity you see, and not just against crude oil as well. (See Figure 2)

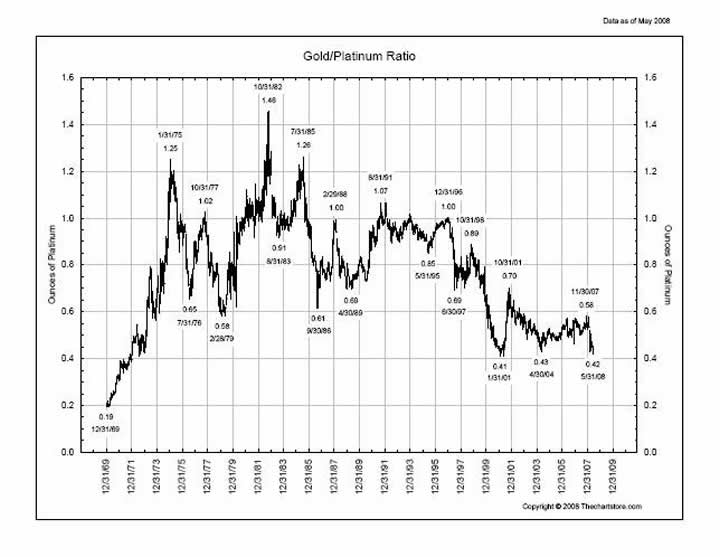

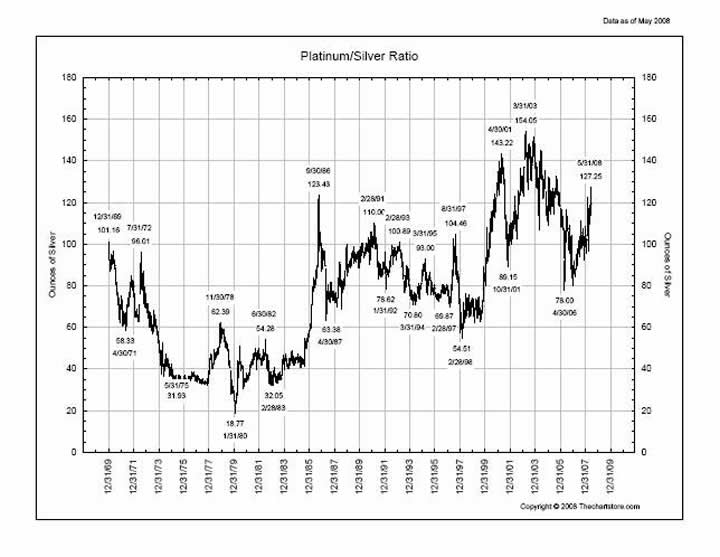

Figure 2

Indeed – not just against crude oil – where above you can see gold is also at historic lows against platinum as well. Can you see a pattern here? Of course there are a few, but from a causal perspective, it should become obvious to even the most casual of observers that something is not right when all the commodities of the world are rising faster than gold. (i.e. in a perfect world it should be the other way around, with gold discounting future inflation / price gains.) So obviously something is wrong with this discounting mechanism, it's either that or the market sees deflation around the corner. Based on a growing monetary base however, we know deflation is not present in macro-conditions at present, although deflating asset bubbles make it appear this way to those suffering losses.

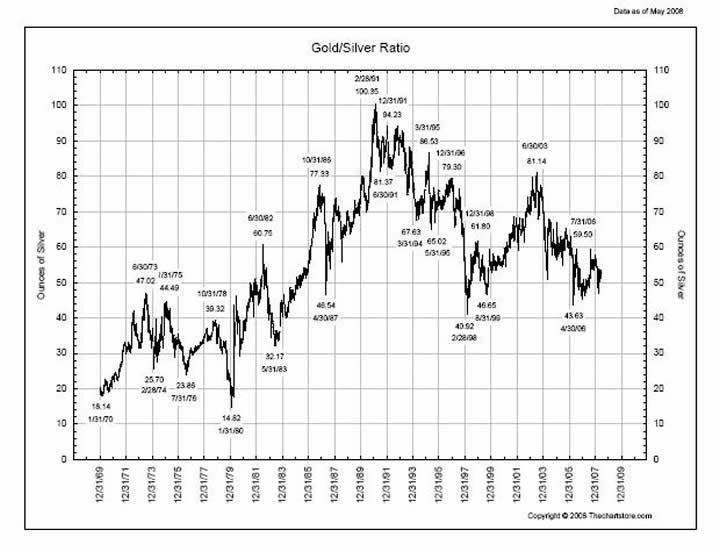

So the question then begs, what could be wrong with gold as a discounting mechanism? Unfortunately the answer to this question is not a nice one, where the sensibilities of linear thinkers prevent many from drawing proper conclusions. Of course we are referring to the complex maze of official sector suppression of precious metals prices, where in fact efforts to keep a lid on silver prices border the lunatic fringe . Why do price managers place such importance on keeping silver prices contained? Because of the fact gold and silver are joined at the hip in terms of both being currency alternatives, with the former superior to the latter. If this is true however, again one may ask why go to such lengths to keep silver suppressed if gold is more important? Answer: It's in history again, that being the historic relationship silver and gold share. (See Figure 3)

Figure 3

As can be seen above, within inflationary times, silver to gold relativity brings extremes closer to 15 than 50, which is where we are right now. Of course this is the opportunity, where if you do the math here, assuming gold goes up to its Consumer Price Index (CPI) adjusted 1980 price of approximately $2400, then at even just 20, silver would go to $120 before the party is over. At 15 this would obviously be much better, with silver running all the way to $200. And if shadowstats.com is correct about inflation over the past 30 years, then gold should rise to $5000. We will let you do the math on that one in terms of where silver is going if gold runs all the way to $5,000.

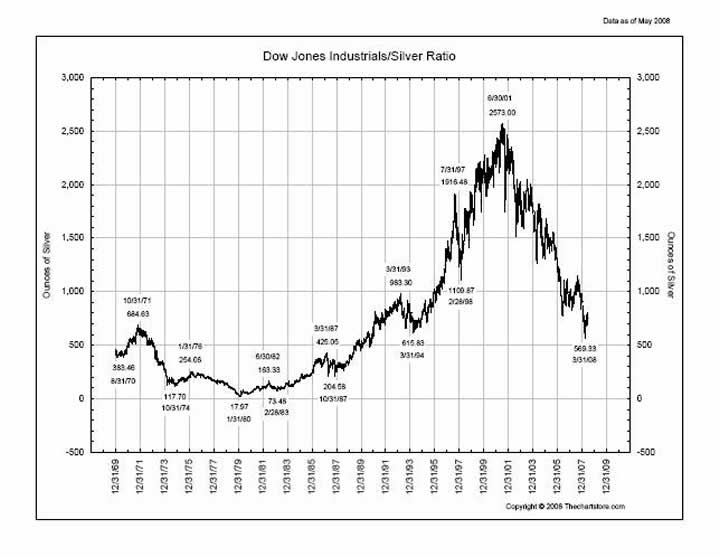

Did you do the math? Does this figure seem impossible to you? If so, keep in mind that markets like to do what the majority of participants think is not possible. In this respect, right now the bullion banks believe it's not possible for them to lose control of the silver market, which as we have been saying, is why silver will lead the next leg of the precious metals bull market when this occurs. What's more, most market(s) participants still believe silver is a dead asset class, and that the stock market is still the place to be. This is why in spite of the stock market breaking long-term support(s) yesterday, no panic exists as of yet, seen here in still low put / call ratios and VIX . This is of course why stocks will keep falling then, because of complacency towards the decline. Eventually the lights will come on for increasing numbers however, who will then switch from stocks to the newly perceived safety of precious metals, which will crash stock(s) to silver ratios. (See Figure 4)

Figure 4

The head and shoulders pattern in the Dow / Silver Ratio is the structural underpinning behind this hypothesis, where because the majority of market participants do not see this relationship, the pattern should trace out. Additionally, it should be pointed out that the above confirms the multidimensional nature of precious metals relativity beyond the widely followed Dow / Gold Ratio, meaning precious metals should be measured against things other than just commodities. This of course expands on the understanding gold and silver are currencies, not commodities like bankers would like you to believe.

In doing the math associated with the above, and to show you the number associated with gold running to $5000 is not impossible (if the Dow / Gold Ratio goes to unity at the climax of a Grand cycle), then at 18, the Dow / Silver Ratio yields a value of approximately $280. And while not as high as the $350 (5000 / 15) one gets in calculating optimal outcomes based on gold to silver relativity, this exercise / understanding does support the contention silver is headed much higher – much higher. Heck – in terms of its move against platinum, it hasn't even begun yet. (See Figure 5)

Figure 5

Unfortunately we cannot carry on past this point, as the remainder of this analysis is reserved for our subscribers. Of course if the above is the kind of analysis you are looking for this is easily remedied by visiting our newly improved web site to discover more about how our service can help you in not only this regard, but also in achieving your financial goals. For your information, our newly reconstructed site includes such improvements as automated subscriptions, improvements to trend identifying / professionally annotated charts , to the more detailed quote pages exclusively designed for independent investors who like to stay on top of things. Here, in addition to improving our advisory service, our aim is to also provide a resource center, one where you have access to well presented ‘key' information concerning the markets we cover.

On top of this, and in relation to identifying value based opportunities in the energy, base metals, and precious metals sectors, all of which should benefit handsomely as increasing numbers of investors recognize their present investments are not keeping pace with actual inflation, we are currently covering 70 stocks (and growing) within our portfolios . This is yet another good reason to drop by and check us out.

As a side-note, some of you might be interested to know you can now subscribe to our service directly through Visa and Mastercard by clicking here .

And if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these matters.

Good investing all.

By Captain Hook

http://www.treasurechestsinfo.com/

Treasure Chests is a market timing service specializing in value-based position trading in the precious metals and equity markets with an orientation geared to identifying intermediate-term swing trading opportunities. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested in discovering more about how the strategies described above can enhance your wealth should visit our web site at Treasure Chests

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities, as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2008 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

Captain Hook Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.