Is the Most Hated Stocks Bull Market in History Over?

Stock-Markets / Stock Markets 2016 Mar 01, 2016 - 12:36 PM GMTBy: Sol_Palha

"An ounce of patience is worth a pound of brains." ~ Dutch Proverb

Throughout this bull-run, a plethora of reasons has been laid out to indicate why this bull should have ended years ago. Mind you most of those reasons are valid, but that is where the bucket stops. Being right does not equate to making money on Wall Street. In fact, the opposite usually applies. The Fed recreated all the rules by flooding the markets with money and creating and maintaining an environment that fosters speculation.

The reason this is the most hated bull market in history is because there is no logical reason to justify it. In 2008-2009 volume on the NYSE was in the 8-11 billion ranges and sometimes it surged to 12 billion. Before that, every year, the volume continued to rise, this indicates market participation. From early 2010 volume just vanished, it dropped to the 2-3 billion ranges and even lower on some days. Hence, all market technicians and students of the markets assumed that the markets would tank as markets cannot trend higher on low volume and that is where they erred.

We were and still are in a new paradigm; the US government stepped in and started to support the market directly that is why volume dropped so dramatically. However as there were no sellers, the markets drifted upwards. Later on, they got the corporate world in on the scam. They set up the environment that propelled corporations to buy back their shares by borrowing money for next to nothing and then using this trick to inflate t EPS (earnings per share), without doing any work or even increasing the profitability of the company.

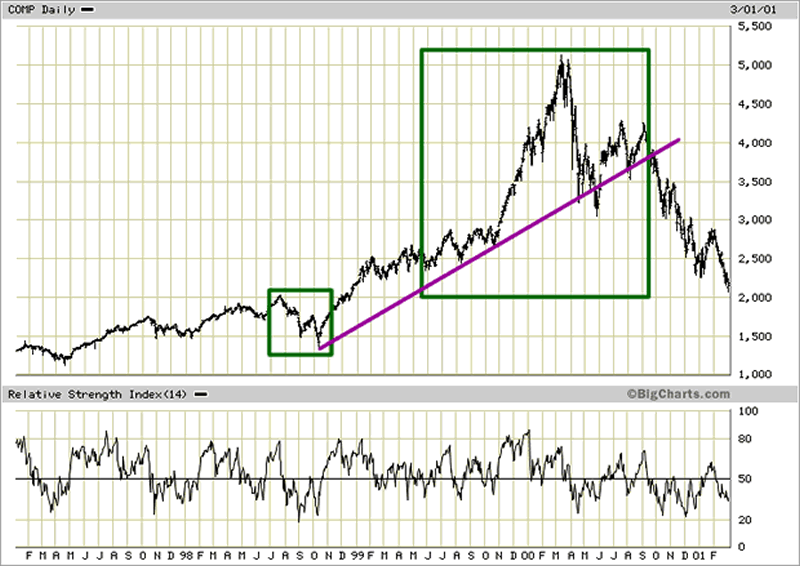

In between a few minor corrections were allowed to transpire almost all of which took place on ever lower volume, to create the illusion that there was some semblance of free market forces at play. The current correction is the only one since 2011 that is real in nature, and it could prove to be a precursor to a larger upward move. If you recall, the dot.com era, the markets corrected strongly in 1998, it looked like the end was near but then the NASDAQ had its best year ever in 1999. It had tacked on gains of roughly 100%. The chart below highlights this dramatic reversal.

Finally, we also have something known as dark pools, this, in essence, allows institutions to purchase large blocks of shares without leaving any tracks. Dark pools now account for over 40% of all U.S stock trades. Theoretically, it provides the government via the PPT (plunge protection team) an avenue to manipulate the markets without leaving any evidence of foul play.

Game Plan

The Fed is hell bent on forcing everyone to speculate, and that is why we have moved into the next stage of the currency war games; the era of negative interest rates. Negative rates will eventually force the most conservative of players to take their money out of the banks and speculate. This process will be akin to another massive stimulus and will provide the bedrock for another monstrous rally.

Make a list of stocks that you would like to own and use strong pullbacks to add to or open new positions in blue chip companies or companies with strong growth rates. Some examples are OA, AMZN, BABA, GOOG, RTN, CHL, etc

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.