Is This The Debt Jubilee?

Interest-Rates / Global Debt Crisis 2016 Mar 18, 2016 - 12:58 PM GMTBy: John_Rubino

Not so long ago the financial world viewed certain numbers as limits beyond which lay trouble. Interest rates near zero, for instance, were thought to risk destabilizing the banking system. And government fiscal deficits above 3% were considered so dangerous that exceeding this level was prohibited by the Maastricht treaty that all euorzone members were required to sign.

Not so long ago the financial world viewed certain numbers as limits beyond which lay trouble. Interest rates near zero, for instance, were thought to risk destabilizing the banking system. And government fiscal deficits above 3% were considered so dangerous that exceeding this level was prohibited by the Maastricht treaty that all euorzone members were required to sign.

Those numbers -- 0% and 3% -- are still considered bad. But now for the opposite reason: They're insufficiently aggressive.

A big part of the world, as everyone now knows, operates with negative interest rates. And prominent economists are urging even greater negativity as a way to make government debt profitable and get people borrowing and spending again.

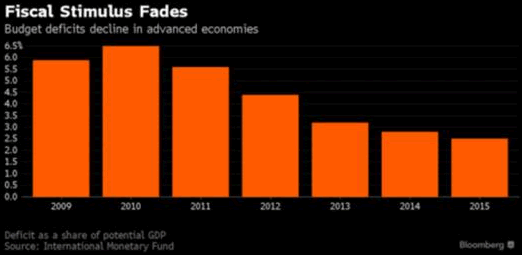

More recently, fiscal deficits -- barely below 3% of GDP in the developed world -- have come to be seen as dangerously inadequate and in need of dramatic expansion. From today's Bloomberg:

Say good-bye to the bond vigilantes and hello to the budget brigade

A passel of investors, academics and even central bankers are calling on governments to spend more and tax less to provide a budgetary boost to the struggling global economy. That's a 180 degree turn from the bond vigilantes of yore who pressed for smaller deficits and less debt about a quarter century ago.To hear the budget backers tell it, bigger shortfalls are a no-brainer. With interest rates at -- or even below -- zero in much of the industrial world, central bankers are pushing up against the limits of what they can do to buttress growth. Yet those same low interest rates make it exceedingly cheap for governments to borrow money to finance bigger budget shortfalls.

"A large part of what monetary policy can do, it has done," former Treasury Secretary Lawrence Summers told Bloomberg television last month. "In Japan, in Europe, and perhaps on a forthcoming basis, in the U.S., we need further impulses to growth," including from fiscal policy.

The dirty little secret is that budgets are starting to be loosened in some countries after years of austerity. Yet in many cases, that is more by happenstance than by intent. And the size of the resulting stimulus is small and far short of the more sweeping steps advocated by card-carrying members of the budget brigade.

"There's pretty widespread consensus in the financial community that fiscal policies should come to the rescue," said Joachim Fels, global economic adviser for Pacific Investment Management Co., which oversees $1.43 trillion in assets.

Even central bankers are shedding their traditional reticence to stray into the political arena to sound off on the need for a more balanced growth strategy.

Mohammed El-Erian, chief economic adviser at Allianz SE, said he's worried that it would take a downturn in the global economy to prompt concerted action on the fiscal front.

"That is my fear," said El-Erian, who is also a Bloomberg View columnist. "How much of a crisis do we need as a wake-up call" for policy makers?, he asked rhetorically.

The sense of panic is palpable, and not surprising given the troubles that beset pretty much every part of the global economy. Latin America's biggest countries are in various kinds of crisis. Japan's Abenomics policy is widely seen as a failure. Europe has both negative interest rates and deflation, which seems like a deadly combination. US manufacturing is contracting and corporate profits are shrinking. China's slowdown has sparked the kind of labor unrest that terrifies its leaders.

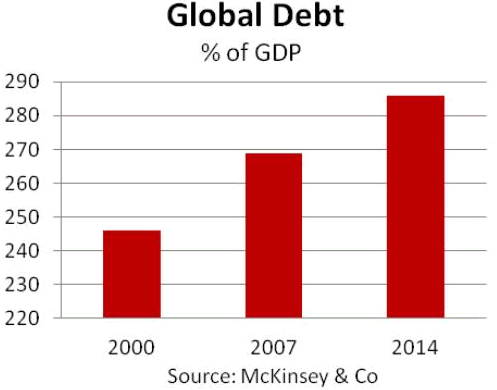

Hence the calls from the architects of the policies that got us here for something dramatic to save their reputations and investment portfolios. But the one thing that seems to be missing from these glib prescriptions is an acknowledgement that we've been there, done that, without the miraculous results now being promised. Post-2008, the world ran huge fiscal deficits. The US nearly doubled its federal debt, China borrowed even more and Japan (already running big deficits) kept on without missing a beat. At this point it's helpful to revisit the McKinsey & Company study showing that the world took on $57 trillion of new debt between 2007 and 2014:

So the question that's been dogging proponents of negative interest rates -- if zero didn't work why should we expect -1% to do better -- needs to be asked of deficit fans: If $57 trillion of new debt didn't produce a robustly-growing global economy, why gamble on another $57 trillion?

Meanwhile, the two concepts -- NIRP and deficits -- dovetail in a fairly terrifying way: All the new debt we take on to rekindle growth will have to be refinanced in the future. So the more we borrow now the more we'll have to roll over then -- and the bigger the impact on government budgets of an eventual rate normalization. Unless the ultimate plan is to never raise rates to old-school positive levels, in which case the world of the future is so different from that of the past that we may as well toss existing theories of market dynamics and individual freedom out the window.

A final thought: One way to sell ramped-up government deficits in the face of lingering doubts will be to give the money directly to citizens. This has appeal across the political spectrum -- on the left because giving away free money is always popular and on the populist right because it bypasses the much-hated big banks. Coupled with a requirement that recipients pay down existing debts, such a "QE for the people" might bring along even traditional debt-averse economists. In other words, this might finally be the year of the debt jubilee.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.