This is 'The Bubble' Which 2008 was 'The Warm Up'!

Stock-Markets / Financial Crisis 2016 Feb 23, 2016 - 08:34 PM GMTBy: Gordon_T_Long

... It is going to take longer to unfold then people think!

... It is going to take longer to unfold then people think!

Graham Summers is the Chief Market Strategist with Phoenix Capital Research in Washington, DC. Phoenix capital research is an investment research firm, that has clients in 56 countries around the world, specializing in investment research on a subscription basis.

Japan's NIRP announcement & the US$

Japan's NIRP announcement & the US$

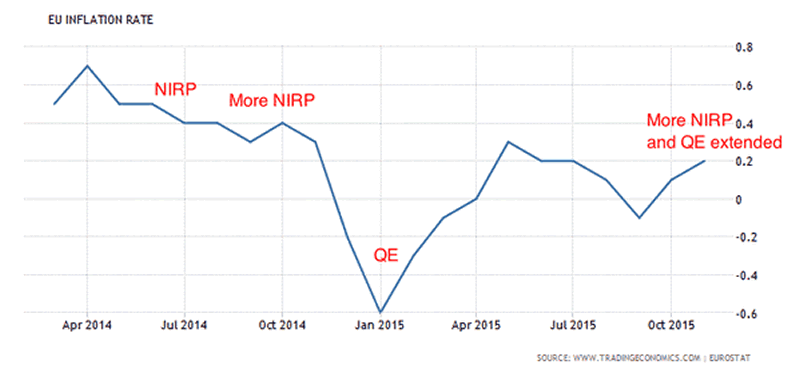

Japan is at the forefront of the Keynesian central planning that has been in the markets for the past few decades. The federal reserve first went to ZIRP and launched quantitative easing in 2008. The European central bank went to ZIRP and they launched QE in 2015. The bank of Japan first went to ZIRP in 1999, in which they then launched quantitative easing in 2000. They're much more experienced in seeing what these sorts of policies can accomplish.

A week or two before NIRP was announced, Kuroda, the head of the Bank of Japan announced that Japan's potential GDP growth was 0.5% or lower, which is an astounding admission, implicitly admitting that no matter how much money is printed or what monetary policy will be used, Japan's GDP will not and cannot break above 0.5%.

Graham states, "From a psychological perspective, this is like a central banker saying, 'we don't have the tools required to generate economic growth' - Similar to a doctor saying, 'no matter how much medicine you take you won't possibly get better'."

That was the beginning of the end. "It wasn't too surprising for me that shortly thereafter when the Bank of Japan went to NIRP, the market reaction was terrible. When you reach the end game for central banking omnipotence, there are no longer positive results from central bank policy."

"Anytime you cut interest rates, or launch quantitative easing, there will always be negative as well as unintended consequences. The one positive consequence since 2008 is that when these policies are launched, stocks go up" "None of these policies really generate economic growth, they're all about the bond bubble."

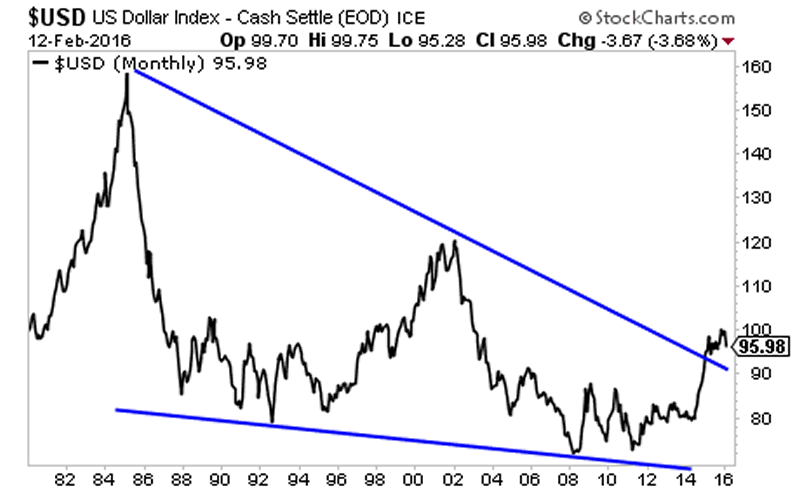

Graham mentions that when Kuroda launched NIRP, the positive consequences of that policy which is the Japanese stocks rising, only lasted one day. The negative aspects exist, and Japan has since had to cancel a bond auction due to a lack of interest, which in Japanese history, has never happened. Meaning that Japan was not able to sell it's debt on the markets because investors did not want to buy bonds at a negative yield. "When the crisis hit in 2008, all central banks coordinated their responses, however, this was in a fiat world, where everything was relative. All the policies consisted of currency debasement, with the idea of inflating away debt payments." The problem with this is that when any one country launches any policy, it has an adverse effect on the currency against which their currency trades. The most obvious example being the euro vis-à-vis US federal reserve and the dollar. The euro represents 56% of the value against which the dollar trades, if the ECB does anything to push the euro down, the dollar would naturally go up. The bank of Japan and the European Central Bank employing NIRP, should be very dollar positive. However, for years hedge funds have been betting very large leveraged sums that are shortening the yen and going long on the Nikkei, when the Bank of Japan implemented NIRP and the negative consequences occurred, that trade began to surge, as did the yen, and the Nikkei collapsed. What this has done is forced very many institutions and hedge funds to liquidate their positions.

"We are seeing the yen soaring and the dollar is falling as a result. That is not based on any fundamentals, that is just liquidity sloshing around the system. From a global perspective, what the bank of Japan did should be very dollar positive and I believe it will be proven to be the case."

"We are in such a central planning oriented world that what has been driving markets in the short term is perspective on what central banks are going to do."

An Imploding Bond Bubble

The bond bubble is the bedrock of the financial system, it is over $100 Trillion in size, and is going to take years to deflate. The first wave of deflation was the high yield bond market, which has begun to implode. It will also feature emerging market corporate debt defaulting. Slowly, one by one each foot will fall until we will reach the sovereign bond default but it will take months, if not years.

"Oil experiencing a 60% price collapse in about a 6 month period in 2014, was really the bond bubble, the junk bonds in the energy sector blowing up. The bubble we're dealing with right now is the crisis to which 2008 was the warm-up, and it will take much longer to unfold than people think."

Gold

Gold was in a bit of a bubble in 2011, it was so far overextended above it's overall bull market trend line, it was bound to collapse. When that collapse is combined with central bank manipulation and the effort to suppress gold, you're going to see an asset class struggle for years to find it's legs again.

Since China devalued the Yuan in August - September, gold has begun to outperform stocks. Since Japan went to NIRP this process has accelerated dramatically. It appears for the last 6-7 years, investors were loading into stock as a hedge against central bank policy, and gold would also benefit from this. This trend reversed in 2011, investors continued to use stocks as a hedge against central bank policy, but they abandoned gold. That seems to have reversed, investors are now moving into gold as a hedge against central bank error and stocks are suffering. The reason gold is having such a dramatic move is that the gold market is so much smaller than stock, that when you start seeing large scale chunks of capital moving into gold, the movements become very significant.

Custodial Risk

Graham explains that custodial risk is the question of what an individual actually owns. He uses the example of buying stock and how individuals no longer receive a paper certificate, and the assets are held digitally, usually in a broker's account. If the financial institution who is sitting on these assets for you, goes out of business, what are people to do with their money? Graham illustrates that gold and physical cash is so appealing due to the lack of custodial risk.

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.