Here We Go Again: U.S. Government Ramps Up Borrowing As Private Sector Slows

Economics / Government Spending Mar 22, 2016 - 06:33 AM GMTBy: John_Rubino

This morning, US existing home sales plunged and the Chicago Fed’s national activity index turned negative. Both are obvious signs of a slowing economy.

This morning, US existing home sales plunged and the Chicago Fed’s national activity index turned negative. Both are obvious signs of a slowing economy.

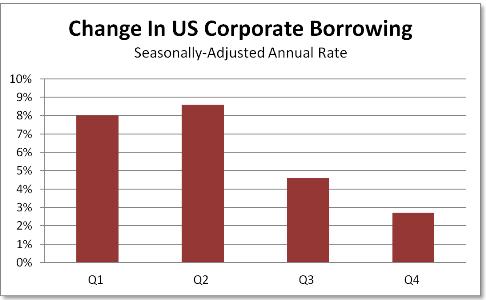

Anticipating this kind of news, Credit Bubble Bulletin’s Doug Noland in his most recent column analyzed the Federal Reserve’s quarterly Z.1 Report for signs of changing financial trends, and found something potentially serious. The following three charts tell the tale:

First, corporate borrowing slowed dramatically in 2015’s fourth quarter…

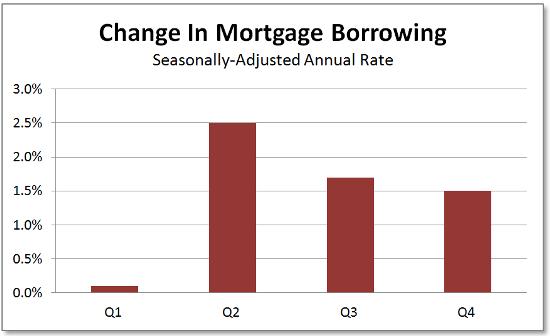

…while households scaled back their mortgage borrowing:

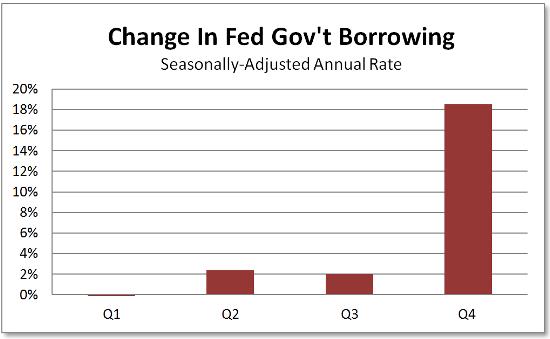

And guess who stepped in to save the credit bubble? That’s right. Federal government borrowing soared:

Writes Noland: “This more than offset the private-sector slowdown, ensuring that overall Non-Financial Debt growth accelerated to an 8.6% pace in Q4.”

In other words, monetary policy (QE and low/negative interest rates) has stopped working and now we’re reverting to deficit spending to juice the economy. If this is the beginning of a trend, expect to see a torrent of announcements in coming months touting new government programs on infrastructure, health care and/or the military.

It’s as if the people making these decisions have forgotten that 1) the world borrowed $57 trillion post-2008 and got next to nothing for it and 2) the new debt will have to be rolled over at higher rates if interest rates are ever to be normalized, thus decimating government finances. For more on the implications of this latest iteration of the Money Bubble, see Is This The Debt Jubilee?

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.