Canadian Dollar Now Even Less of a Haven from US Dollar Collapse Than Before

Currencies / Canadian $ Feb 12, 2016 - 02:34 PM GMTBy: Jeff_Berwick

In 2011, we posted an article entitled “The Canadian Dollar is No Haven from a US Dollar Collapse.” The point of the article was that Canada had almost no gold reserves and the only thing backing the Canadian dollar was the US dollar.

In 2011, we posted an article entitled “The Canadian Dollar is No Haven from a US Dollar Collapse.” The point of the article was that Canada had almost no gold reserves and the only thing backing the Canadian dollar was the US dollar.

Canadians were quite smug, back then, with the Canadian dollar trading above par with the US dollar and we wanted to remind them that not only would the Canadian dollar not be a haven from a US dollar collapse, but the loonie would collapse before the US dollar, since nothing is backing it but the US dollar and Canada had no gold (amongst many other reasons).

Since then, the Canadian dollar has fallen dramatically.

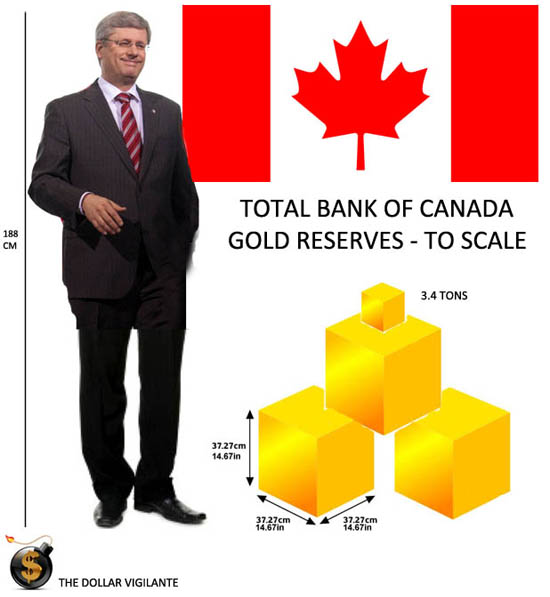

In 2011, we posted this graphic, which showed then Prime Minister at the time, Stephen Harper, standing beside a to-scale image of the tiny amount of gold Canada held.

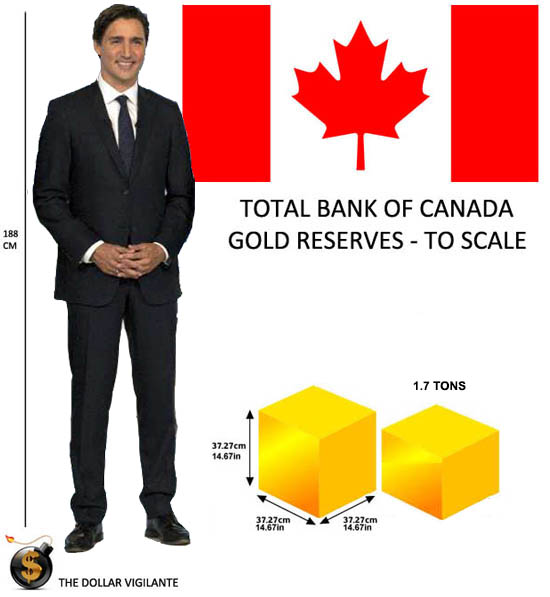

Well, now, just five years later, that number has been reduced by half as the Canadian government sold another 1.3 tons of gold in recent weeks and now holds an even smaller amount, 1.7 tons of gold, total.

Here’s the updated version of the to-scale image. The size of the Prime Minister stayed the same, he just got prettier and more socialist, but Canada’s total reserves of gold are now small enough to fit in one of Trudeau’s desk drawers.

This is only the latest bout of selling. Canada followed the UK in selling gold in the 1990s when gold was at a historic low of several hundred dollars.

Back in 1965, Canada had 1,023 tons of gold reserves but by 1985 it only held 500 tons. As part of a central bank scheme to damp the price of gold against the dollar, Canada kept selling along with other banks.

Throughout the 1990s up to 2002, Canada kept selling. And now it holds a laughable 1.7 tons. Compare that to China’s 1,700 tons. The US says it has 8,000+ tons, but no one has seen it since the 1950s… and we go by the “if no one has seen it in over 80 years it’s probably not there” rule.

There is always someone in the crowd who will say, “But, Canada has a lot of gold in the ground!”

So? If what you are saying is that the Canadian government, if need be, can nationalize and take over private in-ground gold holdings held by landholders and private individuals and companies… then you are saying, “But, Canada can become more like Venezuela!”

Yes, it could. But, that wouldn’t be a good thing!

The point is that the Bank of Canada and the Canadian government have removed any hard-money backing from the dollar over the decades and the only thing backing it now are pieces of paper backed by the most indebted country in the history of the world, the US.

Canadians are already finding out how brutally mismanaged their currency has been. And Americans should take note because it will happen there next.

Food prices have skyrocketed in Canada due to the decline of the Canadian dollar. Images have gone viral on the internet of $7 cauliflowers and celery and $3 cucumbers.

These are the kinds of topics we’re going to be discussing at our upcoming TDV Internationalization & Investment Summit on February 18th in Acapulco, Mexico.

We’re almost sold out now and I would encourage you to book your reservation as soon as possible.

While the Canadian government has been selling the last vestiges of its gold holdings, wise Canadians who have been buying gold have seen their investment rise dramatically, in Canadian dollar terms, in the last two months alone.

Join us at the TDV Summit to learn how to protect yourself from the ongoing collapse. Or, if you can’t make it, subscribe to the TDV newsletter (more info here) to get information and analysis to protect yourself and profit from the collapse.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.