Gold Stocks Sector: Rubber, Meet Road

Commodities / Gold and Silver Stocks 2016 Feb 05, 2016 - 01:03 PM GMTBy: Gary_Tanashian

You may have noticed that I have written relatively little publicly about the gold sector over the last few years (we have covered it consistently in NFTRH to keep subscribers aware of the bear’s status, and protected against it). Is that strange for a writer who was probably known first and foremost as a ‘gold guy’? Not at all! It’s just that it is not desirable to get bogged down obsessing on a sector in a bear market when there are other fish to fry on the global macro landscape. But the process of finding and confirming a bottom in the gold sector is now front and center as more of the fundamentals that actually matter come into place. To those fundamentals, we need to marry the technicals.

You may have noticed that I have written relatively little publicly about the gold sector over the last few years (we have covered it consistently in NFTRH to keep subscribers aware of the bear’s status, and protected against it). Is that strange for a writer who was probably known first and foremost as a ‘gold guy’? Not at all! It’s just that it is not desirable to get bogged down obsessing on a sector in a bear market when there are other fish to fry on the global macro landscape. But the process of finding and confirming a bottom in the gold sector is now front and center as more of the fundamentals that actually matter come into place. To those fundamentals, we need to marry the technicals.

We have consistently worked a theme that sees a comparison to the 1999-2001 bottoming phase in the gold sector. That was a time when stock markets topped out, an economic counter cycle took hold and gold began out performing most other items. Within this, we have also been considering the possibility of a final washout within the sector, whereby prices decline despite continually improving fundamentals. This condition was in play in Q4 2008, which was the last great buying opportunity.

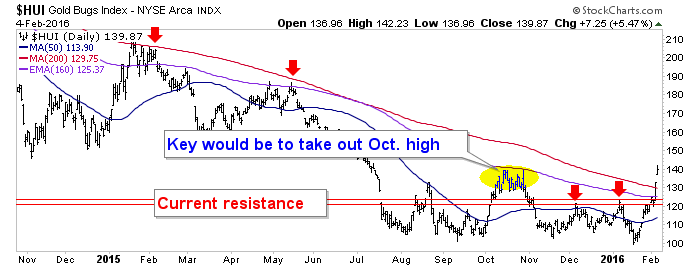

If the sector moves high enough in the near-term it will negate the final washout prospect by changing the intermediate trend to up. So where are we at? Let’s look at a simple daily chart, as used in NFTRH 380. We followed HUI as it broke resistance, hit the 200 day moving average and now, hits the final parameter at 140. As the chart states, this is the key to changing the intermediate trend to up; and I don’t mean by simply closing a day at or above 140. A weekly close and then some successful back testing are needed.

So this is HUI’s technical rubber that needs to meet the fundamental road in order to distinguish this bounce, as impressive as it has been, from those that came previously. Since both sector and macro fundamentals continue to improve, I for one am now interested in the sector to a degree well beyond any of the myriad bounces that have taken place to date in this bear market. As one ill-fated example of those, recall the disaster that the hype fueled summer 2014 bounce ended up being. Ukraine or Bird Flu, anyone? Those were promoted as fundamentals but in reality, they were phony baloney.

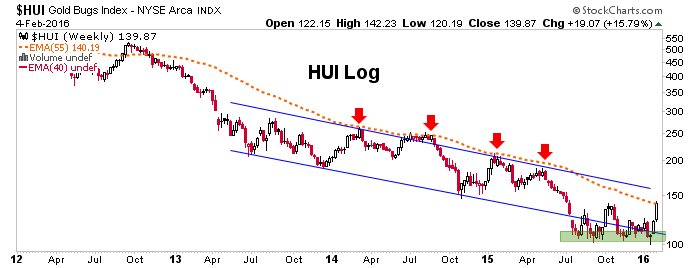

Above we see the daily situation. What about the weekly time frame? Well, we have been using these two charts in order to display why the bears were wishfully thinking in using a log scale chart to see what they wanted to see (a breakdown from a trend channel). For months, the gold bear cottage industry obsessed on (and shorted per) a breakdown that did not exist…

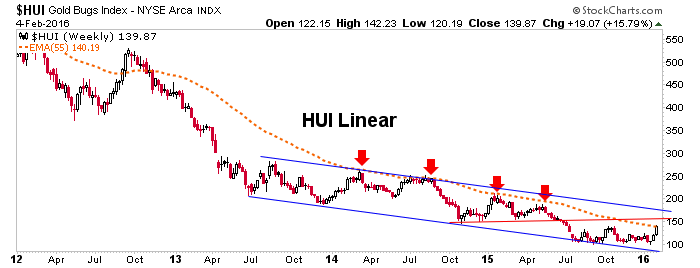

…as the linear chart made clear. It was best to leave the sector alone during that sideways phase, not try to trade it.

What both of these charts show however, is a potential limit point at the weekly EMA 55. That is interesting because it also happens to be at 140, which is the key parameter on the daily chart above. If the bounce really takes off the upper channel line awaits. These conditions would change the intermediate trend to up, but a new cyclical bull market would only be indicated by a rise above 261 (2014 highs).

It is ‘rubber meets the road’ time in the gold stock sector. The fundamentals are doing their part and now the technicals are more constructive, but have a lot of work to do as well. So far, so good. But be aware of the potential reaction points as illustrated above.

Market management has become infinitely more enjoyable for me in the last 6 months due to the firm signals that broad stock markets have made. It will become more so if the gold sector continues to improve fundamentally and technically. We will of course be defining events from short-term daily perspectives like that above to a long-term monthly analog of 1999-2001, which is playing out nicely. Consider an affordable subscription to NFTRH for grounded, hype-free, profitable (and risk-managed when appropriate) tracking of these events.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.