Brexit Defiance of the EU

ElectionOracle / EU_Referendum Mar 23, 2016 - 11:41 AM GMTBy: BATR

The UK media is out in force to scare Brits from voting to leave the European Union. Thursday June 23: Date of the in/out referendum is set for the vote. Just the notion that an actual plebiscite will take place on such an important issue, is encouraging. Proponents of exiting the EU are natural allies in the struggle to promote national populism. The long and distinguished history of England has an opportunity to show the world that the voice of the people can register a resounding repudiation against the technocrats of an unelected European Union.

The UK media is out in force to scare Brits from voting to leave the European Union. Thursday June 23: Date of the in/out referendum is set for the vote. Just the notion that an actual plebiscite will take place on such an important issue, is encouraging. Proponents of exiting the EU are natural allies in the struggle to promote national populism. The long and distinguished history of England has an opportunity to show the world that the voice of the people can register a resounding repudiation against the technocrats of an unelected European Union.

So it is refreshing to hear from a ‘City of London” bank remarks that run contrary to the official pleas to stay within the EU. Britain could BENEFIT by leaving the EU, says Barclays: Bank believes worst effects of a Brexit would be felt in Europe is a rare statement of what is best for England.

“The report by Barclays experts added that Britain could become a safe haven from a disintegrating Europe, giving investors shelter from problems with the euro.

‘If politics in the EU turned for the worse, the UK may be seen as a safe haven from those risks,’ it said. But the bank also warned that if the referendum favours exit, it could lead to the collapse of the EU itself.

Analyst Philippe Gudin said: ‘The referendum is generally seen as a UK issue when it is better seen as a European issue.’

He warned that the political and institutional aftershocks of a ‘leave’ vote were far greater than the economic fears.

Mr Gudin added that if Britain voted to quit, it would encourage other EU member states to think about leaving amid the migration crisis.”

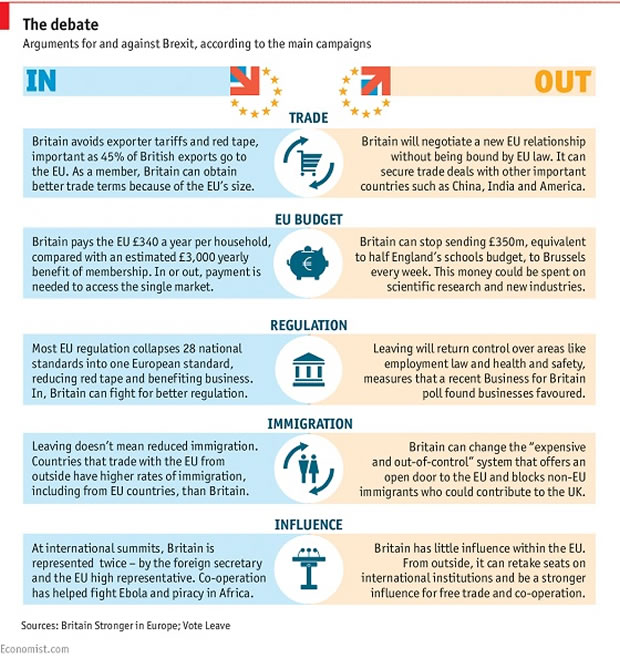

Even the “Queen has no interest in her country remaining in the defunct, corrupt, and completely inept European Union.” But before rejoicing that common sense has returned to the British Isles, the warning from the Banksters flagship publication, The Economist A background guide to “Brexit” from the European Union wants you to believe that all other options are negative.

“Broadly, there are five models to choose from. The first is to join the European Economic Area, a solution adopted by all but one of the EFTA states that did not join the EU. But the EEA now consists of just one small country, Norway, and two tiddlers, Iceland and Liechtenstein. The second option is to try to emulate Switzerland, the remaining EFTA country. It is not in the EEA but instead has a string of over 20 major and 100 minor bilateral agreements with the EU. The third is to seek to establish a customs union with the EU, as Turkey has done, or at least to strike a deep and comprehensive free-trade agreement. The fourth is simply to rely on normal World Trade Organisation (WTO) rules for access to the EU market. The fifth, preferred by most Eurosceptics, is to negotiate a special deal for Britain alone that retains free trade with the EU but avoids the disadvantages of the other models, but it would be extremely hard or even impossible to negotiate this in an atmosphere, post-Brexit, that would hardly be a warm one.”

In their normal and innumerable way, the Economists are playing the same game as they did on countering the nationalistic sentiment during the Scottish independence referendum in 2014. The class society that is Britain has the upper crust ready to condemn an exit vote. House of Lords warned EU will punish UK if it votes for Brexit is another expected insulting notice.

Stop for a minute and ponder such a warning. The Lords of the Crown are saying that they prefer their privilege within the EU super elites, and fear that ordinary Brits might take measures to liberate themselves from the bureaucratic regulatory dictates of unelected continental overseers.

Any protracted doubts should be dispelled when the granddaddy of central banks chimes in. Bank of England Intentionally Strangles UK Economy to Discourage Brexit moves to applied economic coercion prior to the upcoming vote.

“When Bank of England Governor Mark Carney claimed in recent testimony that Brexit could severely harm the British economy, anti-EU legislators called his remarks “unacceptable” and asked for his resignation.

But “Project Fear,” as anti-Brexit forces call it, remains ongoing.

· Prime Minister David Cameron recently released a video warning that a pro-Brexit vote would have a negative impact on markets and real estate values.

· A pro-Brexit vote would collapse the value of the pound by 14-20 percent, according to Goldman Sachs economists.

· Morgan Stanley has suggested that British stocks could lose up to 20 percent of their value with an EU exit.

· Financial firms like HSBC have suggested that jobs could move out of the City to countries like France if Britain takes its leave from the EU.”

Political pressure from the other side of the pond from Obama’s Plan To Visit London To Lobby Against Brexit Infuriates British Lawmakers has MP’s asking, ““Why should President Obama tell the U.K. whether we should be part of a European superstate or a sovereign nation?”

Nervous panic among the transnational elites is evident whenever their private economic playground is threatened. Brexit represents a tremendous prospect to start the necessary and inevitable breakup of the European Union.

The total breakdown of the EU from the mass migration into their territory is undisputed proof that a superstate is unrealistic. Countries need to reclaim their own unique identity and cultures. Economic trade will naturally flow between and among nations when each benefit from the transactions.

Under the present EU system, the technocratic regimentation is starving the native populations. Advancing, the Brexit referendum, especially during a time of great political turmoil increases the prospects that Brits will want to exit the failed multicultural experiment. Prosperity is within reach with the separation from Brussels. The Bank of England has never demonstrated any concern for the populace interest. Send a message to the City of London that the Union Jack needs to fly over the UK and be hauled down from the Berlaymont building.

Source: http://www.batr.org/corporatocracy/032316.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2016 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.