Crude Oil Price Action & Forecast

Commodities / Crude Oil Mar 21, 2016 - 04:38 PM GMTBy: Chris_Vermeulen

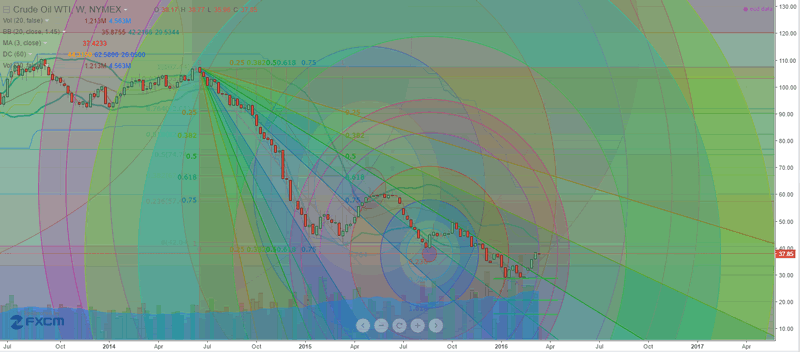

Recently, Light Crude has seen a dramatic 35%+ increase in value. As the current price continue to flirt with $40 per barrel, the likelihood of a further price rise is on everyone’s mind. With recent lows near $26 per barrel, what is the possibility that oil will form a base above $30 and attempt a rally?

Recently, Light Crude has seen a dramatic 35%+ increase in value. As the current price continue to flirt with $40 per barrel, the likelihood of a further price rise is on everyone’s mind. With recent lows near $26 per barrel, what is the possibility that oil will form a base above $30 and attempt a rally?

Historically, the 2009 low price for oil was $33.20. This level should be viewed as a key level of support for current price action. The recent price rotation below this level is a sign that oil prices are under extreme pressure in the current economic environment with a supply glut and slower than expected demand.

It is my opinion that the price of oil will continue to reflect the supply/demand aspects of the global markets in relation to global economic activity. Thus, my analysis is that Oil will likely attempt to retest support, near $30 or below, in the immediate future in direct relation to continued supply production in conjunction with slower global demand.

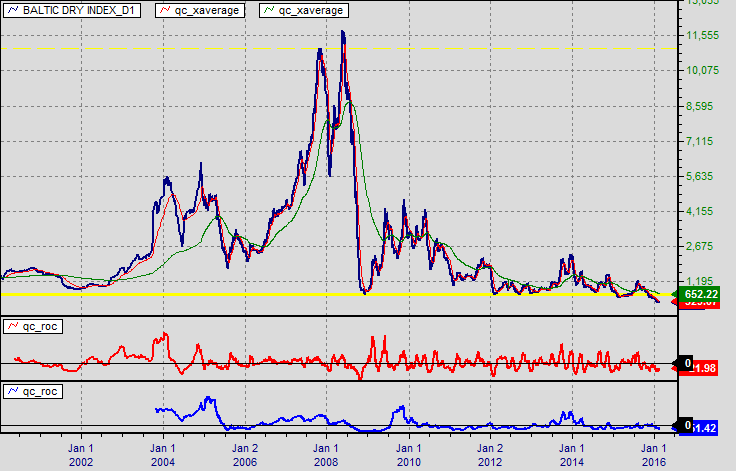

(Baltic Dry Index Chart – LongTerm)

The BDI Index continues to attempt to push to new lows. This is a strong indication that global exports and international demand from consumers and business is continuing to diminish.

Crude Oil Analysis & Trade Signals: www.TheGoldAndOilGuy.com

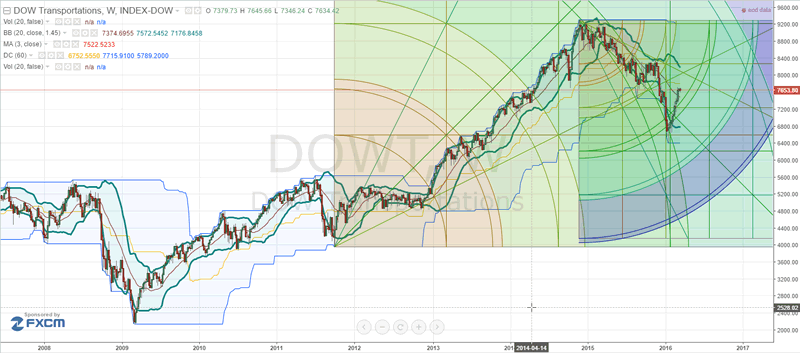

(DOWT – Transportation Chart)

Even though the DOW Transportation Index has risen recently, the current direction is decisively bearish in indicates the next level of support is near 6265 – clearly 1400 points below current levels.

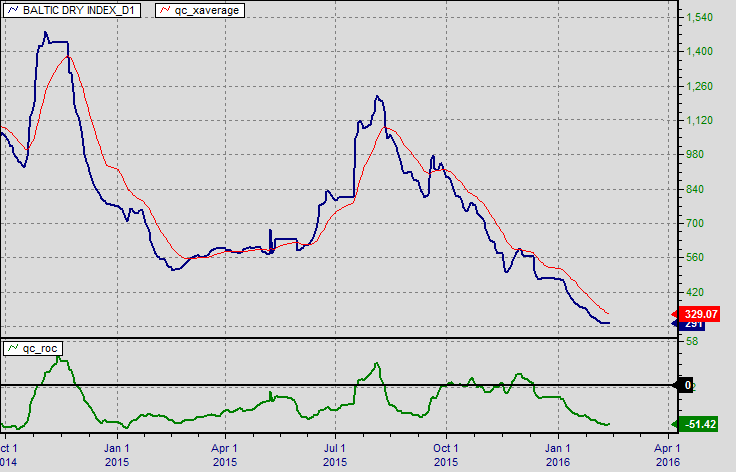

(Baltic Dry Index Recent)

The longer the BDI continues to push to new lows, the more likely we are to see continued contraction in demand for commodities and global exports. Thus, with the continued supply production throughout the globe and continued global contraction, one could expect that Oil prices will continue to be under pressure globally.

The simple mechanics of the equation are that certain ME and foreign countries require continued income from oil production/sales. As the continued decline in Oil prices creates economic pressure, these countries have little alternative but to continue producing and selling as any price to feed their need for dollars. This creates a mechanism that propels a vicious cycle or over production and sales in an attempt to generate dollars that are desperately needs to fund a relatively mature economy.

As all things are in a constant state of flux, it become important to understand that price rotation in the Oil market will likely continue between $28 and $42 for a period of time. This is really a traders market in the sense that a nearly rotation level this large, in percentage relation, is available for all traders. Be cautious of rallies as they may be short-lived. I expect a number of weeks of rotation near $36 ppb followed by a lower price rotation back to near $25 ppb between April 5th and May 5th.

After that price rotation lower, then I expect one of two targets to be tested, $21 ppb or $37 ppb. It all depends on how the global markets are performing in a month or two.

(CL Chart)

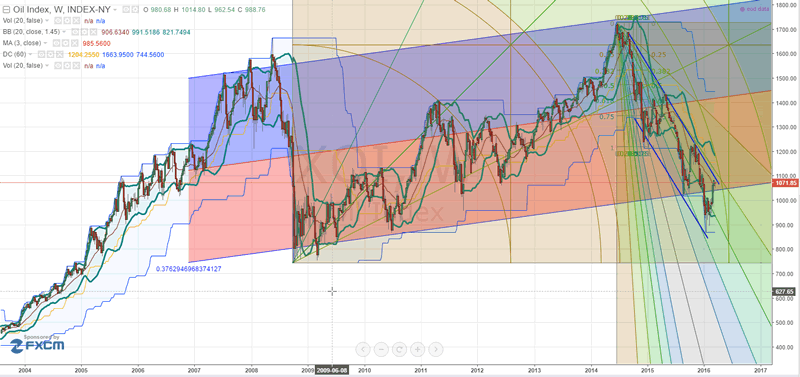

(XOI Chart)

Right now, expect continued price rotation between $42 ppb and $28 ppb till shortly after April 5th. Then expect much larger price rotation till after May 5th. At that point, we’ll have to see how the global economic factors are playing out to make further price expectations.

I expect there to be some big trades around crude oil for both short term swing trades and long term trend trades but the market just is not yet here.

Learn & Trade With My Daily Video Analysis & Trades: www.GoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.