Where to Hide Your Money From Reckless Governments

Stock-Markets / Financial Crisis 2016 Feb 12, 2016 - 11:02 AM GMTBy: Casey_Research

By Justin Spittler

By Justin Spittler

A major central bank just made a desperate move…

If you’ve been reading the Dispatch, you know we’re living through a gigantic “global monetary experiment.”

In short, global central banks cut interest rates to zero to fight the 2008 financial crisis. They’ve held interest rates near zero ever since.

These reckless “easy money” policies have made it extremely cheap to borrow money. Using borrowed money, people have bought trillions of dollars’ worth of stocks, bonds, cars, commercial real estate projects, and single-family homes.

This has warped prices of nearly everything. U.S. stocks, commercial real estate, and art prices have all climbed to record highs.

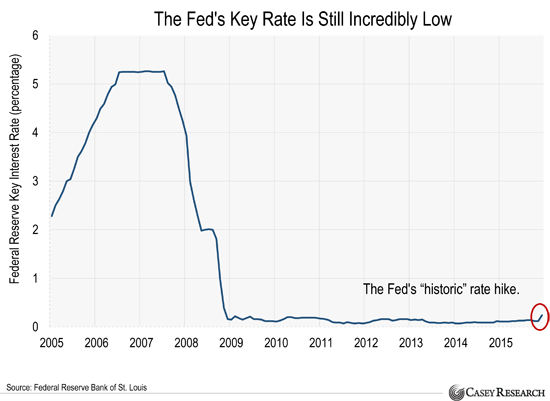

• In December, the Federal Reserve raised its key interest rate for the first time in years…

Many in the mainstream media called it the end of easy money. We pointed out at the time that interest rates were still extremely low. You can see in the chart below that the rate hike was tiny:

Although the rate hike was tiny, global stock markets couldn’t handle it. U.S. stocks were in a strong bull market from March 2009 through December 2014, gaining 204%. However, since the Fed raised rates on December 16, the S&P 500 has dropped 6.4%.

Foreign stocks have also fallen. The Stoxx Europe 600, which tracks 600 of Europe’s largest stocks, has dropped 5.4% since December 16. The Japanese Nikkei has dropped 8% in the same period.

If markets were healthy, a tiny rate hike would not cause them to fall apart. Global financial markets are addicted to easy money.

• On Friday, Japan’s Central Bank dropped its key interest rate below zero…

The Wall Street Journal reported (emphasis ours):

Central banks around the world are going to new lengths to boost their economies, underscoring both the importance and limits of monetary policy in a global economy plagued by paltry growth and unsettled markets.

The Bank of Japan on Friday joined a host of European peers in setting its key short-term interest rates below zero.

The BOJ lowered its key rate to -0.1%. It’s the first time in history Japan has seen negative rates.

The idea of negative interest rates sounds bizarre to most people. After all, the whole point of lending money is to earn interest…

With negative interest rates, the lender pays the borrower. If you lend $100,000 at -1%, you only get $99,000 back.

This is the Japanese government’s latest scheme to jump-start the economy. The Bank of Japan has pumped hundreds of trillions of yen into its financial system in the last couple years. The flood of new money helped goose Japanese stock prices for a while. From December 2012 to August 2015, the Nikkei surged 120%.

However, Japan’s easy money scheme hasn’t helped the “real” economy at all. Japan has slipped into a recession three times since 2010. And Japan’s currency, the yen, has lost 36% of its value against the U.S. dollar since 2012.

• Many major countries are using negative interest rates…

The Eurozone’s key rate is -0.3%. Sweden’s key rate is -0.35%. Denmark’s key rate is -0.75%. Switzerland’s key rate is -1.1%.

On Friday, Financial Times reported that $5.5 trillion in government bonds worldwide now have negative rates. That’s about one-quarter of the world’s government bonds.

According to The Wall Street Journal, countries that account for 23% of world economic output have negative interest rates.

• The European Central Bank (ECB) adopted negative rates in June 2014…

Today, its key rate is -0.3%.

Like Japan, negative interest rates haven’t helped Europe’s economy. Europe’s 9.1% unemployment rate is nearly double the U.S. unemployment rate. And the euro has fallen 20% against the U.S. dollar since the ECB introduced negative rates in June 2014.

• Dispatch readers know the global economy is stalling…

China is the world’s second largest economy. Last year, it grew at its slowest pace since 1990. Brazil, the world’s eighth biggest economy, is going through its worst economic downturn since the 1930s. Canada slipped into a recession last year.

Meanwhile, the U.S. economy has grown just 2.2% annually since the financial crisis ended in 2009… well below its historical average growth rate.

• And there’s little reason to think the global economy will pick up any time soon…

Last week, Caterpillar (CAT) reported bad quarterly results. Caterpillar is the world’s largest equipment and machinery maker. It sells equipment used to construct buildings, clear land, and dig mines. Caterpillar’s sales are a good indicator of how healthy the global economy is.

The company’s sales dropped 23% last quarter. It recorded a net loss of $87 million for the quarter… after making a $757 million profit during the fourth quarter of 2014.

Caterpillar’s sales dropped in December for the 37th month in a row. Caterpillar’s stock has dropped 31% over the past two years to its lowest level since 2010.

• Near-zero interest rates are failing to stimulate the economy…

We expect more governments to adopt negative rates. After all, making “easy money” even easier is the only way governments know how to fight a slowing economy.

And keep in mind this is all a gigantic experiment…

Central banks have never used negative interest rates before. No one knows how this will end. It’s very likely these reckless policies will blow up the financial markets.

That’s why we recommend taking two important steps to protect your money…

One: Own physical gold. Unlike stocks, bonds, or cash, it’s the only financial asset that has value no matter what happens to the financial system.

Two: Put some of your wealth outside the “blast radius” of a financial crisis. We wrote a new book with all of our best advice on how to do this. And we’ll send it to you today for practically nothing… we just ask you to pay $4.95 to cover our processing costs. Click here to claim your copy.

Chart of the Day

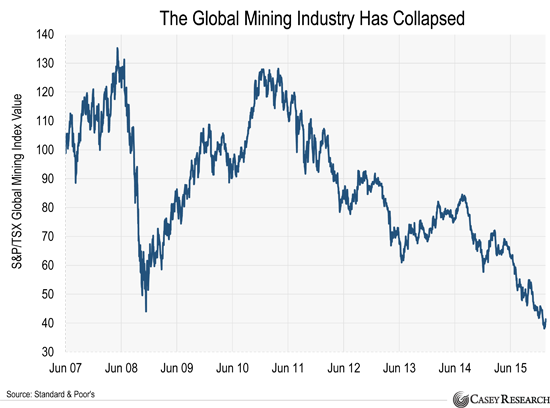

The global mining industry is in a severe downturn…

Today’s chart shows the performance of the S&P/TSX Global Mining Index. This index tracks the global mining industry, including producers of aluminum, coal, gold, and silver.

This index has been in a downtrend for nearly five years. It’s fallen 68% from its 2011 peak.

Global mining stocks have crashed with commodity prices. The Bloomberg Commodity Index, which tracks 22 different commodities, hit an all-time low less than two weeks ago.

Many of the world’s largest mining stocks are now trading at incredible bargains. Share prices of Glencore (GLEN.L) and Anglo American (AAL.L), two of the world’s largest mining companies, both recently hit record lows.

It’s tempting to buy these stocks at all-time lows… but we think they could get even cheaper. The global economy is slowing. This means companies will build fewer bridges, homes, and office buildings. That’s bad news for commodity prices and mining companies.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.