Gold Price Surges 3.2% To $1,241/oz As Deutsche Bank, Stocks Fall Sharply

Commodities / Gold and Silver 2016 Feb 11, 2016 - 02:47 PM GMTBy: GoldCore

Gold has surged over 3% today on increased safe haven demand as stocks and in particular bank stocks see sharp falls. German shares have nose dived again and German colossus Deutsche Bank has fallen over 8%.

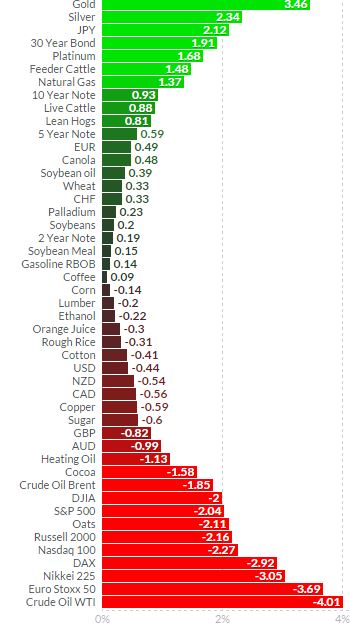

Futures – 1 Day Relative Performance – Finviz.com

A host of negative factors sent investors fleeing riskier assets. Oil prices slid on inventory data and on concerns about slowing global growth as Federal Reserve Chair Janet Yellen warned of several risks facing the U.S. and Chinese economies, and the global economy.

Gold and Silver News and Commentary

Central banks and Chinese buyers helping to spur gold demand – Reuters

Flight to safety sends gold surging above $1,200 to 8-1/2 month highs after Yellen – Reuters

Indian gold demand to climb in 2016 as buyers seek safe haven – Reuters

Gold demand jumps as fear grips markets – Telegraph

Banks drag European shares down as investors seek safety in gold – Independent

VIDEO: JP MORGAN – Gold Rally Breaks the Bullion Downtrend – Bloomberg

VIDEO: I’ve never liked gold-but I do now: Trader – CNBC

Why Gold Has Been on a Tear in 2016 – Fortune

“It’s Probably Something” – Gold Surges Above $1200; USDJPY, Oil, Stocks Plunge – Zero Hedge

China is on a massive gold buying spree – CNN Money

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.