Bitcoin Trading Alert: $400 Level Becoming More Important

Currencies / Bitcoin Mar 22, 2016 - 06:42 PM GMTBy: Mike_McAra

In short: short speculative positions, target at $153, stop-loss at $515

In short: short speculative positions, target at $153, stop-loss at $515

It has been known for some time that Bitcoin transactions are not really anonymous. Now, a company focused on Blockchain surveillance has received significant venture capital funding, we read on The Telegraph website:

A British technology company that attempts to fight crime by spotting suspicious Bitcoin deals has raised $5m (£3.5m) as banks and regulators begin to take the blockchain technology that backs up the virtual currency seriously.

London-based Elliptic claims to help solve one of the biggest challenges of Bitcoin for companies that use it - the inherent anonymity, which means banks are reluctant to embrace it for fear of falling foul of anti-money laundering regulation.

(...)

Dr James Smith, one of Elliptic's three co-founders, said its software, which uses artificial intelligence to scan the Bitcoin network, makes it easier to identify patterns of suspicious behaviour and trace it back to the source. It is already widely used by online exchanges and law enforcement to detect potential money laundering, and has processed around $2bn in Bitcoin transactions.

(...)

Paladin Capital, a US-based investor with close connections to the US government, led the investment. Kenneth Minihan, a former director of the US National Security Agency who is now a managing director at Paladin, said: "Elliptic is a game-changer for blockchain and is already trusted by some of the smartest minds in law enforcement and compliance. The firm's monitoring capability will be an essential component of any blockchain in the future and we will help Elliptic to expand in the US, via our contacts and knowledge of US law enforcement and government agencies."

Bitcoin has never really been anonymous, to start with. Actually, the fact that all transactions are recorded in a public ledger seems to make Bitcoin surveillance not so big a problem. This is not the first time we actually hear about the possibility to analyze various transactions but it might be the first highly-publicized professional attempt to tackle the subject.

The way Bitcoin is set up makes it relatively easy to track transactions but not necessarily easy to discover who is behind them, at least not always. Elliptic seems to be focused on discovering patterns in the Bitcoin data which could identify potentially fraudulent transactions. We'll still have to see whether this evolves into an AML system. For the time being, it seems that financial institutions are very much interested in the possibility to have tools identifying potentially suspicious transactions. This could make Bitcoin-based systems more attractive to them, ceteris paribus.

For now, let's focus on the charts.

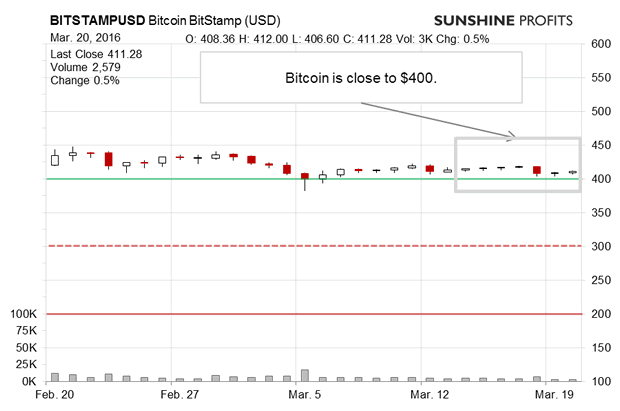

On BitStamp, we have a situation where Bitcoin hasn't really moved very much in a couple of weeks. This doesn't mean that the current situation is boring, in our opinion. The mere fact that Bitcoin hasn't moved recently is by no means a guarantee that it won't move in the future.

Since Bitcoin hasn't moved much, our previous comments are still up to date:

(...) Yes, we saw a failed breakdown below $400 but it doesn't necessarily have any meaningful implications for the next significant move in the market. Bitcoin might go up some based on the bounce back above $400 but the implications are weak and of very short-term nature. The most important part still is the fact that we're below a possible long-term declining resistance line.

(...)

Additionally, we now see that the late-February local top in Bitcoin is lower than the January and December tops, not to mention the November spike. A series of potentially lower highs might be a bearish indication.

The recent lack of action and the fact that Bitcoin remains below the possible long-term declining resistance line are indications that the previous trend remains unchanged - down.

The mere fact that Bitcoin hasn't moved might lull some traders into thinking that volatility has died down. This might not be the case. There were periods in the past when declines took some time to unfold. In any case, we wouldn't bet on Bitcoin staying in place.

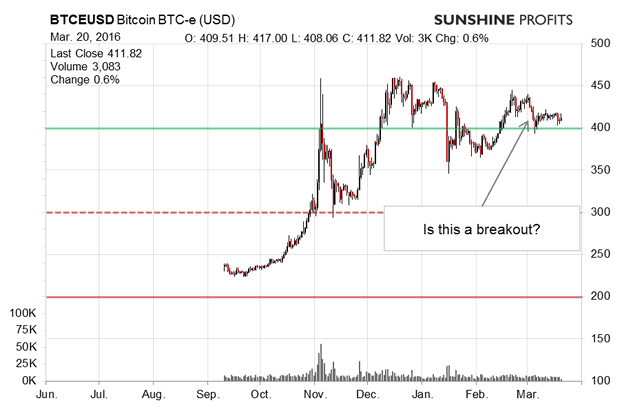

On the long-term BTC-e chart, we don't see much action, in spite of the recent problems with BTC-e withdrawals. We actually still think that anybody considering depositing funds with BTC-e should check that the situation is now resolved.

Bitcoin remains relatively flat above $400 and this means that there haven't been serious changes in the outlook. Recall our previous comments:

For the time being, it seems that we still have important resistance lines $450-470, so the situation doesn't really seem bullish. (...) Combining this with the bearish indications still results in a bearish indication, particularly given the recent rally. It seems that Bitcoin might be ready for more declines (in our opinion).

Even if we were to see the recent months as a head-and-shoulders formation (which itself might be debatable), it would seem that we are now after the second shoulder. This would itself be a bearish indication for the next couple of weeks.

Right now it seems that Bitcoin has a lot of downside potential ($350 being the first possible pause for a potential decline) while at the same time not displaying much upside potential. If we see a slip below $400, the decline might accelerate.

(...) What is more, if you take a look at the RSI, it's around 50, implying that there still might be room for Bitcoin to decline. As mentioned in our previous comments, there seems to be a lot of downside potential for Bitcoin with not much upside potential. Combine that with a series of lower highs, a lack of breakout above a possible long-term declining resistance line and the recent low volume of the moves up, and the situation still looks very much bearish.

Actually, Bitcoin has been trading above $400 for some time now. Does this mean that a move up will follow? It might, there are no sure bets in any market but our assessment is that depreciation might actually be the next part of the move. The fact that the $400 level has not been taken out in the last two weeks suggests that the next move below $400 might be a more violent one.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.