Stock Market Trendlines May be Crossed Today

Stock-Markets / Stock Markets 2016 Mar 23, 2016 - 01:06 PM GMT Good Morning!

Good Morning!

The SPX Premarket attempted to stay above the trendline in overnight action. However, it has lost upward momentum without making a new high and is threatening to cross beneath the short-term rally trendline.

The larger 4.3-year trendline is still the most important, so a decline below 2040.00 may indicate that the longer trendline is also being taken out.

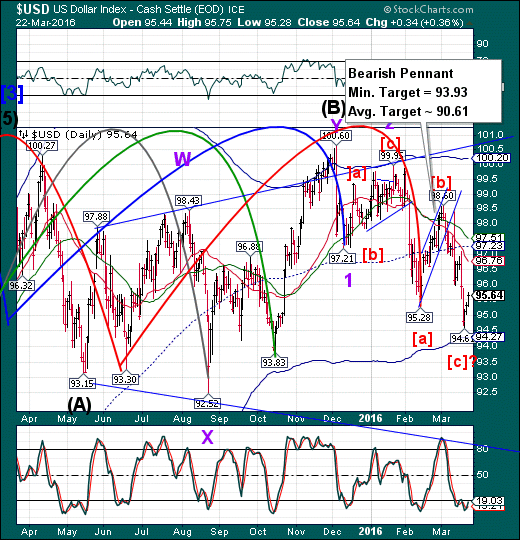

USD futures have climbed to 96.08, creating more overlap in the Wave structure. Wave [c] may not be complete, but the current action makes analysis more difficult. For the moment, I stand by my call that Wave [c] may drop even lower, since a Wave [c] of 3 is generally larger than [a]. Wave [c] must reach 93.92 simply to be equal with [a]. Otherwise this appears to be an oddity in the Wave structure.

Could the Central Banks be at it again? The reason I say this is because USD/JPY is on the rise again, perhaps to stimulate a potential rally in SPX.

At the moment, SPX isn’t paying it any attention.

ZeroHedge reports, “…But while equities remain surprisingly uneventful despite loud warnings by both JPM and Goldman now that another bout of volatility and equity downside is coming, in FX there has been a substantial change, one which has seen the US dollar rise for a fourth day, the longest winning streak in a month, driven by the latest round of hawkish Fed jawboning courtesy of the Chicago Fed's Charlie Evens yesterday, which in turn has pushed down prices of oil, gold and copper.”

VIX futures have flat-lined in the overnight market. However, it also closed very near its Pennant trendline. What’s surprising is that the bottom has been flat since last Friday when it last made a low of 13.75.

Dana Lyons reports, “Data from the volatility market suggests that expectations in the near-term may have finally gotten a bit too complacent.

For the duration of this post-February stock rally, we have been consistent in noting the tepid, or even skeptical, sentiment readings being generated along the way. Along with strong breadth and momentum measures, this lack of belief in the rally has actually been one factor that has enabled its persistence. About 6 weeks in now, however, we are finally getting some preliminary signs of complacency toward the rally on the part of traders.”

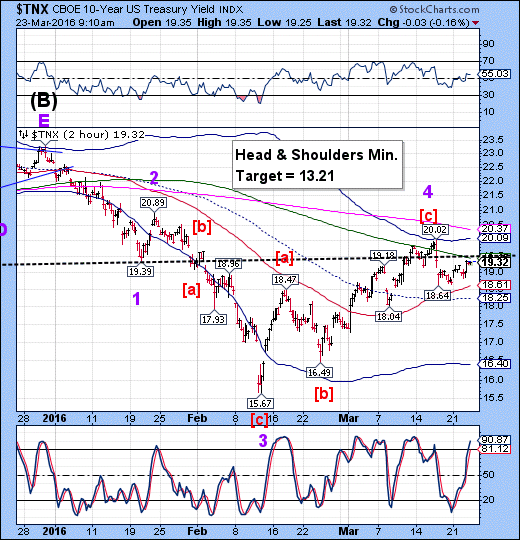

TNX also remained flat overnight. It is poised for its largest decline yet, but may be waiting for a catalyst. Whatever it is may be big.

As I said yesterday, all of the Cycles are inverted (stocks, bonds, commodities, currencies). This appears to be the wind-up for a very large move.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.