Sprott Global: Minimally Consider 20% in Real Assets Including Farmland and Diamonds

Stock-Markets / Investing 2016 Mar 03, 2016 - 08:09 AM GMTBy: Gordon_T_Long

Gordon T Long interviews Jason Stevens of Sprott Global Resources Investment. Stevens has an education background in the natural resources and precious metals field for the past 12 years, and has worked alongside mining engineers, geologists and the industrial industry executives to support his research and work with Sprott Global.

Gordon T Long interviews Jason Stevens of Sprott Global Resources Investment. Stevens has an education background in the natural resources and precious metals field for the past 12 years, and has worked alongside mining engineers, geologists and the industrial industry executives to support his research and work with Sprott Global.

Sprott Global is widely known for providing alternative investments in the precious metals field of economy for investors. Recently, they have created two qualitatively weighted indexes, ETFs, as opposed to market capital ratings that give larger companies a higher rating without any supporting evidence.

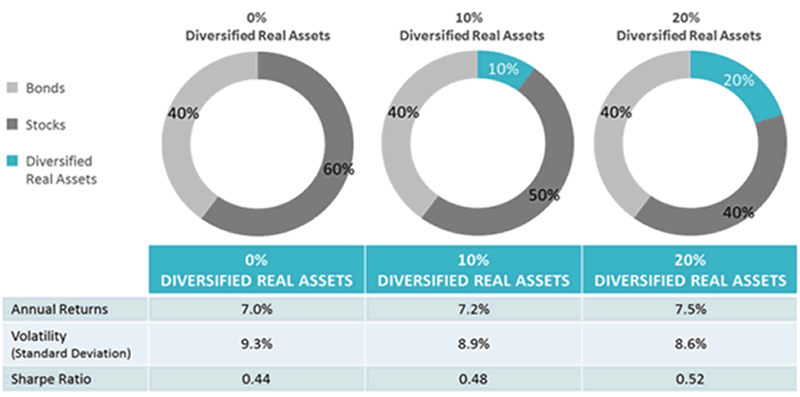

Portfolio Risk

Jason suggests that including 20% of your investment portfolio into the real asset classes, such as precious metals and natural resources (including gold and silver), you can increase your overall return and expect less risk for your portfolio; this is referred to as risk adjusted return. Most successful investors are more worried about how much downside they have in their portfolio rather than how much money they can make in the bull market. It is important to worry about protecting assets, and long standing consistent returns instead. This means to optimize your risk return, 20% would be the minimum amount of real assets that you should at least have ensures your portfolio is secure.

Farmlands

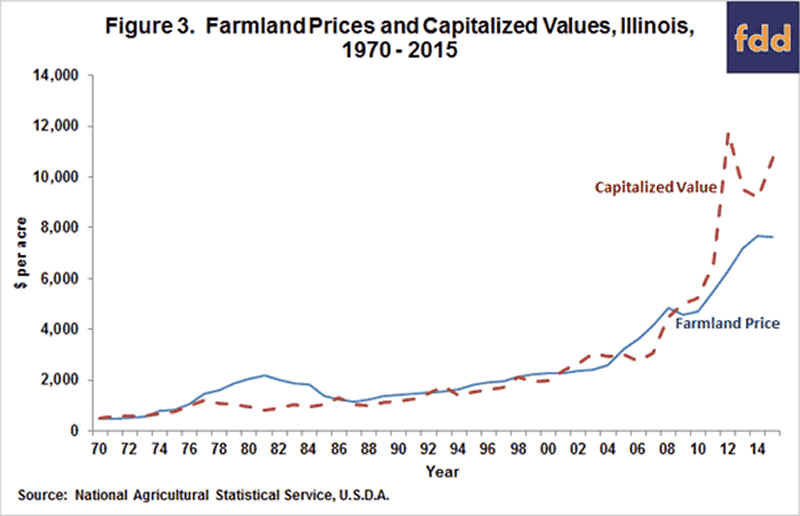

Even with the commodity prices falling as of late, Sprott Global have shown that long term investments in farm land can yield great results for investors if they have the right people backing them. Total returns on Row-crop farmlands during the 2008 crisis yield a positive return of 26% as opposed to the -46% return on the S&P 500. Whitney George, the new chairman of Sprott Global, who is a 5-star rated morning star mutual fund manager, has given them 5 good reasons to invest in farmland: Income generation, capital appreciation, low volatility, inflation protection, diversification. It is important to understand that managing these farmland investments can only be done by a farmer or an equally knowledgeable person who has a good understanding of what is going on with their own farms to ensure positive returns, which is something Whitney George specializes in.

Farmlands are never a bad investment as the consumption of the world is ever rising along with the price a demand of goods as we reach upwards of up to 8 billion people. People do not view farmlands as a technology class of investments; however the corporate and even family owned farmlands require the latest technology to stay up to standards and be able to produce the amount demanded by the people of not just America but all around the world. It is an industry that is very dependent on finding and creating new technology, whether that is to assist in the planting process or fertilizers provided to yield larger and faster crops for the season.

Diamonds

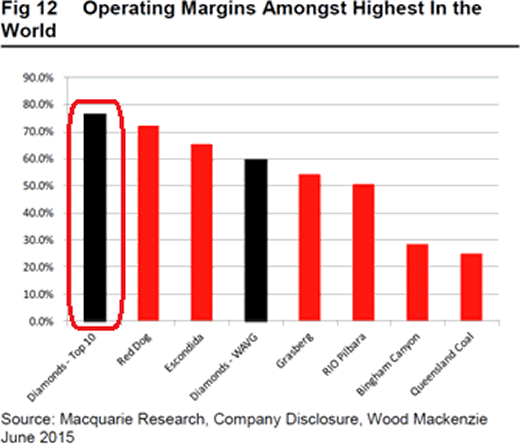

Diamonds have always gone under the radar, a commodity that has always been producing consistent returns and earnings that are never too high, and always provide good value to store assets. It is not an insurance policy but instead a consumer item that has 90% of its demands coming from jewelry. There will always be a demand for it, especially now since the rising interest in Canada's Northwest Territories waiting to be capitalized by De Beers mining company. De Beers does majority of its mining in South Africa, and is a good estimate of how large this mine will actually be once it is fully functional. The diamond industry has gone under the radar due to its lack of discovery, the latest major discovery was made over 20 years ago and for this reason it has been consistent and yielding positive returns depending on the diamonds found.

Colored and large stones did not have a large demand in the past but as of late the larger diamonds have received great interest from consumers and auctioneers. Possibly a rise in their demand value, a single stone is expected to be auctioned off at approximately $110 million U.S dollars, the greatest ever in the diamond mining history.

Jason's real background is in mining but due to his technical expertise in precious metals he infers that the most movement will come in the gold market. This suggests that we should always keep a close eye on commodities. Even if we are currently seeing a decrease in their prices we must always look at the balance sheet and look at how the commodity is valued, to understand how well a market is doing and not just base it off the hype it may receive in the media.

You can contact Jason from Sprott Global for any investment inquires, as well as through his personal email at jstevens@sprottglobal.com.

Abstract By: Saad Gohir

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.