Stock Market Pop-n-drop is Probable...or Maybe just a Drop

Stock-Markets / Stock Markets 2016 Mar 04, 2016 - 02:28 PM GMT Good Morning!

Good Morning!

As mentioned last night, the algos took the SPX futures to 2002.50 before rolling over. This appears to be the final probe of the rally. Although the Premarket may currently show a positive number, chances are that the market may open in the red.

The only reason that I can give for this final surge is that the 61.8% retracement level is 1999.44.

ZeroHedge reports, “If bulls were expecting a February payrolls miss, they did not get it when moments ago the BLS reported that nonfarm payrolls surged by 242K in the past month, smashing expectations of 195K, with the January and December prints both revised higher by 21K and 9K respectively. The unemployment rate at 4.9% printed unchanged from the prior month and as expected. According to the BLS, over the past 3 months, job gains have averaged 228,000 per month.”

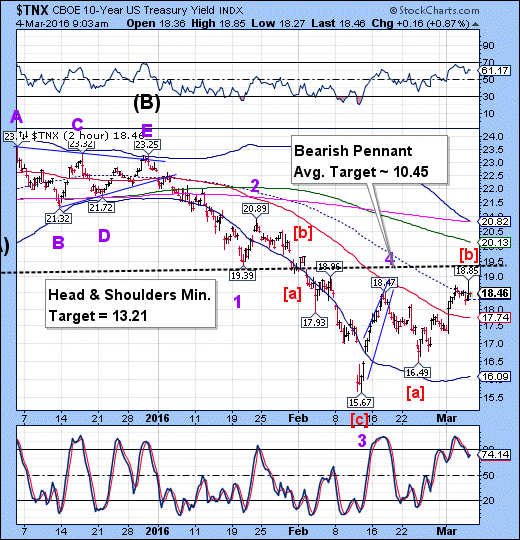

TNX did make that final spike, changing the wave structure back into agreement with the SPX.

The article last night says it all.

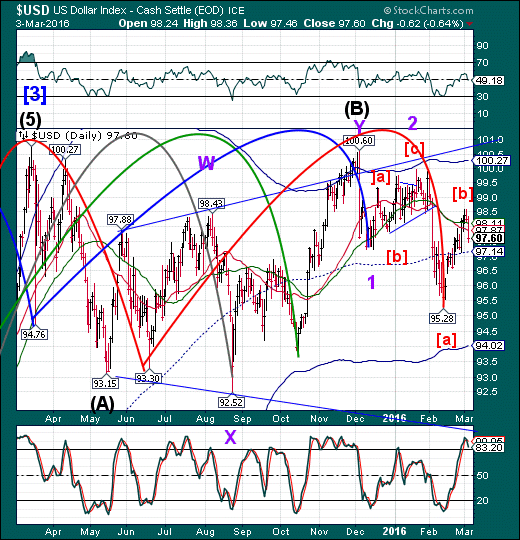

USD spiked back to 98.05 in th morning futures, challenging overhead resistance before completely reversing down to tag mid-Cycle support at a 97.17 morning low. The reversal pattern appears complete with a good probability that the USD may break support no later than Monday.

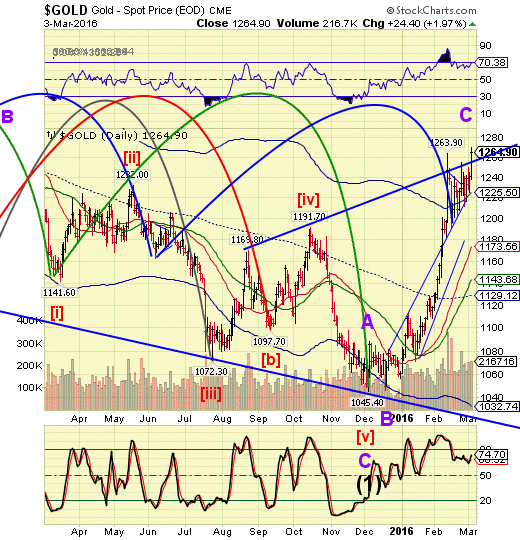

Gold spiked to a morning high of 1275.69 before swinging down over 24 points to 1251.30. This now gives us an estimate of the final target for gold. It now appears that gold may run out of steam at 1288.51.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.