Gold Price Next 10% Move is Down, Not Up

Commodities / Gold and Silver 2016 Mar 07, 2016 - 04:17 PM GMTBy: Chris_Vermeulen

Gold has been on a tear since the start of this year. It is the best performing asset with a 16% rise in 2 months, however, if you are planning to enter gold at these current levels, you are likely in for a big surprise. Gold is overbought and technical analysis is pointing to a drop in gold price to the $1150/oz. level, a good 10% lower from the current levels.

Gold has been on a tear since the start of this year. It is the best performing asset with a 16% rise in 2 months, however, if you are planning to enter gold at these current levels, you are likely in for a big surprise. Gold is overbought and technical analysis is pointing to a drop in gold price to the $1150/oz. level, a good 10% lower from the current levels.

The equity markets are in a bounce/rally mode and likely to remain buoyant till end of March. Oil prices, which were causing a scare worldwide are also on the mend, the bottom is likely in place at $26/barrel.

The Nonfarm Payroll data, released on March, 4th 2016, has given a green signal to the FED to move ahead with the next proposed rate hike. Whether they go ahead with the hike or postpone it till the next meeting is difficult to assess, but the U.S. Dollar will likely trade with a bullish bias as long as the chances of a rate hike remains on the table.

A strong dollar dims the sheen on the yellow metal, if the dollar continues to remain strong, gold will likely come off towards our target low area of $1150.

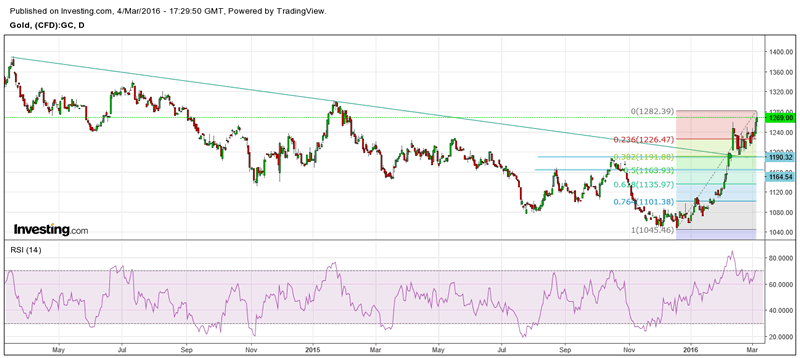

Technically, gold has risen from its lows without any retracement, as shown in the chart below. Though gold has broken out of its long-term downtrend, the market participants should remain cautious on it. Many bulls will want to pocket their profits as gold is nearing a resistance area. The bears will enter shorts closer to resistance. With both of these events coinciding together, gold will retrace back to its breakout level.

The bulls will buy closer to $1190/oz., which was the earlier resistance, they will attempt to defend the level and support the market. The market can either take support at $1190/oz. or drop down towards $1150/oz. area to shake out many long positions before rising again.

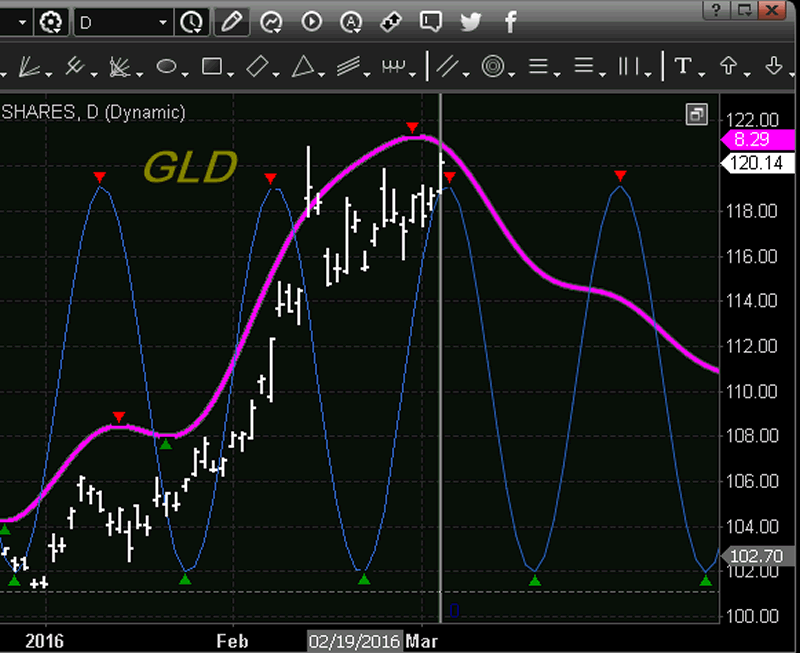

Take a look at my gold cycle analysis. The pink line is a blend of multiple cycles and follows the actual price very closely and allows me to predict into the future if the bias will be downward or rising.

Both Societe Generale and Goldman Sachs are negative on gold with targets of $1150/oz. and $1000/oz. I totally disagree with them on their longer bearish views, I want to make it clear that I am not bearish on gold from a longer term perspective. Gold price will make new highs in the coming months, however, the next 10% move for gold is down rather than up.

I want my readers to enter long positions close to the bottom, in order to maximize their gains. So wait, for the right time to enter again closer to $1150-$1190/oz. levels. It will be the last opportunity to buy gold before it embarks on a new long-term bull trend.

Get My Specific ETF Trade Alerts at: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.