Major Stock Market Reversal Signal from Waning Enthusiasm for Share Buybacks

Stock-Markets / Stock Markets 2016 Mar 19, 2016 - 06:26 PM GMTBy: EWI

"State of the Global Markets Report -- 2016 Edition" (excerpt)

"State of the Global Markets Report -- 2016 Edition" (excerpt)

Editor's note: The following article was adapted from the just-published State of the Global Markets Report--2016 Edition, one of our most anticipated annual reports for technically minded investors and analysts around the world. We are making the first 10,000 copies of this $99 report available 100% free. Click here to get your free copy now >>

In the May 2008 issue of The Elliott Wave Financial Forecast, three months before the infamous Lehman Brothers bankruptcy, we cited a sudden loss of enthusiasm for company buybacks as another component of a major market reversal.

We noted that for companies issuing buyback announcements "cheers invariably turn to jeers" as the stock market reverses from up to down.

Our evidence included the following headline from 2001: "Buybacks Hit a Wall of Fear."

The 2008 version from The Wall Street Journal read, "[From] Buyback Boom To Buyer's Remorse."

Well, here are some more recent headlines:

Stock Buyback Deals Can Be Stinkers (USA Today, Nov. 5, 2015)

The Stock Market Has a Buyback Problem (Fortune, Nov. 18, 2015)

Surge In Stock Buybacks Good or Evil? (The Wall Street Journal, Nov. 22, 2015)

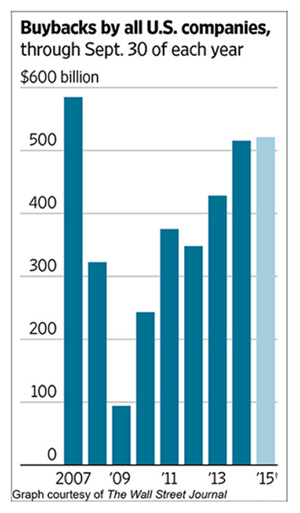

As the following chart shows, through the first three quarters of 2015, buybacks were the strongest since the record year of 2007, when stocks made a major top.

Until recently, share repurchases were considered a positive development for companies. But a widely circulated report from Research Affiliates says buybacks offer "little overall benefit. 'Buybacks are simply a mirage.'" Fortune concludes, "Investors might soon regret the buyback binge."

They always do, and the outbreak of skepticism is a sure sign that the falling share prices that invariably compounds those regrets is very close.

Originally published Nov. 6, 2015.

To continue reading insights like this, we recommend you get the 50-page State of the Global Markets Report--2016 Edition 100% free. See below for details.

Your FREE Report:

|

This article was syndicated by Elliott Wave International and was originally published under the headline Waning Enthusiasm for Share Buybacks Signals Major Market Reversal. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.