U.S. Banks Ready for Negative Interest Rates?

Interest-Rates / Credit Crisis 2016 Feb 17, 2016 - 10:43 AM GMTBy: BATR

The test run proved that negative interest rates can push savers into minus territory. Public outrage, while registered is not heard by the central bankers. The reasoning that commercial banks will start making loans because of the cost of sitting on deposits is pure fantasy thinking. As the article, Low Interest Rates Impoverish Savers shows,

The test run proved that negative interest rates can push savers into minus territory. Public outrage, while registered is not heard by the central bankers. The reasoning that commercial banks will start making loans because of the cost of sitting on deposits is pure fantasy thinking. As the article, Low Interest Rates Impoverish Savers shows,

“How long will people accept this thief? The options to parking cash in hand with a FDIC insured institution seems worth an examination. However, few alternatives for working class savers exist. Surely, this occurrence is intentional because the real objective of the "New Normal" is to bankrupt Middle America. What other conclusion makes sense?”

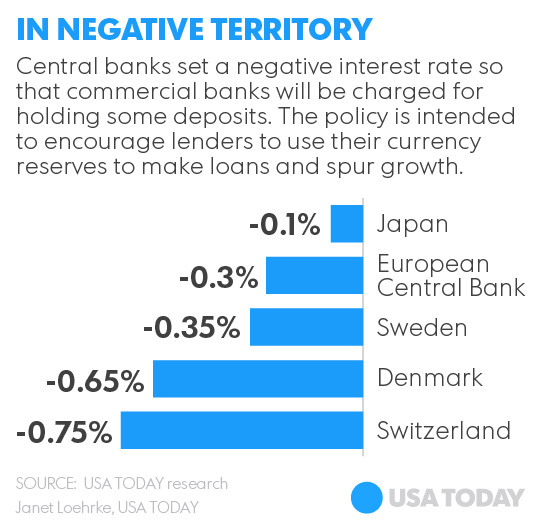

Part of this deliberate devaluation of your money in a zero interest rate environment, now gets a new shock. Janet Yellen: Negative rates possible in U.S. "We're taking a look at them ... I wouldn't take those off the table," Federal Reserve chair Janet Yellen said Thursday at a Congressional hearing.

Imagine putting a C note in a bank account and getting 99 Federal Reserve dollars back. Some might say, well just another tax. Others may shout hell no and take their money out and close their account. In either case the facts are undeniable; we all will be poorer if the Fed pushes the button to go negative.

Tim Maverick in the Wall Street Daily warns in Negative Interest Rates Coming to the U.S.

“Even if steeply negative rates on cash don’t happen, a negative rate of 4% or more would have drastic effects around the financial system.

Two immediately come to mind:

1) Most, if not all, fixed income assets would have a negative yield. How are pension funds and insurance companies supposed to earn income to pay their policy holders or pensioners?

2) Highly negative yields will make anything with a positive yield, such as equities, highly desirable. We may see the “mother of all stock market bubbles” if rates go highly negative.

Get ready for Alice in Wonderland, coming to U.S. financial markets…”

Bloomberg Business reports Fed sentiment in The Fed Wants to Test How Banks Would Handle Negative Rates.

“New York Fed President William Dudley said last month that policy makers were "not thinking at all seriously of moving to negative interest rates.

"BUT I suppose if the economy were to unexpectedly weaken dramatically, and we decided that we needed to use a full array of monetary policy tools to provide stimulus, it’s something that we would contemplate as a potential action," he said on Jan. 15.

Fed Vice Chairman Stanley Fischer said Monday that foreign central banks that had resorted to negative interest rates to stimulate their economies had been more successful than he anticipated.

“It’s working more than I can say I expected in 2012,” he told the Council on Foreign Relations in New York. "Everybody is looking at how this works," he added.”

Are you scared yet? Well, you should be. When the CFR gets their heads-up from the Fed, you know the New World Order has plans that will cost you plenty. A little evidence to prove this point comes out of the New York Times, when they ask: Why People Are Paying to Save ?

“But don’t people just withdraw cash rather than pay to deposit it at their bank or buy a government bond that will give them back less than they paid?”

Here is their answer: “it looks as if the convenience of keeping money in a bank account is worth a small negative interest rate or fees for most consumers and businesses, at least at the only slightly negative rates currently in place. Storing and providing security for cash may be more expensive than a small bank charge.”

If you are normal you should be getting a migraine headache by now. Let’s keep this simple. If you withdraw your money and even close your account, you might be tagged as a drug dealer or a money- launderer. If you keep your dollars under the mattress, start worrying about getting robbed, a fire or worse yet, a currency recall that may not honor your alleged ill-gotten gain.

Jump on Treasuries and go pray that the Dollar will survive. Or buy gold and wake up to the news that it once again is illegal to possess the gilded metal. In the vernacular of the street, we are all F%#$ed.

OK go into the markets and start buying equities and wait for the ultimate bottom and watch the washing machine strip away half or more from your liquid wealth.

So coming full circle, one needs to listen to another flagship of the Globalists; The Economist explains, Why negative interest rates have arrived—and why they won’t save the global economy. “Many big economies are now experiencing “deflation”, where prices are falling.” What an admission as if rational observers did not understand this reality long ago.

What’s next, some financial wizard will argue that one is actually making money paying the price under a negative interest rate because your remaining money will buy more stuff. Balderdash . .

Maybe it is time to rewrite the movie The Big Chill using a script about The Big Squeeze and end with a funeral for the saver and plot the enjoyment of freely spending what little money one has before the hammer comes down on the coffin. Catch 22 revisited is an appropriate title as faith in the Federal Reserve exists only in the demented minds of a central banksters.

America cannot escape the capital liquidation that follows a Derivative Meltdown and Dollar Collapse. The saying being “Nickel and Dimed” has never been truer, if and when the interest rates go under water. Unless the Federal Reserve is abolished and debt created issuance of money eliminated, the end game will be bloody. Safety exists only in the minds of the deniers. The risk of societal implosion cannot be hedged when the instruments used are merely another variation of the same Ponzi scheme.

James Hall

Source: http://www.batr.org/negotium/021716.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2016 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.