SPX Breaks its First Support

Stock-Markets / Stock Markets 2016 Mar 03, 2016 - 05:04 PM GMT SPX just broke its 2-hour Cycle Top at 1980.09, suggesting an end to this swing rally. It is now in a retracement back above that support. When it is broken a second time this may be a good aggressive short entry for any dry powder at hand. Confirmation may not come until SPX declines beneath its 50-day Moving Average at 1937.03. However, the decline has the potential to be massive, so take your best shot.

SPX just broke its 2-hour Cycle Top at 1980.09, suggesting an end to this swing rally. It is now in a retracement back above that support. When it is broken a second time this may be a good aggressive short entry for any dry powder at hand. Confirmation may not come until SPX declines beneath its 50-day Moving Average at 1937.03. However, the decline has the potential to be massive, so take your best shot.

ZeroHedge reports, “In 60 years, the US economy has not suffered a 15-month continuous YoY drop in Factory orders without being in recession. Today's -1.9% YoY drop may suggest the slide is decelerating, but off the weakness in December (-2.9% MoM), January's bounce +1.6% MoM missed expectations (+2.1%) notably (and Ex-Trans decline MoM).”

And again, “From the narrative-destroying 49.8 preliminary print for US Services PMI (the lowest since the government shutdown in 2013), today's final February Services PMI printed an even worse 49.7 (below 50.0 expectations) even as stocks have soared in the last 2 weeks. Business confidence tumbles to its lowest since Aug 2010 (record lows). This drops the composite PMI to a dismal 50.0, implying negative GDP growth in Q1. Then ISM Services printed 53.4 (down from January but a small beat) to 2 year lows, confirming the decoupling from manufacturing's demise was a fallacy (merely a lagged response) as the last leg of the economic recovery's stool gets kicked away.”

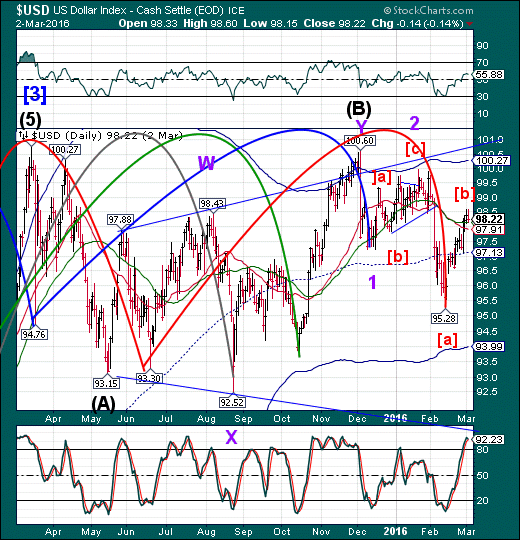

USD fell beneath support this morning to a low of 97.73, beneath both the 50-day Moving Average at 98.13 and Intermediate-term support at 97.91. The reversal is on schedule and ready for action. This is having an effect on USD/JPY and the Yen carry trade, which supported equities until now.

The Cycles are falling into place as indicated in the Model.

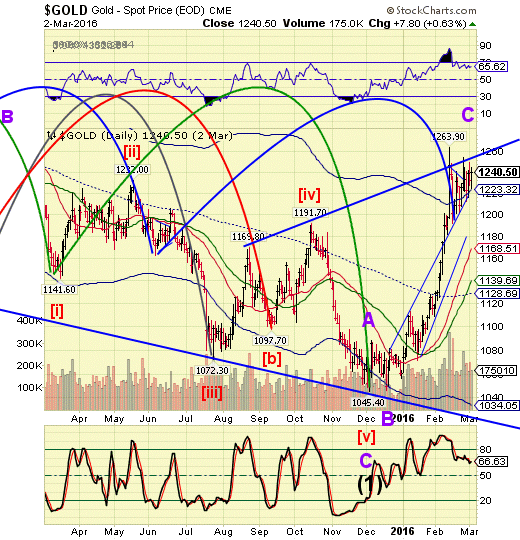

Gold futures are at the breakout point at 1259.70 this morning. A continued rally may take gold to a potential average target of 1335.00 in the next week or so. However, gold may not stay inversely linked to the USD. It also may join the decline in stocks, especially should a panic arise and liquidity becomes scarce.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.