GLD ETF Continues To Add Gold

Commodities / Gold and Silver 2016 Mar 03, 2016 - 04:39 PM GMTBy: Dan_Norcini

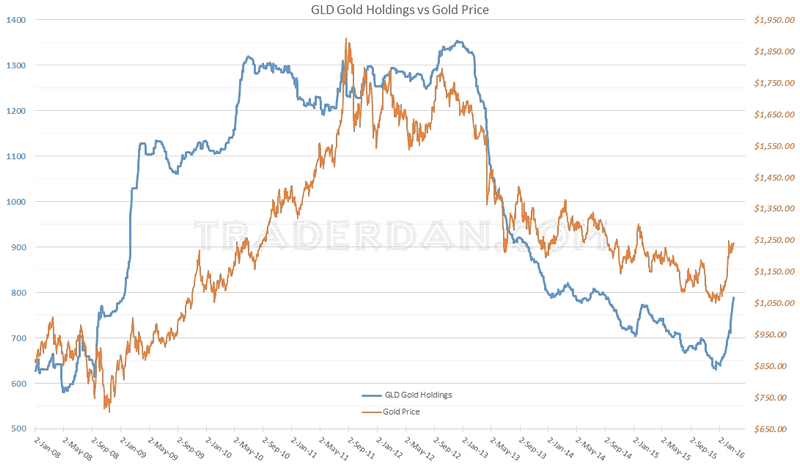

The continued build in the number of reported gold holdings in the large gold ETF, GLD, is nothing short of phenomenal. This week alone, another 22 tons of gold have been added to the ETF bringing the total in storage to 788.6 tons.

The continued build in the number of reported gold holdings in the large gold ETF, GLD, is nothing short of phenomenal. This week alone, another 22 tons of gold have been added to the ETF bringing the total in storage to 788.6 tons.

Here is a chart showing the sharp increase in holdings.

Gold Price and GLD Holdings Chart

This is the largest amount of gold in GLD since September 2014.

I have been watching very closely that continued build in speculative long positions over at the CME against the growing short position among the Commercials and Swap Dealers and have been growing increasingly concerned about that imbalance now that gold is moving sideways at its current levels.

However, this continued build in GLD is ameliorating somewhat those concerns as it shows continued very strong demand here in the West for gold.

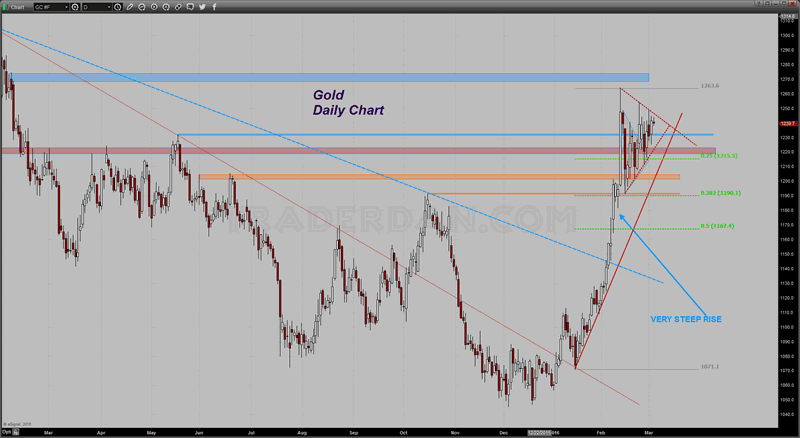

Daily Gold Chart

At this point I am not sure whether gold is moving higher for safe haven reasons, currency woes, or what, but it is evident that demand for the metal remains firm, firm enough that the metal continues to coil on the chart. The coil is tightening and the direction is towards the upper end of the coil which would put the odds more in favor of an upside resolution of this coiling/consolidation pattern. I would like to see a CLOSE above $1250 to feel more confident that the market has some further upside left in it.

If you notice, the market has NOT CLOSED above that level yet in this recent upswing. A close through $1250 would not only put it outside the coil but it would also be the best closing price in thirteen months if it could accomplish that.

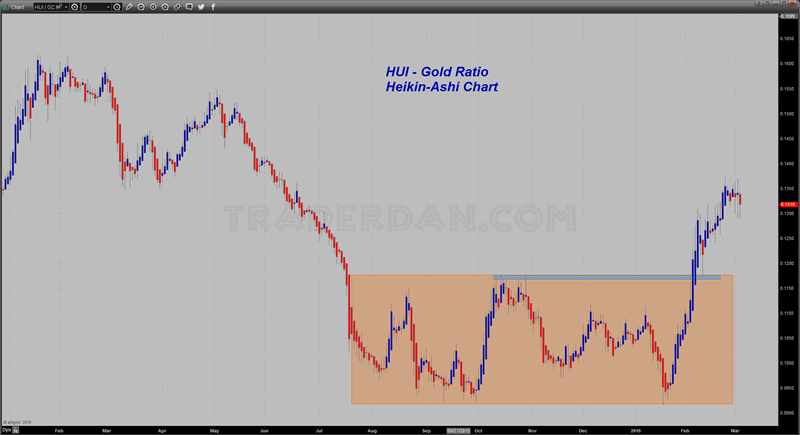

The HUI/Gold ratio has set back from its best recent levels and is showing some signs of stalling out here so this will need to be monitored and weighed against what is happening in GLD.

HUI - Gold Ratio Chart

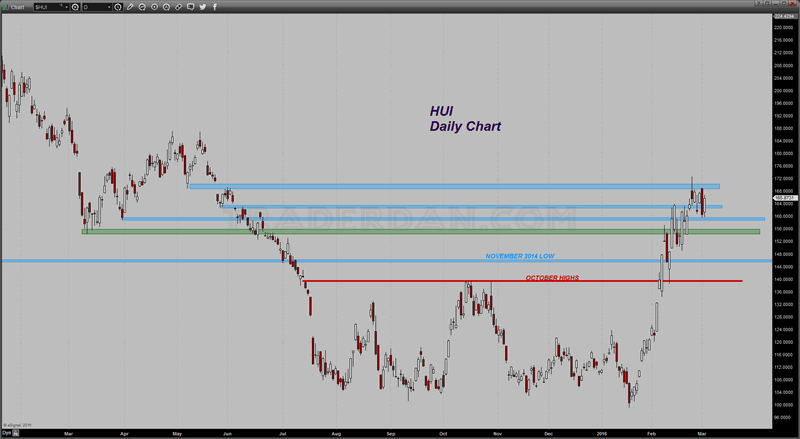

The HUI itself is hesitating below 172 but it is holding support at this time.

HUI Daily Chart

So far all of these various indicators that we are monitoring to track gold and the factors that might be moving the price are showing no signs of any serious breakdowns. There is hesitation however to move higher and that means we will more than likely need some sort of fresh stimulus to break this logjam.

The big thing for me is whether or not that heavy speculative long position will remain put or grow impatient and liquidate. As long as GLD stays firm it should limit the downside and keep prices within a consolidation pattern in spite of the imbalance in the futures market but if GLD shows any serious signs of drop in reported gold holdings, I would expect to see some of these longs head for the exits.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.