World Markets Are in Sync

Stock-Markets / Financial Markets 2016 Feb 10, 2016 - 03:36 PM GMT Good Morning!

Good Morning!

In order to understand what is happening to SPX, we must also look at the other major indices to gain a perspective.

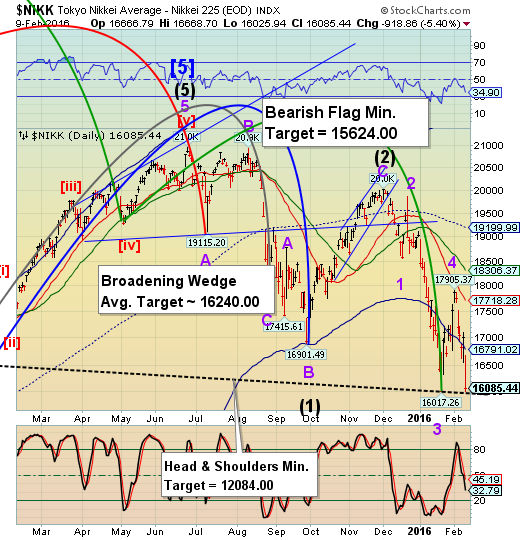

Yesterday the Nikkei declined to, but below a major support, otherwise known as a head & Shoulders neckline. This morning I can say that the Nikkei Index broke that support and is poised for the follow-through.

The Cycles Model suggests a Primary Cycle Pivot (low) this weekend. That suggests a possible 23% decline in the next two + days. Since the Pivot low happens on the weekend, the decline may “bleed over” into Sunday night.

The EuroStoxx 50 Index bounced to 2818.61 this morning as I write. This “touchback” of the Head & Shoulders neckline is acceptable and will relieve the oversold pressure enough for another plunge.

The Cycles Model suggests a Primary Cycle low on Friday, with a possible extension to Tuesday.

The SPX Premarket has bounced back to its smaller Head & Shoulders neckline at 1872.00 and its Cycle Bottom resistance at 1877.81. The retracement now appears complete and the decline has begun. A 38.2% retracement would terminate at 1873.82. I have re-labeled the Wave structure. After further thought, there doesn’t appear to be enough time for a more complex decline.

What prompted this was the memory of the October 10, 2008 Wave (3) bottom, which did not quite reach a massive Head & Shoulders target at 825.00. Instead, it bottomed at 839.50, causing me to delay taking profits. The SPX rallied 10% in less than an hour of profit taking.

I also wish to correct the timing that I had laid out yesterday evening. Depending on whether SPX makes a new high or yesterday’s high remains, a 17.2 hour Cycle will last until 11:00 am to 12:00 am on Friday Morning. A 21.5 hour Cycle may last until 3:00-3:30 pm on Friday. Today is a Primary Cycle Pivot and Friday is the next primary cycle Pivot, which may define both the top and bottom of Wave 5 of (3) of [1].

I also changed the EW structure simply because there is not enough time to complete anything more complex.

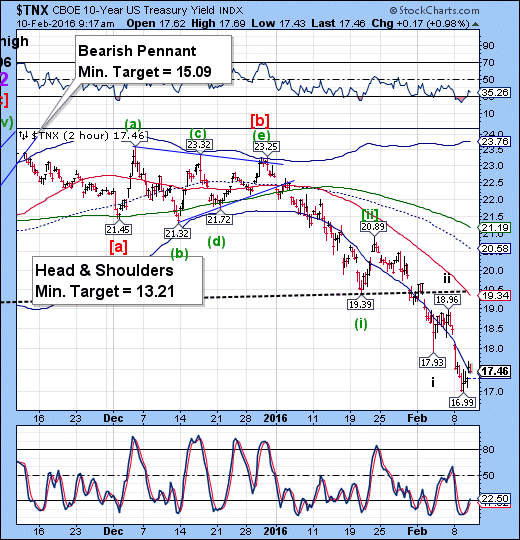

TNX is challenging its 2-hour Cycle Bottom, but doesn’t appear to have overcome it. This suggests at least a mild pop in the SPX. At this juncture, it appears that yesterday’s high in the SPX will stand.

WTIC has just made a new low at 27.62, beneath its daily Cycle bottom at 27.67. It appears that crude oil two potential bottoms this week. The first Primary Cycle Pivot is today and the second on Friday. If it makes a new low beneath 27.56 today, then we will be expecting its Master Cycle low on Friday.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.