Gold ETF Suspends Issuing Shares Due To “Surge” In Demand

Commodities / Gold and Silver 2016 Mar 07, 2016 - 02:32 PM GMTBy: GoldCore

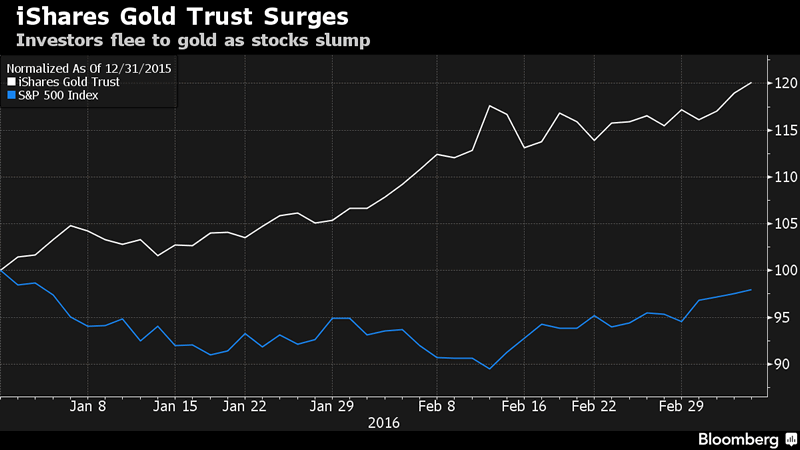

Gold ETF, the iShares Gold Trust, had to stop issuing new shares in its $7.7 billion on Friday as a “surge” in investment demand for gold caught out the provider of the ETF and the world’s largest money manager, BlackRock Inc.

According to a statement from the company

“Since the start of 2016, in response to global macroeconomic conditions, demand for gold and for IAU has surged among global investors,” causing the ETF to expand its assets under management by $1.4 billion this year alone.

“This surge in demand has led to the temporary exhaustion of IAU shares currently registered under [law]. We are registering new shares to accommodate future creations in the primary market by filing a Form 8-K to announce the resumption of the offering of new shares,” according to the statement. “The ability of authorized participants to redeem shares of IAU is not affected.”

Bloomberg further elaborated:

Investors had piled into the fund so fast that BlackRock didn’t register in time with the U.S. Securities and Exchange Commission to issue more shares. The suspension means that the share price of the fund may deviate from the price of its underlying assets — the physical gold — until issuance resumes, probably within two or three business days, according to a person familiar with the matter.

The misstep by New York-based BlackRock comes as providers of exchange-trade funds face mounting concern that the products may pose risks that investors aren’t always aware of. Cracks in the system were revealed on Aug. 24, when many equities didn’t open for trading, yet the ETFs that hold them did, causing confusion among investors about their value.

“One would suppose this would be something they would be monitoring more carefully,” said Ben Johnson, director of global ETF research for Morningstar Inc.…

ETFs hold a basket of assets that are rolled up into a single security that can be traded on an exchange. The ETF market has exploded in size, jumping 2 1/2 times in value since the end of 2009. Kara Stein, a U.S. Securities and Exchange Commissioner, last month expressed concern that the ETF market has become too difficult for retail investors to understand.

“I fear that the risk presented by some of these new products may not be fully understood by those who have invested in them,” Stein said at a conference in Washington, speaking generally about new ETFs. “Indeed, even plain-vanilla, equity index ETFs may present risks that are not always anticipated or fully understood, as evidenced by the events of Aug. 24.”

…

BlackRock said that, even without new share issuance, market makers have a range of tools to meet investor demand, including using existing inventory.

“This suspension does not affect the ability of retail and institutional investors to trade on stock exchanges,” BlackRock said. “Retail and institutional investors will continue to be able to buy and sell shares.”

Gold ETFs have many unappreciated risks as we outlined from their inception. Risks from these created financial instruments include valuations, annual fees and expenses, counter-party risks as well as liabilities and responsibilities of the market participants such as the auditors and custodians.

Gold bullion is unique among asset classes as it is an asset class not dependent on the performance of auditors, management, corporations, financial institutions, banks, politicians and governments. Nor is physical gold dependent on the performance of trustees, custodians and or sub custodians.

Gold ETFs are fine for those wishing to take a speculative position long or short the gold market. However, for the majority of of investors and pensions they are likely not suitable. They should not be confused with owning physical gold coins or bars in allocated and segregated accounts. ETFs are quite high risk financial products while gold bullion is a proven hedging instrument and safe haven asset.

LBMA Gold Prices

07 Mar: USD 1,267.60, EUR 1,156.96 and GBP 896.13 per ounce

04 Mar: USD 1,271.50, EUR 1,158.67 and GBP 898.93 per ounce

03 Mar: USD 1,241.95, EUR 1,141.48 and GBP 882.24 per ounce

02 Mar: USD 1,229.35, EUR 1,131.53 and GBP 881.54 per ounce

01 Mar: USD 1,240.00, EUR 1,141.70 and GBP 886.09 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.