SPX Rally Curbed by the Trendline

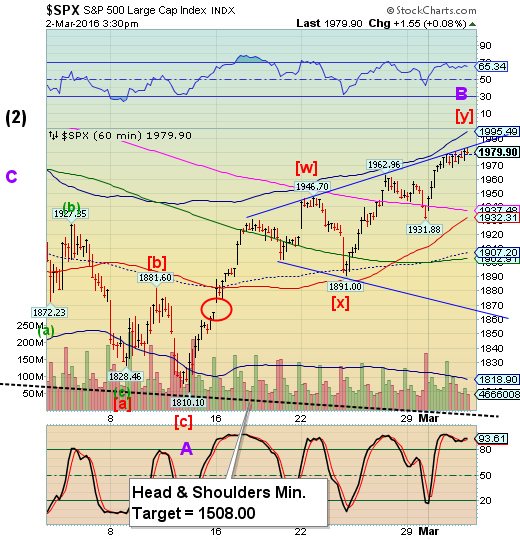

Stock-Markets / Stock Markets 2016 Mar 03, 2016 - 08:16 AM GMTEach successive high has been stopped multiple times at the Broadening Flag trendline. Wave (c) of [y] consists of 17 waves, which is a very extended impulsive wave.

Tomorrow is day 43 from the January 20 low, a Primary Cycle Pivot day. It appears that we may have our Primary Cycle top after all, but measured from a prior low instead of the February 11 low.

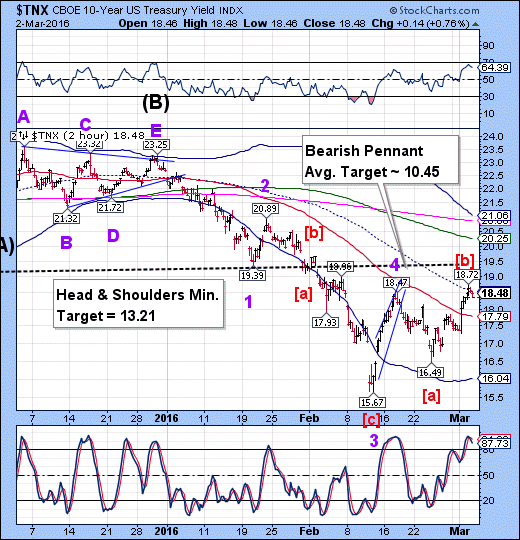

. TNX spiked higher this morning, but drifted back near breakeven this afternoon.

ZeroHedge reports,, “Over the past several days, in addition to the ongoing bear market rally in the S&P500, another dramatic move has been the impressive slide in Treasury prices, manifesting itself in the following spike in 10Y yields:

This move has prompted rates traders to wonder if the selling was organic, if somewhat panicked, unwinding of long positions or just an influx in new shorts, whether due to macro considerations or as rate-locks as a slew of new Investment Grade issuance comes to market.

Courtesy of Stone McCarthy and Credit Agricole, both of whom point out our favorite repo market "stress" indicator, the "specialness" level of the 10Y, we now have the answer: as of this morning, there has been an unprecedented spike in new shorts manifesting itself in a plunge in the repo rate on the 10Y alone even as all other points on the curve remain largely unchanged.”

That makes a lot of sense, traders have taken their shorts off the SPX and gone short the UST.

I’ll write the Mid-Week Report this evening.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.