Mario Supersized Stock Market Stimulus

Stock-Markets / Stock Markets 2016 Mar 10, 2016 - 04:18 PM GMT Mario Draghi supersized his stimulus announcement. EuroStoxx ramped after the announcement, but what will be the follow-through? Will this be another Kuroda, European style?

Mario Draghi supersized his stimulus announcement. EuroStoxx ramped after the announcement, but what will be the follow-through? Will this be another Kuroda, European style?

ZeroHedge Reports, “Well, the people wanted a "bazooka-sized" surprise from Draghi, and they got it.

Moments ago the ECB announced not only a 10 bps cut to the deposit rate expected pushing it to -40%, but also announced a 5 bp rate cut to the refinance (pushing it to 0.00%) and the marginal lending rate (now at 0.25%), and also boosted QE by €20bn to €80 billion per month, the addition of afour new targeted TLTROs each with a maturity of 4 years, but the most surprising announcement was that the ECB would also for the first time include investment grade euro-denominated bonds issued by non-bank corporations along the list of assets that are eligible for regular purchases.”

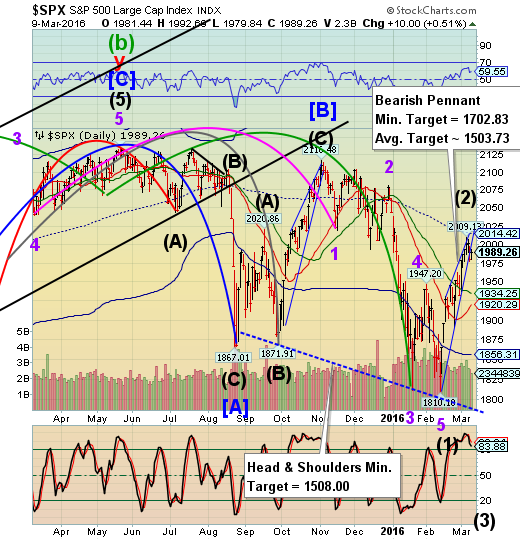

SPX Premarket has also rallied to challenge the March 4 high at 2009.13.

I am reluctant to change the Wave labels on the chart, but the SPX futures have already exceeded the March 4 high of 2007.50 by ramping to 2009.75 this morning. That suggests the SPX may at least match the March 4 high. The 2-hour Cycle Top is at 2012.77 and may be a natural barrier to a further high.

My reluctance stems from several issues. First, there are several structural issues with the decline that cannot be clearly explained. But a new high today would clearly label this rally as an A-B-C which fits the Wave (2) structure. In addition, we have run out of time for additional delays before going directly into a Wave (3) decline.

Putting another perspective on it, SPX may also be probing to its daily mid-Cycle resistance at 2014.42. This level also has a Fibonacci value of 66.666% of the decline.

Although a new high may be made, we may also expect to see a sharp and dramatic reversal.

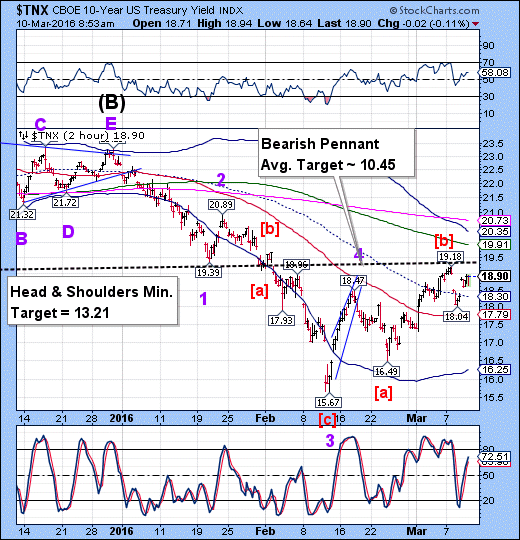

TNX isn’t buying the rally, suggesting that most, if not all the stimulus is coming from Europe. It suggests a very short-lived rally in SPX this morning, but not a likely follow-through.

I will be away most of the day, unfortunately.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.