Stock Market Retracement High was Made... Prepare for What's Next

Stock-Markets / Stock Markets 2016 Mar 10, 2016 - 06:59 PM GMT SPX clearly made a corrective high beneath Friday’s high before impulsively declining to its low at 1969.25. The 61.8% retracement is at 1991.39, where the bounce may be expected to go. We may see the ensuing decline begin in earnest either in the last hour of the day or overnight. Be Prepared.

SPX clearly made a corrective high beneath Friday’s high before impulsively declining to its low at 1969.25. The 61.8% retracement is at 1991.39, where the bounce may be expected to go. We may see the ensuing decline begin in earnest either in the last hour of the day or overnight. Be Prepared.

VIX popped above the daily mid-Cycle resistance at 18.97. If is firmly in the “buy” camp. This is a confirmation of the SPX sell signal.

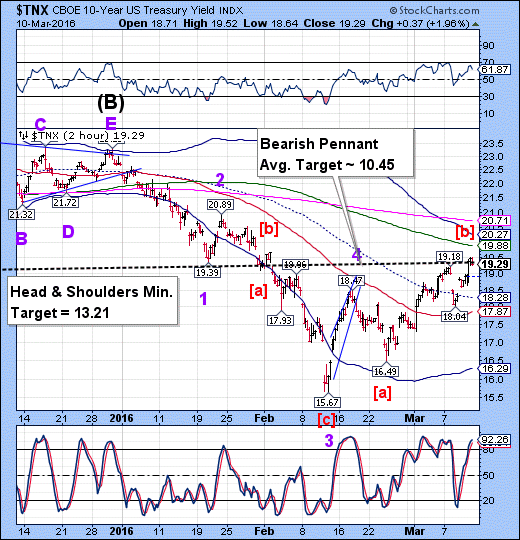

TNX is at the top of its Head & Shoulders neckline. So far this is a non-confirmation of the SPX sell signal. It appears to be clearly offering misinformation about the state of the market.

ZeroHedge reports, “Well we warned you. Bund yields were extremely optimistic about Draghis' bazooka.. and were disappointed.

As traders dumped their Bund bets so this has sent Treasury yields jumping to the highs of the day (compressing the UST-Bund spread by 12bps)...

as it appears Draghi has driven a great rotation (for now) into IG credit from Treasuries.”

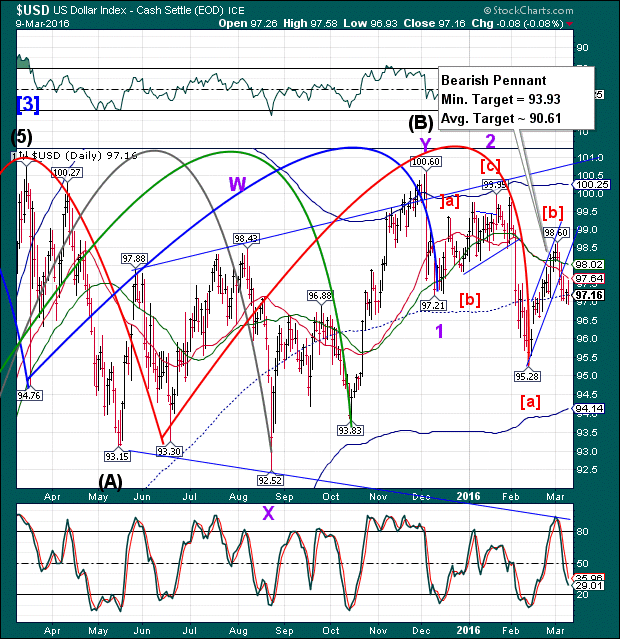

The big move that took the air out of the SPX rally was the USD, which fell under 96.00. It is currently at 96.11, near the bottom of its decline.

ZeroHedge comments, “The last time that global liquidity conditions contracted at this pace was March 2008 (right as stocks dead-cat-bounced on the back of The Fed's guarantee of Bear Stearns' sale to JPMorgan)... and things escalated rather quickly thereafter.”

Prepare for a panic decline.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.