Why Crude Oil Prices Could Continue FALLING From Here

Commodities /

Crude Oil

Feb 07, 2016 - 04:08 PM GMT

By: Jesse

By Brett Eversole

By Brett Eversole

Oil prices HAVE to go higher... Or do they?

Crude oil is already down 17% this year. It broke into the $20 range last month. And the total fall since July 2014 is 72%.

You (and nearly everyone else) expect much higher oil prices after a crash like we've seen. But that's the problem...

Everyone expects oil prices to rise from here. I'm not saying the crown can't be right. But when everyone believes something, the opposite tends to happen. And that means lower oil prices from here are entirely possible...

What's most incredible about the fall in oil is that investors are still optimistic today. Like I said above, nearly everyone expects higher prices right now.

In fact, speculative bets on higher oil prices through exchange-traded funds (ETFs) have soared.

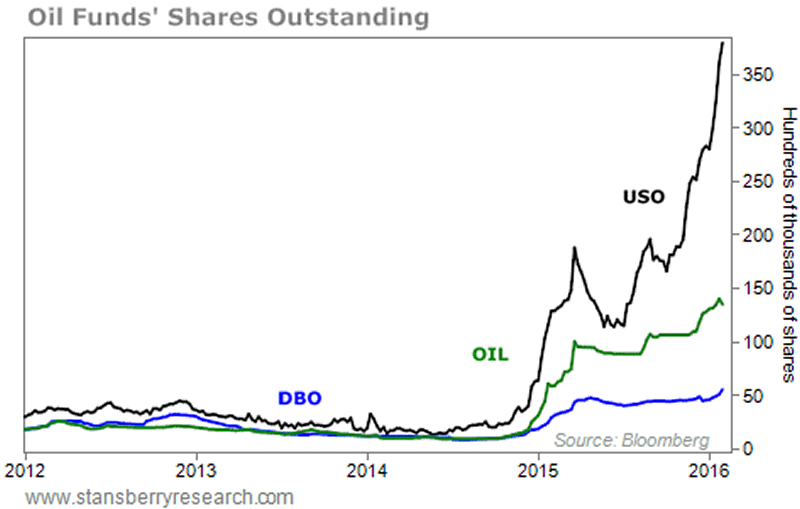

The chart below shows the shares outstanding for the largest three oil ETFs – the United States Oil Fund (USO), the iPath S&P GSCI Crude Oil Total Return Index Fund (OIL), and the PowerShares DB Oil Fund (DBO). These funds create and liquidate shares based on demand. So a rising share count shows investors are betting on higher oil prices.

Bullish bets soared in recent months as oil broke down to new lows. Take a look...

Combined, the three funds contain more than $4 billion in assets. That's real money betting on higher prices.

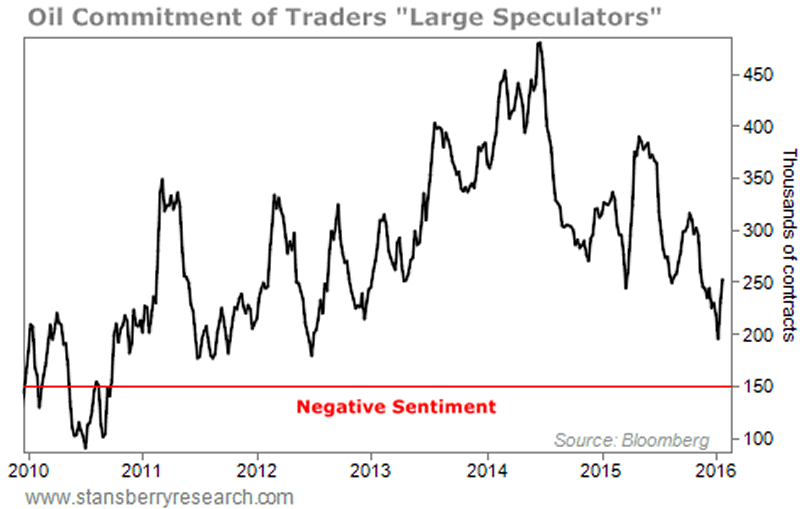

If we look at a larger market – the futures market – we again see that investors aren't at a negative sentiment extreme for oil. The chart below shows the Commitment of Traders ("COT") report for oil.

The COT report is a weekly report that shows the real-money bets of futures traders. It often acts as a contrarian indicator... When most futures traders bet against an asset, the asset is poised to bounce.

Today, the COT report shows futures traders are getting negative on oil. But they aren't at an extreme today. Take a look...

The chart shows "large speculators" in the oil market. They are considered the "dumb money" and are often wrong when they agree.

Obviously, bets have fallen dramatically from the mid-2014 extreme, which kicked off oil's dramatic fall. However, sentiment can still fall much farther before hitting a negative extreme.

Of course, none of this means an oil rally isn't possible. But right now, ETF investors are wildly bullish on oil. And futures traders aren't at a negative sentiment extreme.

The consensus on oil is that prices HAVE to go higher. I don't buy it. Sentiment is too positive. And that means the oil decline will likely continue.

Good investing,

Brett Eversole

Steve's note: As Brett mentioned, investors are still super bullish on oil right now... even though it's stuck in a downtrend. This is exactly what you want to see in a short trade.

And in our brand-new issue of

True Wealth Systems – out today after market close – we've found the perfect way to profit. This trade could deliver 20% gains in the next three months. To subscribe – and get this issue in your inbox tonight –

click here.

Source: http://www.dailywealth.com/3198/why-oil-prices-could-continue-falling-from-here

http://www.dailywealth.com

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

By Brett Eversole

By Brett Eversole