Stock Market Panic Decline Begins...

Stock-Markets / Stock Markets 2016 Feb 08, 2016 - 03:25 PM GMT Good Morning!

Good Morning!

SPX has plunged below 1860.00 this morning, challenging the Broadening trendline. Due to its position, the Broadening Flag appears to be a consolidation that allows the index to continue its former trend. I am not yet labeling the decline because the declining pattern may take several paths. Thus far, the pattern suggests that it may not stay at the trendline very long. Its next target appears to be at or below the Head & Shoulders neckline.

ZeroHedge reports, “The biggest event of the weekend, if not the month, was China's FX reserve outflow update, which at $100BN was slightly better than the $120BN expected (it pushed China's reserves to the lowest in nearly 4 years) but it was in the "no man's land" between the BofA best case scenario ($37.5BN), and the GS worst case ($197BN). And while there was some hope this number, together with China being offline for the next week could lead to some stability across markets, this is what we said yesterday about this indecisive number: "for markets, what this means is that the next month will likely be market by more of the same sharp, illiquid volatility that has characterized 2016 so far."

VIX futures are ramping higher as well, and may challenge the lesser Head & Shoulders neckline this morning.

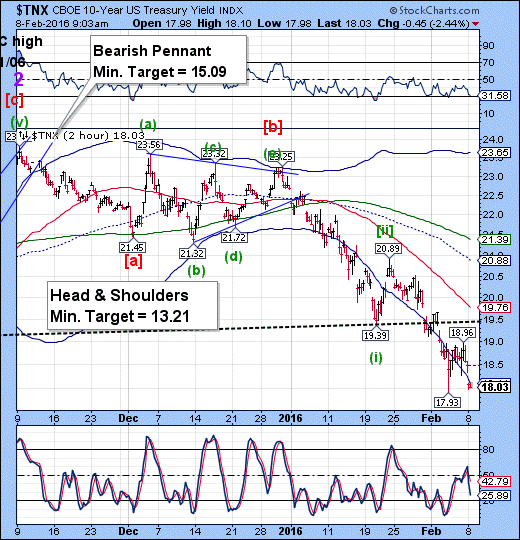

TNX resumes its decline this morning, It has gapped beneath its 2-hour Cycle Bottom and may now be in free-fall territory. We will continue to watch this index as it often gives us a “heads up” to what may happen next in SPX.

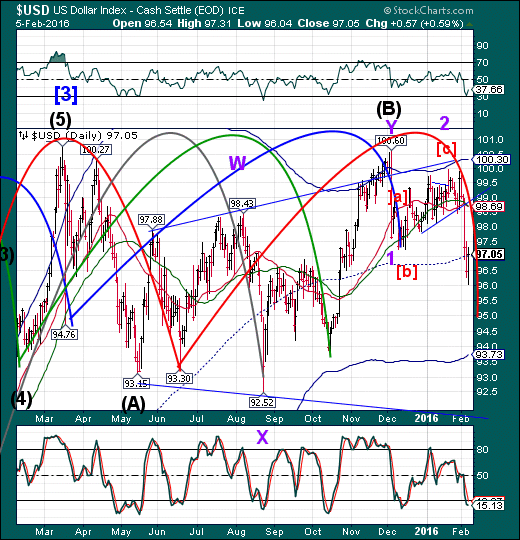

USD futures made a high at 97.49 this morning, possibly completing its retracement. The next move appears to target the Cycle Bottom at 93.73.

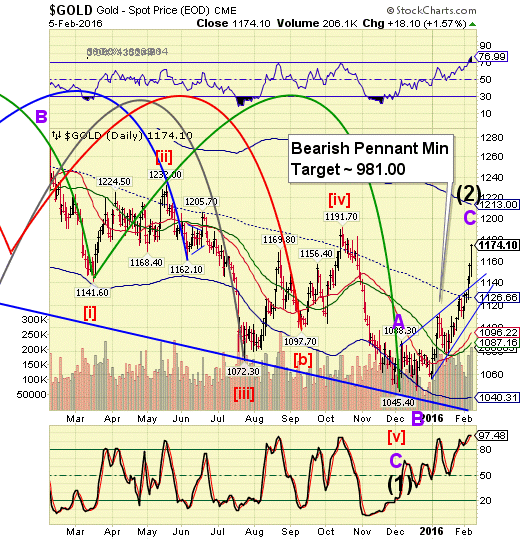

Gold reached 1184.00 this morning in a throw-over that appears to be aimed at its Cycle Top at 1213.00. This move may still be considered to be a retracement of the larger decline from its January 2014 peak at 1307.00. The prior high at 1191.70 may be the first line of resistance while a breakout above the Cycle Top at 1213.00 would have us re-evaluate our position on gold.

ZeroHedge reports, “Gold is now up over 13% from its pre-Fed rate-hike lows, having surged through its 200-day moving average by the most in 2 years. As bank risk spikes globally, it appears bonds & bullion are the investment of choice once again in the face of systemic fragility concerns. At 4-month highs, gold is nearing a crucial breakout point...”

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.