Will Harry Dent Eat Crow on His $700 Gold Price Prediction?

Commodities / Gold and Silver 2016 Feb 12, 2016 - 12:16 PM GMTBy: Jason_Hamlin

Investment guru Harry Dent has made quite a few predictions since his start in the 1980’s. He has certainly been correct a few times and had to backtrack several other times. In early 2013, he predicted a financial crash will begin between the end of 2013 and the first half of 2014. This prediction was incorrect or maybe just early by a few years.

Investment guru Harry Dent has made quite a few predictions since his start in the 1980’s. He has certainly been correct a few times and had to backtrack several other times. In early 2013, he predicted a financial crash will begin between the end of 2013 and the first half of 2014. This prediction was incorrect or maybe just early by a few years.

In 2014, while promoting his book, he predicted a major Australian housing market correction beginning in 2014 after an even bigger one in China. While the housing market is cooling in both countries, we have yet to see a major correction.

His latest prediction that has attracted much attention in the gold investment community, is that the price of gold will fall to $700 per ounce in 2014. That didn’t happen and so he revised this prediction to 2015, which also didn’t happen. Harry Dent’s latest prediction on gold is that:

Around $700/ounce is a certainty in gold by 2015 to 2016, and $250 is a possibility well down the line by 2020–2023.

I guess you just keep moving the years out until you are right and add the word “certainty.” This is why I try to steer clear of short-term price predictions in the gold market, as they are nearly impossible to get right.

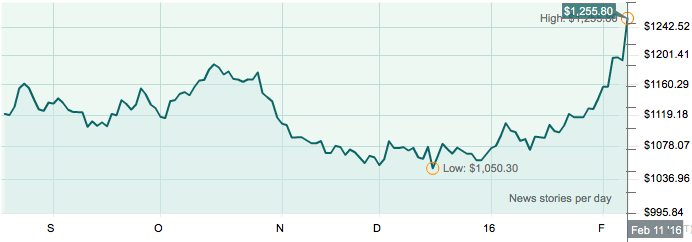

The gold price has rocketed nearly $200 higher (18%) to $1,250 so far in 2016. It is climbing despite deflationary pressures in the marketplace and the FED hiking rates for the first time in nearly a decade. How can this be?

There is a common misunderstanding that gold needs inflation and low rates in order for the price to climb. Yet, gold has historical precedent for appreciating not only during inflationary periods, but also during deflationary ones. Furthermore, the gold price advanced very strongly during the 1970’s when interest rates were rising. In fact, one-year Treasury bills (T-bills) rates climbed from 3.5% in 1971 to over 15% by 1980. During the same time period, the price of gold skyrocketed 16 times higher from $50 an ounce to $850 an ounce. Indeed, gold has performed well during past rate-hike cycles.

More specifically:

- From August 1971 through December 1974 the gold price rose from $35 to $200 per ounce, while the effective Fed Funds Rate rose from 5.5% to 8.5%.

- From January 1975 through August 1976 the gold price dropped to just over $100/oz, while the Fed Funds Rate fell to 5.25%.

- In January of 1980 the gold price peaked at over $800/oz while the Fed Funds Rate rose to 14%.

- The gold price then fell to about $290/oz in late February, 1985, while the Fed Funds Rate fell to 8.6%.

Deflationary periods also do not ensure a lower gold price. It is the expectation of deflation that usually drives the gold price lower. When deflation actually arrives, gold tends to bottom as forward-looking investors bid up the gold price with expectations that the FED will overshoot in attempts to stop the bleeding and this will lead to a swing back to inflation.

The most recent price action is a prime example. Deflationary trends have been dominant for the past year and the equity markets are finally crashing. Yet, the gold price is soaring higher.

The bottom line is that investors should not simply look at interest rates or inflation/deflation in order to determine which way the gold price is headed. I keep an eye on the USD index, which has run into stiff resistance at 100 and turned lower. But even dollar strength/weakness is not necessarily a good indication of which direction gold is headed. The gold price can climb higher along with the USD, which is essentially just a measure of one fiat currency versus other fiat currencies.

I prefer to look at supply and demand fundamentals, which are very bullish for gold at the current time. The World Gold Council (WGC) reported that demand in 2015 remained near record levels, with strong growth coming from investment demand (+8%). Looking at the latest data, Q4 total demand was up 4% from an already high base, with investment demand up 15% and central bank demand up 25%.

On the other side of the equation, total supply was down 4% in 2015 and a whopping 10% during the most recent quarter. Anyone that passed Economics 101 knows that higher demand and lower supply leads to higher prices.

But one of the most important factors deciding the gold price (other than paper manipulation) is human emotion. Are investors currently fearful in chaotic markets or confident in stable markets? I would say that despite reassurances from FED chair Yellen and the media’s usual rose-tinted perspective, investors are probably the most fearful and markets the most chaotic that they have been since the financial crisis of 2008/2009. This is undoubtedly fueling the fire and helping to push the gold price sharply higher in 2016.

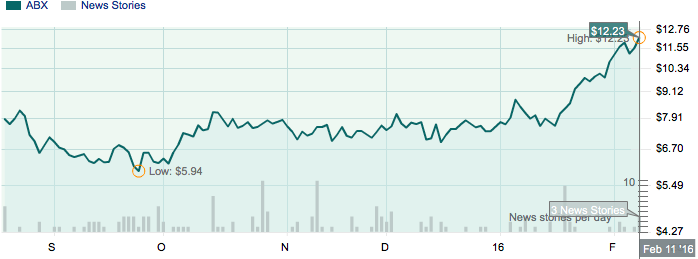

Anyone that remembers the beginning of this gold bull market knows just how fast prices can rocket higher when money begins flowing into this relatively small sector. This is especially true of the major producers early in the bull cycle, with companies like Barrick Gold up 65% year to date and more than 100% from the 2015 low.

If we have indeed bottomed at $1,045 gold, there is plenty of upside ahead. Gold is currently trading at $1,255 and the move higher shows no signs of slowing due to deflation or rising rates. At this point, one has to wonder if Harry Dent will eat crow on the $700 gold price prediction?

While Harry has been short gold, we have been long and adding to our positions during the dip. The Gold Stock Bull portfolio is racking up strong gains for our subscribers. Join us by clicking this link or the green button below. You can view the GSB Portfolio, receive the monthly Gold Contrarian Report and get our weekly trade alerts for just $95. If the newsletter doesn’t pay for itself in the first 30 days, simply ask for a full and immediate refund.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2016 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.