TNX Doesn't Buy the Rally in SPX Stocks Index

Stock-Markets / Stock Markets 2016 Feb 25, 2016 - 09:54 PM GMT It appears that the rally is challenging the 50-day Moving Average at 1944.37. A new high above 1946.70 is not needed to change the Elliott Wave structure back to my original assessment, that Wave (2) peaked on February 1. I have re-oriented the chart to show this. The Broadening formation views this as an extension of point 5.

It appears that the rally is challenging the 50-day Moving Average at 1944.37. A new high above 1946.70 is not needed to change the Elliott Wave structure back to my original assessment, that Wave (2) peaked on February 1. I have re-oriented the chart to show this. The Broadening formation views this as an extension of point 5.

Note the trading bands are contracting, suggesting a large move ahead. The next step in this scenario is a potentially sharp decline. The Cycles Model calls for a probable decline through Friday, March 4, if I am reading the Model correctly. There may be a brief extension into Monday, March 7. The Cycles Model has kept my orientation fairly close to what the market has been delivering.

ZeroHedge comments, “Dear Citigroup employees, we suggest you stop reading this post right now or else you may find that the enclosed dose of reality, pardon, permabearishness is precisely what you all want.

For everyone else, here is the latest rant by Richard Breslow explaining not only why traders are frustrated in a market in which nothing makes sense, but where after holding their hands for years central bankers have finally forsaken the 20 year old hedge fund managers:”

VIX is being jammed for the moment, but no new lows. It appears ripe for a strong rally and the Pivots are in line with SPX. In this case, VIX shows strength through March 7 in the Model.

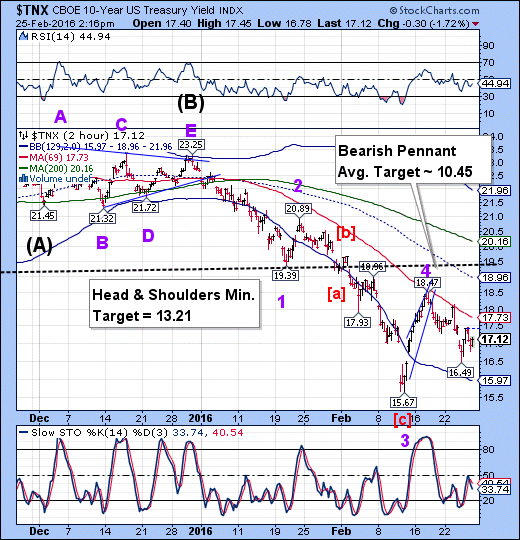

TNX is pulling back from its early lows, but isn’t buying the rally in SPX. The source of the juice in SPX appears to be the USD/JPY in a corrective spike that now appears to be waning…

Treasury yields appear to have already started their crash. A further decline beneath 16.49 or beneath the Cycle Bottom at 15.96 may confirm the crash may be underway.

The BKX was finally able to fill its gap this morning. However, it is now being detained by the short-term resistance at 60.41. Note the Trading Bands are also contracting in BKX.

SKEW tells us that those hedging the SPX in the options have virtually been chased out of the market by the short squeeze down to the early August level. This situation is ripe for a crash because market perception as indicated by SKEW is near 100, which is means the market views tail risk as normal.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.