The 2016 Financial Market Meltdown and The Golden Age

Stock-Markets / Financial Crisis 2016 Feb 16, 2016 - 05:38 PM GMTBy: Chris_Vermeulen

The majority of the world’s stock indices topped out this month on Monday, February 1st, 2016 after a strong oversold technical bounce in price. Several indexes are now in the process of their first re-test of those multi-month lows which should act as support.

The majority of the world’s stock indices topped out this month on Monday, February 1st, 2016 after a strong oversold technical bounce in price. Several indexes are now in the process of their first re-test of those multi-month lows which should act as support.

Trade smarter and make more money with Tradespoon!

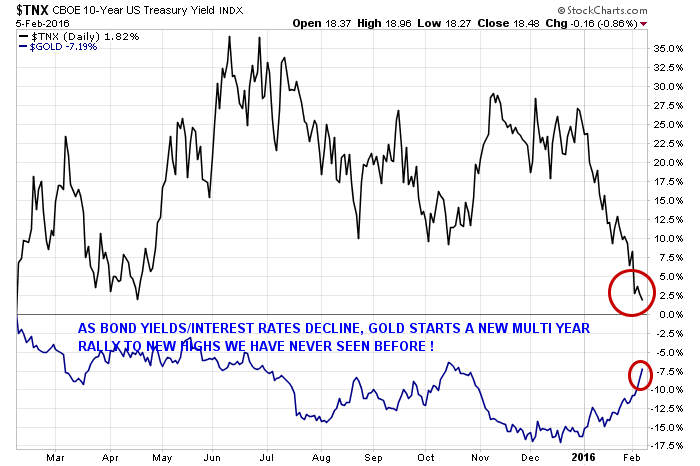

My belief is that the FED will abandon its plan to raise short-term rates in March 2016, given the “economic global contraction” in economic data including the Baltic Dry Index and troubled banking systems in the European Union.

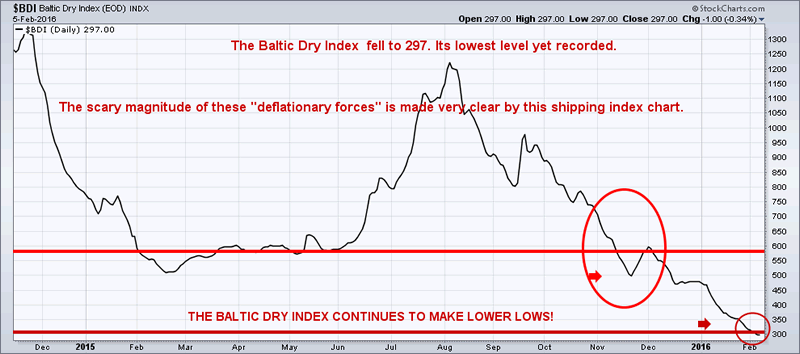

The Baltic Dry Index below displays the major global contraction is now in process, it has now broken support at the 300 level and heading much lower. The Baltic Dry Index tracks the price of shipping raw materials across trade routes which makes it a good indicator of global economic activity. It is the pulse of World trade. The demand for goods is currently collapsing.

The BDI is one of the key indicators that experts look at when they are trying to determine where the global economy is heading. And right now, it is telling us that we are heading into a major worldwide economic downturn. In fact this trader warned of this happening on Nov 2015 in his report: The Collapsing Global Trade

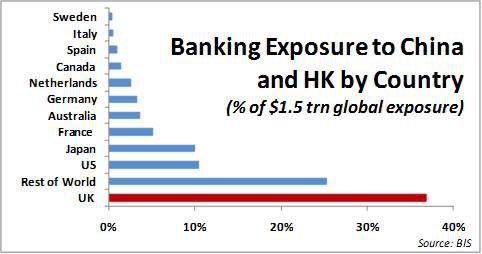

European banks have been absolutely hammered, and Germany is massively exposed because it does huge business with China. Deutsche Bank, Credit Suisse, Santander, Barclays and RBS are among the stocks that are falling sharply sending shockwaves through the financial world.

Deutsche Bank is the biggest bank in Germany and it has more exposure to derivatives than any other bank in the world. Deutsche Bank credit default swaps reflect that there are in deep financial problems and that a complete implosion is imminent.

In 2015, Deutsche Bank had lost a staggering 6.8 Billion Euros. The most important bank in Germany is exceedingly troubled and it could bring down the Europe Union. Credit Suisse announced that it will be eliminating 4,000 jobs. Most U.S. consumer banks are cutting jobs and trimming branches. Bank of America and Citibank eliminated 20,000 staffers between them and JP Morgan Chase eliminated 6,700 positions.

The world is currently threatened by the $200 trillion “credit bubble” that is currently deflating. It was created by the FED and global central banks. Despite so many trillions of dollars in QE, we never experienced the full recovery that we were told would happen!

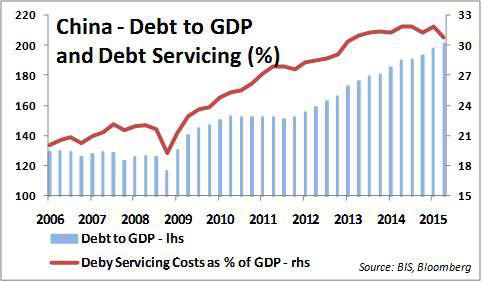

China's banking system is just months away from its day of reckoning. Its $5 Trillion of unstable debt will bring down the whole global financial system. China's debt binge is beginning to unwind.

This is just more evidence that global trade is grinding to a halt and that 2016 is going to be a “cataclysmic year” for the global economy.

As these fears become reality expect the FED to reverse course and perhaps even impose 'negative nominal interest rates.' here in the US. In a speech, on February 22th, 2010, to the University of San Diego's business school, Chairperson Janet Yellen was quoted “If it were positive to take interest rates into negative territory I would be voting for that".

Report explain why lower rates are coming: XLU and TLT suggest that interest rates are going down

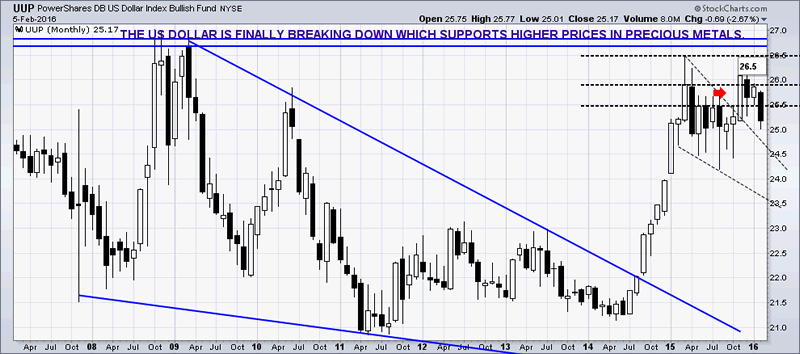

The FED is fearful of making another mistake and they are finding it hard to do anything correct. They are paralyzed. It is my belief they will hold off, thus causing the dollar to fall, while other currencies and precious metals rise.

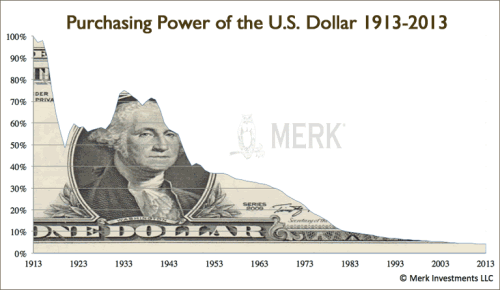

The US Dollar has lost over 95% of its purchasing power in the first 100 years of the FED existence.

Interest-rate jitters going forward are what brought gold up, and with stock markets crashing all over the world and the U.S. “economic contraction” nothing is pointing to more rate hikes, that's why gold is golden AGAIN!

New central bank policies of “negative yield returns” provides a fundamental reason to own gold today going forward. The Bank of Japan has cut interest rates to negative 0.1 percent which follows similar moves by ECB, Denmark, Sweden, Switzerland and very soon South Korea.

The basic idea is that gold will be the new currency to evolve.

The bigger story was in precious metals. Gold continued to soar reaching a new cycle high of $1175.00/ounce and Silver also rallied to a new cycle high of $15.06/ounce on February 5th, 2016, its highest mark in three months. The world's largest gold-backed exchange-traded fund, SPDR Gold Trust rose to 22.3 million ounces on Thursday February 4th, 2016, the highest since late October 2015.

Who would have guessed that gold would be one of the best assets to own in 2016? So far, that has been the case. While the U.S. stock market has rung up its worst start to a year and a cloud of economic doom and gloom continues to roll across much of the world.

Gold is on a hot streak, up 10% this year alone, after shrugging off the Federal Reserve's interest-rate increase back in December 2015. It should have spelled doom for prices, instead, it's on track to gain 10% and more so far in 2016. True, it's still early in the year, but if gold were to just tread water for the next 11 months, it would mark the best annual gain in four years.

Don't waste your time! Click here to find winning trades in minutes!

Typically, a rise in gold and a fall in equites sends the US Dollar lower. From there, other commodities will begin to rise including agricultural, oil and softs such as coffee. But we do not just make money from rising prices. See how traders profited handsomely from the collapse of sugar in January.

2016 is and will continue to be an incredible year for traders and investors. Volatility will remain high, price swings will be large and new big trends are emerging.

If you are an active trader or passive long term investor looking for simple, logical trades to profit from the next major trends in stocks, bonds, and commodities then follow me at: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.