Gold Has Topped, Higher Highs Expected in the Stock Market

Stock-Markets / Stock Markets 2016 Mar 07, 2016 - 05:01 AM GMTBy: Brad_Gudgeon

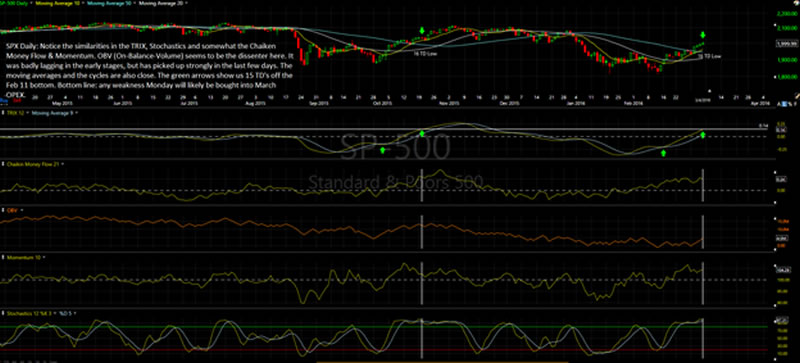

The SPX 8 TD top was due Thursday and we are in the mid band of the Sun translation to Neptune, Saturn and Jupiter on Friday (TD 9). This reversal band has a 10 TD reversal time frame from March 4th, which points to March 18 (OPEX) as the latest we could see a top in the stock market. My chart and indicators corroborates a March 18th top and an early April first low. The 16 TD low is due Monday, so a pullback Monday would not surprise me and we could go as low as 1959 to as high as the 1971/82 area. A 76 point rally from Monday into Wednesday looks likely. June looks likely to be a nesting of lows for the next move down and then late October after that.

The mid band reversal area could also affect commodities and gold. On Friday March 4, we had a key reversal in gold right at the last day of Mars in Scorpio. The candlestick looked like a shooting star or a gravestone doji. My charting work suggests a nearby low on March 15 for gold, just before the FED meeting. GDX could go as low as 15.28 to as high 16.80 by then. The rising wedge in GDX points to a 14.11 target minimum. We may go sideways and not make a new high in gold in April. There is another low due in Gold around mid April and again in late May/early June. COT figures do not agree with a new bull market in gold just yet. New lows look forthcoming in gold and GDX late this year (October). We are in a deflationary bust. 2016-19 look good for the precious metals. Beyond that it is hard to predict. If we have a major World War (which is very possible) around 2020, gold and silver may continue to go much higher into 2024.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.