NDX, Banks and EuroStoxx All Tumble

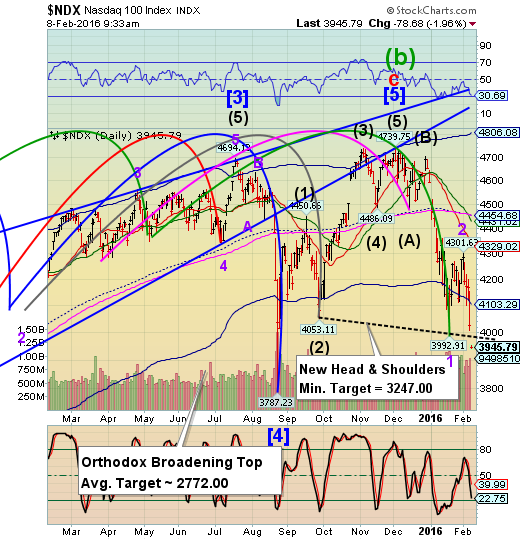

Stock-Markets / Stock Markets 2016 Feb 08, 2016 - 04:38 PM GMT NDX gapped down 76.48 points, putting it well beneath its Head & Shoulders neckline and its prior low.

NDX gapped down 76.48 points, putting it well beneath its Head & Shoulders neckline and its prior low.

ZeroHedge comments, “Just over two weeks ago, JPM's Marko Kolanovic, whose unprecedented ability to predict short-term market moves is starting to seem a little bizarre, warned that the next "significant risk for the S&P500" was the bursting of the "macro momentum bubble." Specifically, he said that there is an emerging negative feedback loop that is "becoming a significant risk for the S&P 500" adding that "as some assets are near the top and others near the bottom of their historical ranges, we are obviously not experiencing an asset bubble of all risky assets, but rather a bubble in relative performance: we call it a Macro-Momentum bubble."

In retrospect, following tremendous valuation repricings of several tech stocks, last week's LinkedIn devastation being the most notable, he was once again right. And over the weekend, he did what he has every right to do: take another well-deserved victory lap.

This is what he said in his February Market Commentary: "Tech Bubble Burst?"

The FANG stocks have been defanged.

The BKX is in even worse shape. I have not located the European Banks Index symbol, but the US and Europe should be in tandem. Notice the retracement did not even have enough strength to touch back the Head & Shoulders neckline.

European banks are in a bloodbath and now subject to bail-ins. ZeroHedge comments, “While the ongoing slaughter in European bank credit, and mostly counterparty risk, is troubling, it is nothing new: we have been showing it for over a month, most recently on Friday in "European Bank Risk Soars To 3 Year Highs, US Risk Rising."

EuroStoxx Index is at 2804.66, beneath its neckline and prior low.

This week is turning out as the Cycles Model suggested.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.