U.S. Monetary Policy Kaleidoscopic Context

Interest-Rates / Money Supply Mar 22, 2016 - 08:12 PM GMTBy: Mike_Shedlock

Dennis Lockhart, Atlanta Fed president, made a speech today trumping up the possibility rate hikes as soon as April.

Dennis Lockhart, Atlanta Fed president, made a speech today trumping up the possibility rate hikes as soon as April.

In his speech, Lockhart cited "sufficient momentum evidenced by the economic data to justify a further step at one of the coming meetings, possibly as early as the meeting scheduled for end of April."

Let's dive into his speech and also put a spotlight on his claim of "sufficient momentum."

Kaleidoscopic Context for Monetary Policy

The title of this post comes from the title of Lockhart's speech to the Rotary Club of Savannah Kaleidoscopic Context for Monetary Policy.

Here are some snips, emphasis his, not mine. Typos not corrected.

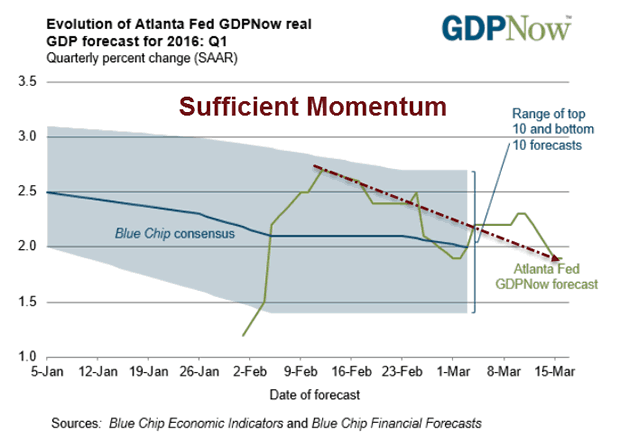

An important question is whether to view the fourth quarter as a one-off aberration or a sign of slowing growth. Since we're still in the first quarter of 2016, it's a little early to come to a definitive conclusion. But we are able to gauge the strength of economic momentum in real time using a method we call a nowcast (as opposed to a forecast). A nowcast takes each data point as it comes in and adds it to a model-based computation of the growth rate of gross domestic product (GDP) on an annual basis. Such a computation is sometimes called a tracking estimate. The data we have in hand as input to this estimate run through January, with a few data points for February. Our tracking estimate for the first quarter is currently 1.9 percent.

Short of some big shock that turns consumer psychoIogy on its head, I see no reason why consumer spending growth should not continue. I think the conditions supporting this engine of economic momentum are likely to hold steady. I should add to the list the so-called "gasoline dividend." Although slower than expected to show through in consumption patterns, lower oil prices and lower gasoline prices should bolster the economy through the consumer channel.

The incoming economic data have been, admittedly, mixed since the momentous December meeting of the FOMC (the meeting at which the Committee raised its policy rate for the first time in almost a decade). We policymakers face some ambiguity. In my experience, this is almost always the case. But overall, I see the recent data as positive. I believe a forecast of sustained moderate growth momentum is realistic and remains the likely scenario. In my opinion, there is sufficient momentum evidenced by the economic data to justify a further step at one of the coming meetings, possibly as early as the meeting scheduled for end of April.

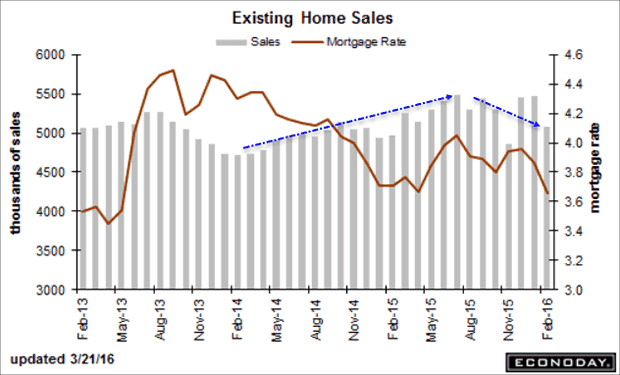

Spotlight on Sufficient Momentum - Existing Home Sales

March 21: Existing Home Sales Plunge "Surprising" 7.1%, Price Concessions the Norm; What Happened?

Averaging things outs, we clearly see sales accelerated from February of 2015 through June of 2015. Since then, sales have decelerated.

The sudden plunge in November sales (released December) was due to change in disclosure rules called "Know Before You Owe".

The bounce in December and January sales was most likely due to delayed closings in November and December. That bounce is now over.

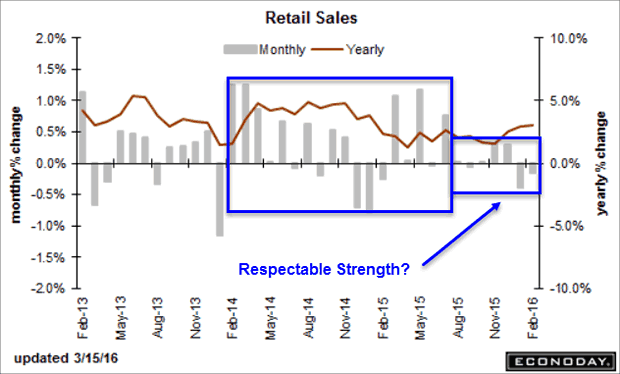

Spotlight on Sufficient Momentum - Retail Sales

March 15: Retail Sales Down, January Sales Revised to -0.4%

Respectable Strength?

It's amusing watching Econoday attempt to spin every conceivable thing positive. Somehow, retail sales at -0.1% on top of a huge downward revision is allegedly indicative of "respectable strength in February".

Reader Tim Wallace pinged me with this pertinent comment: "Down 0.1% in January means February retail sales were actually down 0.7% from January's initially reported number."

Respectable Not!

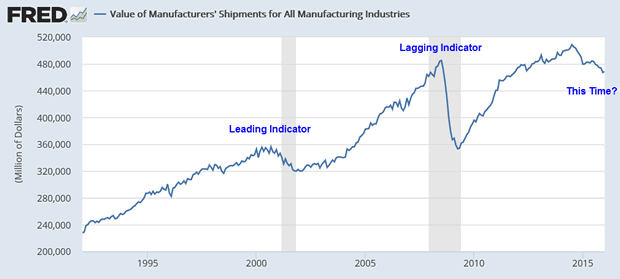

Spotlight on Sufficient Momentum - Manufacturing Shipments

March 3, 2016

I put that chart together today with dated updated as on March 3.

There has never been a dip like this outside a recession or leading up to a recession.

Heading into the 2001 recession, the decline in shipments was a leading indicator. In the 2007-2009 recession, shipments were a lagging indicator. I suspect housing overly distorted the prior recession.

Leading or lagging, Lockhart is wrong either way.

GDPNow - March 16

Questions of the Day

Question 1: Is Lockhart even watching the momentum of his own researcher's model?

Question 2: Is 1.9% and falling really sufficient momentum to hike or does Lockhart have Kaleidoscope Eyes?

Long-time Mish readers know what's coming up: A musical tribute.

Reflections on Momentum

The next Atlanta Fed GDPNow release takes place on March 24.

I have a difficult time gaming how GDPNow will react to economic reports but I strongly suspect today's existing homes sales report will knock 0.3% or so off the previous forecast.

The PMI manufacturing index comes out on Marc 22, the new home sales report on March 23, and durable goods orders on March 24.

New data aside, I agree with Lockhart there is "momentum". However, that momentum is "sufficiently" in the wrong direction.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.