Latest Declines Suggest Stock Market Buying Opportunities

Stock-Markets / Stock Markets 2016 Feb 16, 2016 - 02:52 PM GMTBy: Richard_Cox

For most of this year, stock markets around the world have been under pressure as the majority of investors are starting to take profits and prepare for the inevitable tightening cycle that is now expected for global interest rates. Of course, increases in interest rates will take some time to actually filter through the market but an ounce of expectation is worth a pound of action in the financial markets -- and this is why stock prices are currently falling through important psychological support levels.

For most of this year, stock markets around the world have been under pressure as the majority of investors are starting to take profits and prepare for the inevitable tightening cycle that is now expected for global interest rates. Of course, increases in interest rates will take some time to actually filter through the market but an ounce of expectation is worth a pound of action in the financial markets -- and this is why stock prices are currently falling through important psychological support levels.

But for investors that are focused more on the long-term, these types of declines can actually be viewed as a positive if you are not actually in live positions. In fact, these types of declines tend to be followed by strongly forceful moves to the topside when we look at things from the historical perspective. Here, we will look at some of the long-term trends that have followed these types of environments.

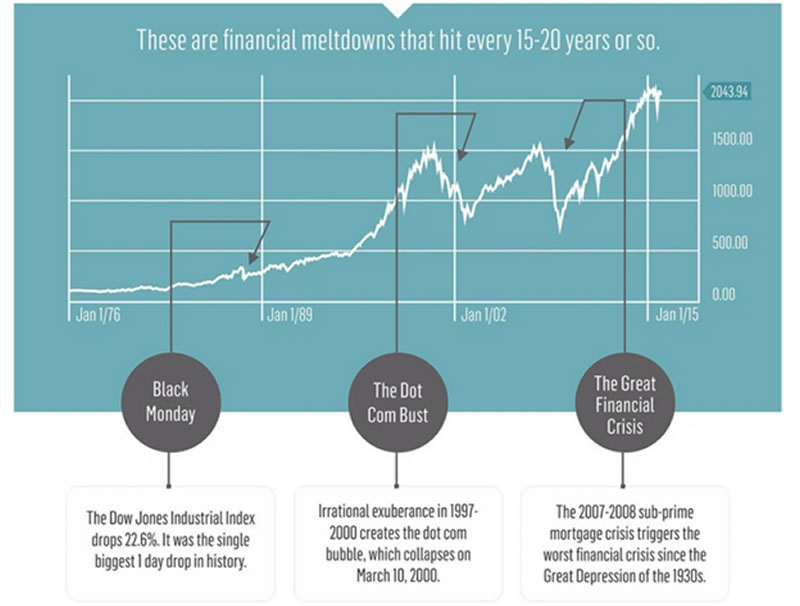

Historical Price Moves in the S&P 500

In the chart graphic above released by Investment Zen, we can see that these latest declines can be viewed as relatively insignificant when viewed against the dominant trends. These types of situations indicate that periods of panic selling tend to generate losses more than gains, and that buy-and-hold strategies tend to be the best methods for riding out market corrections.

This is outlined in three different instances: Black Monday, the Dot-Com Bust, and the Great Financial Crisis of 2008. In each of these cases, periods of bearish correction followed as the market returned to its historical averages with many investors quaring their positions. We can view the current market environment as a microcosm of these events as the fundamental interest rate drivers have spooked investors enough to start taking some of their expose off of the table.

Positioning for the Correction

So while many investors might be looking at this year’s performance as a reason to start exiting all of their positions in equities, a quick look back at the historical tendencies shows us that this is not a prudent move and that it makes much more sense to simply ride out the correction and wait for the longer-term trends to come back into play.

On a percentage basis, the YTD performance in the S&P 500 has not done much to erode the longer-term gains that have been seen in the index. This means that it is still prudent to maintain the bullish bias as long as support near 1500 remains intact. This area marks the double-top resistance from 2007 that is now expected to act as a demand level, and declines should be relatively subdued as long as markets hold above these areas. We would still see further moves lower if the Federal Reserve indicates a need to become aggressive in raising interest rates. But if the historical tendencies are any indication, these moves should be viewed as a correction to buy rather than a trend change to sell.

By Richard Cox

© 2015 Richard Cox - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.