Silver Price Buy Signal – 2016

Commodities / Gold and Silver 2016 Mar 04, 2016 - 04:38 PM GMTBy: DeviantInvestor

The gold to silver ratio has been used for years to indicate buy and sell zones in both gold and silver. Why?

The gold to silver ratio has been used for years to indicate buy and sell zones in both gold and silver. Why?

- At BOTTOMS in both gold and silver, based on 40 years of history, silver prices have fallen farther and faster than gold. Hence the gold/silver ratio reaches a relative high.

- At tops in both gold and silver the ratio is often low since silver rises more rapidly than gold. As Jim Sinclair says, “silver is gold on steroids.”

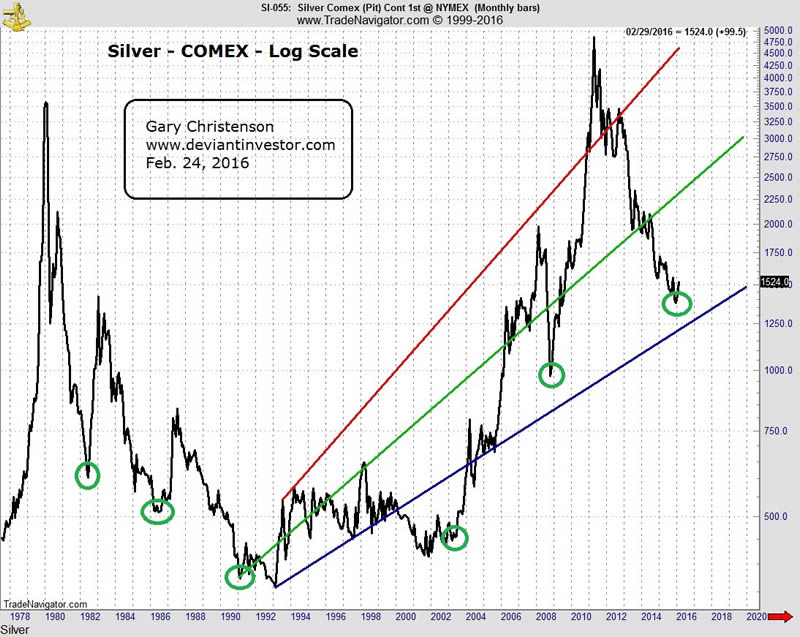

Examine the following graph of the gold to silver ratio (monthly data) for the past 40 years. I have circled the six most extreme highs in the ratio with green ovals.

At 5 of 6 extremes in the ratio silver was at or near a long term bottom. The one minor exception was when silver bottomed in November of 2001 at $4.01 and the ratio peaked later in May 2003. Otherwise the ratio was quite accurate at indicating major silver lows.

For more confirmation, assume a silver buy signal occurs when an extreme in the gold to silver ratio has been reached, and the weekly silver price closes above its 5 week moving average.

Monthly Ratio Extremes Silver (weekly) closes above

(green ovals above) 5 week MA

June 1982 July 2, 1982

August 1986 September 5, 1986

February 1991 March 8, 1991

May 2003 April 11, 2003

November 2008 November 28, 2008

February 2016 January 29, 2016

The six major highs in the gold to silver ratio are marked above with green ovals, and also marked below on the log scale chart of COMEX silver. Note that 5 of 6 price lows were accurately indicated by the ratio highs, with the November 2001 price low being a minor exception.

SO WHAT?

Using the above simple analysis, silver hit a multi-year low in December 2015 and has confirmed that low by closing above its 5 week moving average AND registering a gold to silver ratio slightly above 80, the highest in about 20 years and the most extreme peak since the 2008 crash lows in gold and silver prices.

Silver hit a low on December 14, 2015 at $13.61. The price on Feb. 24, as this is written, is $15.43, nearly $2 higher. Of course the paper silver market will flop around as it is managed by High Frequency Trading but the ratio provides more evidence that a silver bottom occurred about two months ago.

Note the logarithmic lines on the silver price chart. The lines are somewhat arbitrary but roughly represent a lower bound, a middle trend-line, and an upper blow-off line. The middle trend-line passes through $25 in 2016 and the red line shows that $50 silver is one good rally away. We will see $50 silver, perhaps in 2017.

Stacking silver makes sense – silver thrives and paper dies.

For more information on silver demonetization and possible future prices for silver, read my novel “Who Killed Doctor Silver Cartwheel?”

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.