Rising Stock Market Vollatility - Watch out below!

Stock-Markets / Stock Markets 2016 Mar 18, 2016 - 01:14 PM GMT Good Morning!

Good Morning!

I have profiled the 4.3-year trendline which was violated yesterday. You can see that there was another false breakout on September 29. Whether that breakout remains standing at the end of the day is uncertain, since there is a double Trading Cycle Pivot on Saturday.

Today is all about options expiration. This week is known as quadruple witching, which adds to the potential volatility.

While the Wave structure appears complete, they appear to be a-b-c patterns which may often be extended. The Premarket shows the SPX is higher, but that can also disappear at the market open, since that is when index options expire.

The Cycles Model implies a panic decline may be about to occur next week. It may last 4.3 days, but the Primary Cycles extend beyond that. My indicated Cycle Bottom appears to be due on March 29, but it may extend over into another day or so.

VIX was slammed down to the 2-hour Cycle bottom support at 13.43 before bouncing into the close. A further bounce above the trendline may indicate the decline is done. A change of trend may be indicated above the upper trendline of the Pennant formation.

Be prepared for volatility to rally starting today.

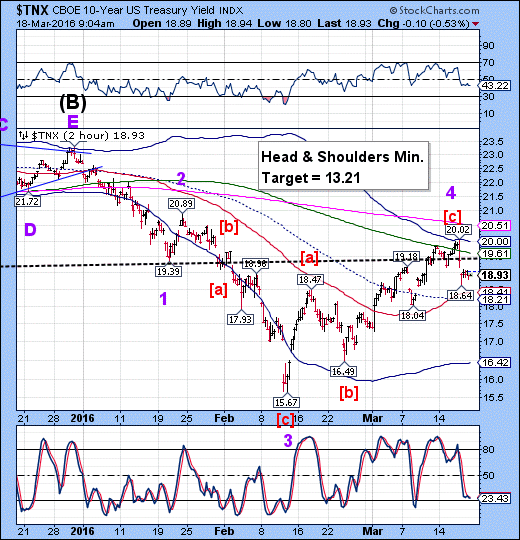

TNX has reversed beneath its Head & Shoulders neckline and appears to be a leading indicatior of what may come in the Equities either later today or over the weekend.

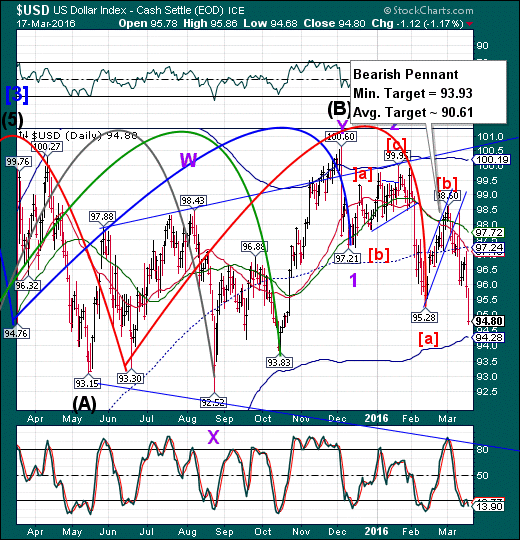

USD broke down hard yesterday and may complete its Wave 3 next week. This may be the catalyst for the decline in equities. Not only will there be a loss of the Carry Trade, but the currency in which stocks are values will be debased.

Here is the SPX as seen through the eyes of the Europeans. While in USD the SPX has made a 77% correction it has only made a 60% correction in Euros. So, it appears much weaker already. What will make SPX unattractive is when both the USD and SPX decline in tandem.

Watch out below!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.