Stock Market Gap Down...

Stock-Markets / Stock Markets 2016 Feb 11, 2016 - 02:50 PM GMT The SPX Premarket is down below the Wave A low at 1828.45. The Elliott Wave pattern has morphed into another A-B-C, due to overlap in the Wave structure. What we are looking at is a hybrid Wave pattern that I have not seen before…but it is consistent and repeating. There is not enough time to complete an impulse down to the bottom of Wave (3). However, there is enough time for a Wave C. It appears that a gap down open is in the cards.

The SPX Premarket is down below the Wave A low at 1828.45. The Elliott Wave pattern has morphed into another A-B-C, due to overlap in the Wave structure. What we are looking at is a hybrid Wave pattern that I have not seen before…but it is consistent and repeating. There is not enough time to complete an impulse down to the bottom of Wave (3). However, there is enough time for a Wave C. It appears that a gap down open is in the cards.

ZeroHedge comments, “Yesterday morning, when musing on the day's key event namely Yellen's congressional testimony, we dismissed the most recent bout of European bank euphoria which we said "will be brief if not validated by concrete actions, because while central banks have the luxury of jawboning, commercial banks are actually burning through funds - rapidly at that - and don't have the luxury of hoping for the best while doing nothing." This morning DB has wiped out all of yesterday's gain.”

Deutsche Bank is now described as “worse than Lehman.” Could this be the catalyst for the plunge?

Initial jobless claims dropped notably last week (from 285 to 269k) but the overall trend (away from the noise) appears in tact. The smoother4-week average remains near 12-month highs and as Goldman notes weakness is widespread - "there is only limited evidence that the rise in claims is due to distress in the energy sector."

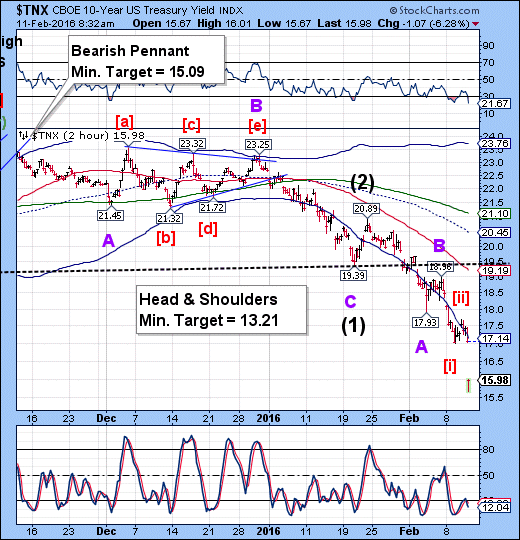

TNX has made its largest daily decline in memory this morning. This also confirms the SPX is likely to gap down at the open.

The EuroStoxx Index has touched down beneath 2700.00, breaking the previous low. It may also be in a Wave [c] decline that is scheduled to bottom this week. However, there is a long way yet to go.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.