As the Stock Market Turns...

Stock-Markets / Stock Markets 2016 Feb 05, 2016 - 06:44 AM GMT SPX rallied to the Broadening trendline, then began impulsing down. The wackiness may be over and the puzzle appears solved. This may actually be a point 7 (an extra zigzag) within what is normally referred to as a five point reversal. All moves within the Broadening formation are corrective, which makes the outcome confusing and uncertain…until it is over.

SPX rallied to the Broadening trendline, then began impulsing down. The wackiness may be over and the puzzle appears solved. This may actually be a point 7 (an extra zigzag) within what is normally referred to as a five point reversal. All moves within the Broadening formation are corrective, which makes the outcome confusing and uncertain…until it is over.

The NYSE just announced “technical issues” as the market turned red this afternoon. However, sending in the algos may not save the day.

The next decline may be memorable.

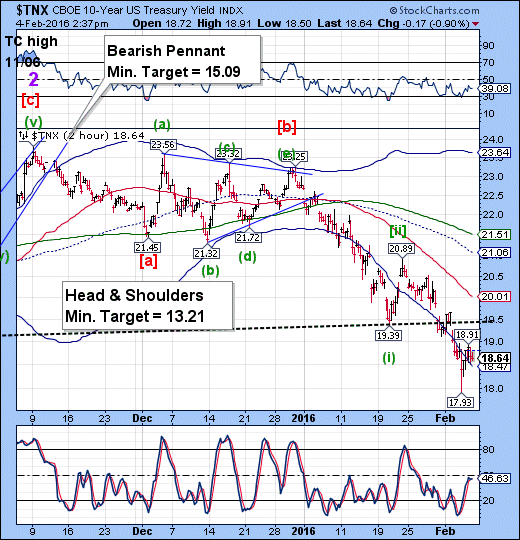

TNX has stayed neutral most of the day. However, it appears that it may change very quickly.

ZeroHedge writes, “The S&P 500 is currently down a little over 7% YTD and 11% of the May 2015 high. Unfortunately, all signs coming out of the bond market are signalling a further fall in equity prices.

The spread between AAA rated corporate bonds and the 10-year treasury bond has blown out to 213 basis points over the past couple weeks. This is the widest spread since September 2011, during another period of market turmoil.”

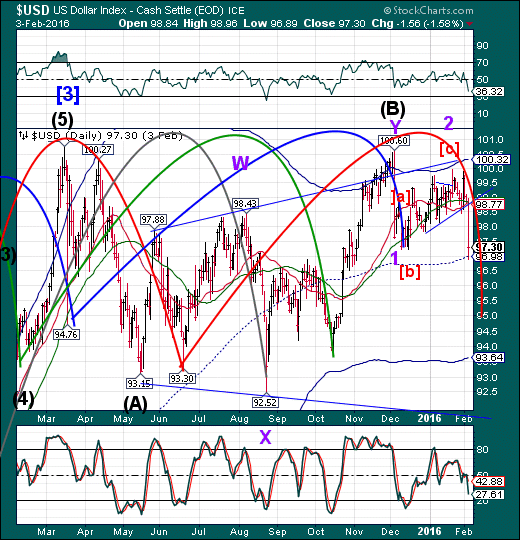

USD appears to be consolidating in a narrow range beneath mid-Cycle resistance at 96.98. It may push up to or above mid-cycle for a day, but may resume its decline to the Cycle Bottom to complete Wave [iii] in the next couple of market days.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.