Gold Price Surges Another 7% This Week – Largest Gain Since 2008

Commodities / Gold and Silver 2016 Feb 12, 2016 - 02:43 PM GMTBy: GoldCore

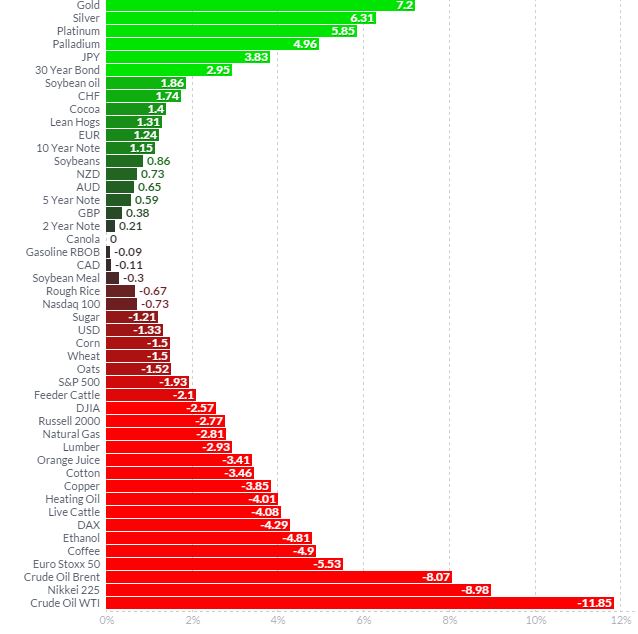

Gold bullion jumped 4 percent yesterday to $1,244.20/oz, its biggest single-day percentage rally since 2013. For the week, gold is 7.2% higher which is its biggest weekly gain since the global financial crisis in 2008.

Gold bullion jumped 4 percent yesterday to $1,244.20/oz, its biggest single-day percentage rally since 2013. For the week, gold is 7.2% higher which is its biggest weekly gain since the global financial crisis in 2008.

Gold and silver have benefited along with high credit government bonds from a rush to safety as investors worry about the health of banks, the banking system and the risk of a global recession. Gold is now 16.7% higher year to date. Analysts and traders see more gains ahead as the weakness in equities is likely to continue.

Silver is 6.3% higher for the week bringing year to date gains to 14%. Both look over valued in the short term and are due a pullback. Prices could continue to rise, making dollar cost averaging prudent. Buyers should be getting into position to buy on the next dip.

Bullion dealers around the world, including GoldCore, have seen a surge in demand for gold and silver. Buyers, who had been waiting for signs that the market had bottomed and a clear uptrend for the precious metals, are allocating funds now. There are some first time buyers coming into the market but demand is mostly coming from bullion buyers adding to allocations.

Global demand for both metals remains robust and has increased as stocks have fallen sharply in recent days. This robust demand is seen in the latest World Gold Council report – Gold Demand Trends released yesterday.

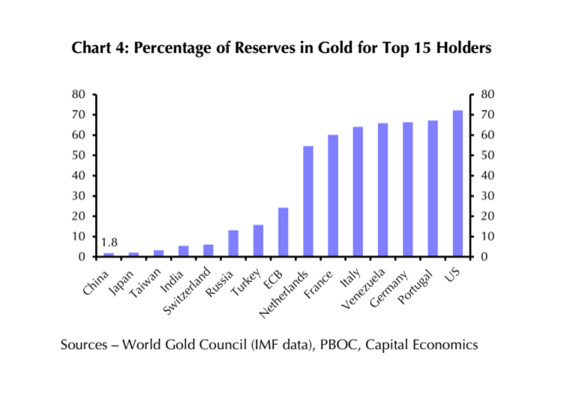

Central banks continue to be some of the largest buyers of gold. Demand for gold bullion from central banks grew by 25% in the fourth quarter of 2015 to 167 metric tons, compared with 134 metric tons the same time last year, according to the World Gold Council’s latest report.

We have long asserted that given the scale of foreign exchange reserves held by central banks, official diversification into gold was likely to continue until their allocations have risen from the extremely low levels of today. As a percentage of overall fx reserves, gold allocations remain extremely small.

This is particularly the case with China and Russia – the two largest buyers of gold today.

Demand for jewellery, bullion bars and coins totaled 934.9 tonnes in Q4 2015, almost matching the Q4 2014 total (938.3 tonnes) and exceeding its 5-year average (913.8 tonnes). This demand has almost certainly increased in recent weeks given concerns about the global economy and the real risks of a new global financial crisis.

Assets in the world’s biggest gold exchange-traded fund, the SPDR ETF, rose 2% yesterday, the biggest inflow in two months. Total holdings of the top eight gold ETFs have surged 3.8-million ounces so far this year, after three consecutive years of decline.

The smart money is reducing exposure to risky assets and continuing to diversify into precious metals. This trend is likely to continue given the scale of the financial and economic challenges facing investors today.

Banks, economists, brokers, financial advisers and other experts did not see the first crisis coming in 2008 and many of them are not seeing it now.

A handful of people are warning about the risks of the coming crisis and again they are largely being ignored. Investors and savers will again bear the brunt for the inability to look at the reality of the financial and economic challenges confronting us today.

Diversification and an allocation to precious metals remains vital in order to protect and preserve wealth in the coming global financial crisis.

LBMA Gold Prices

12 Feb: USD 1,239.50, EUR 1,098.65 and GBP 852.07 per ounce

11 Feb: USD 1,223.25, EUR 1,080.80 and GBP 847.33 per ounce

10 Feb: USD 1,183.40, EUR 1,052.29 and GBP 816.56 per ounce

9 Feb: USD 1,188.90, EUR 1,061.90 and GBP 822.31 per ounce

8 Feb: USD 1,173.40, EUR 1,050.16 and GBP 810.44 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.