Stocks Premarket is Down, Awaits the FOMC

Stock-Markets / Stock Markets 2016 Mar 16, 2016 - 02:18 PM GMT Good Morning!

Good Morning!

The SPX Premarket is down, but not sufficiently to break the next support level at 1988.79. Should the decline continue, I would expect to see a bounce in that vicinity.

The news that may have influenced the decline was that Core CPI increased 2.3% year-over-year.

This morning Peabody Energy, the largest coal producer in the U.S., announced that it had just filed its 10-K and may take Chapter 11 bankruptcy protection.

In the banking sector, Duetsche Bank president, John Cryan announced that it will not be profitable in 2016.

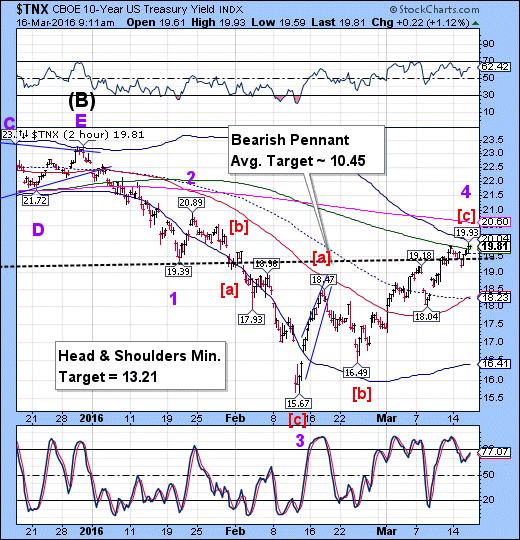

Wave [c] extended to its 2-hour Cycle Top this morning as short sellers of US Treasuries continue to pile on. It appears that this may be an accident waiting to happen as short sellers appears to be very sure of their position. Or maybe this is a last ditch effort by banks to rally stocks in order to pay off their credit lines to energy companies through stock secondary offerings.

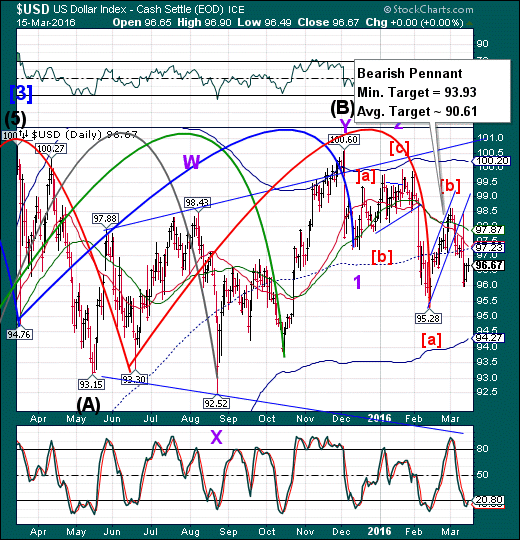

USD rose to 97.06 this morning as the retracement wraps up. Wave 3 may begin its final leg down to 93.93 at any time, but it may be the Fed that gives it the impetus to do so.

Goldman Sachs insists that the Dollar rally is far from over. While their logic may be impeccable, their timing may not be.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.