Kuroda, Draghi, then Yellen Pull the Trigger on Blanks

Stock-Markets / Stock Markets 2016 Mar 17, 2016 - 04:26 PM GMT Good Morning!

Good Morning!

As expected, the SPX Premarket is down again this morning. The “goose” that the markets got at the FOMC announcement are but a temporary reprieve from what is to come.

I will be gone all day to a conference in Indiana, so here is the level at which the market trend turns south. The trendline is self-evidennt, along with Intermediate-term support at 1994.28 as the confirmation of the change in trend.

The Cycles Model suggests an 8.6 market day decline to March 29, the next Pi date. There is a chance of a chaotic decline beginning as early as today, due to options expiration. Be aware of that possibility. If there is any doubt that an 8.6 market day decline can be destructive, remember August 24, which only too, 4 market days from top to bottom.

In other markets, ZeroHedge reports, “Nikkei futures rallied post-Fed into the Japanese open (despite weakness in USDJPY) and then when trade data struck (and exposed the utter failure of competitive devaluation), everything went into freefall. The Nikkei crashed 700 points and USDJPY plunged to its lowest since QQE2... and then - on cue - "someone" started panic selling JPY...”

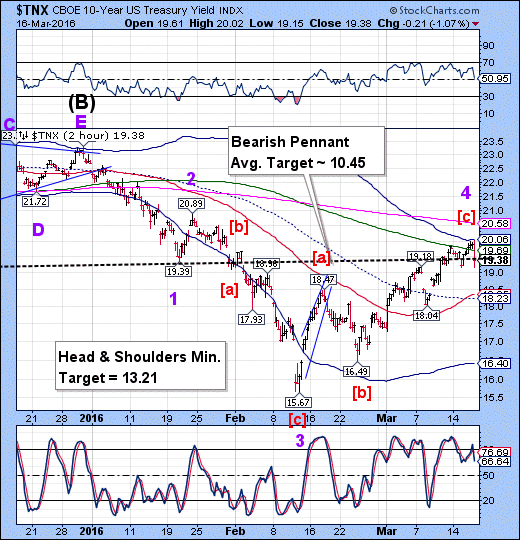

The bond market isn’t open yet as I write, but 10-year treasuries are higher this morning. This may be an additional confirmation of the change.

The VIX and Hi-Lo are still not at their respective sell signals, but the level for VIX is now 18.00 and the level for the Hi-Lo Index is -120.55.

Stay alert and have a great day!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.