Putin Cries Dyadya (Uncle), Is Saudi Arabia Listening?

Commodities / Russia Feb 04, 2016 - 12:59 PM GMTBy: OilPrice_Com

In recent days, signs of a possible breakthrough in the year-long stand-off between Russia and Saudi Arabia on crude production strategy have emerged. Saudi Arabia, OPEC's dominant member, has long insisted OPEC (read Saudi Arabia) would not reduce output to balance supply and demand absent corresponding cuts from non-OPEC members (read Russia), while Russia has consistently insisted harsh climactic conditions prevent Russian producers from reducing output and in any case Russia insists it could withstand low prices as well as any other country.

In recent days, signs of a possible breakthrough in the year-long stand-off between Russia and Saudi Arabia on crude production strategy have emerged. Saudi Arabia, OPEC's dominant member, has long insisted OPEC (read Saudi Arabia) would not reduce output to balance supply and demand absent corresponding cuts from non-OPEC members (read Russia), while Russia has consistently insisted harsh climactic conditions prevent Russian producers from reducing output and in any case Russia insists it could withstand low prices as well as any other country.

January 27, however, Russia announced, in a roundabout way, its willingness to cut. According to Bloomberg, the Russian Energy Ministry issued a statement that "Energy Minister Alexander Novak and the heads of Russia's biggest oil companies discussed the possibility of working with OPEC." The article also reported that Deputy Prime Minister Yury Trutnev told President Vladimir Putin that:

"There was a series of meetings with other governments last week on the issue of oil prices during the World Economic Forum in Davos, Switzerland. Oil exporters are talking about coordination because the current price is "unacceptable" to justify spending on exploration and field development".

These Russian comments were not the only signs of potential movement in the past week. At a conference in Kuwait City, Iraq's Oil Minister Adel Abdul Mahdi stated that "Saudi Arabia and Russia, the world's biggest oil producers, are now more flexible about cooperating to cut output as crude prices have fallen to levels that hydrocarbon-rich nations didn't foresee.

Many observers, however, have been quick to dismiss the significance of these public statements. John Kilduff, founding partner of Again Capital, and frequent CNBC oil contributor, commented January 29 on CNBC that:

"This whole story line about there being a coordinated production cut plan is just rubbish").

More generally, as this quote from a recent Bloomberg article shows, observers believe simply both sides are committed to their current (over)production strategy:

"There's little sign the countries themselves are ready to reach an agreement despite the economic damage wrought by the lowest prices since 2003. Long-standing obstacles remain -- Saudi Arabia's desire to defend market share, Russia's inability to cut production in winter months -- and analysts say talk of a deal probably reflects the hope of producers in pain rather than the expectation of concrete action".

In fact, skeptical observers dismiss these statements' implications at their own peril. Both the Saudis and the Russians are serious, as both have powerful motivations to agree on measures to balance the market through production cuts, reduce crude inventories, and increase prices.

The real question, instead, is whether their interests are sufficiently congruent to agree to simultaneous moves to balance the market.

With Their Economic Situation Dire, Are the Russians Desperate?

Over the last several months, as crude prices have renewed their plunge and taken the Ruble with them, Russian economic prospects have deteriorated sharply. Even a cursory review of press reports reveals the intensity of the economic pain.

At the World Economic Forum in Davos last week, Alexei Kudrin, Russia's respected former Finance Minister, stated—or perhaps warned—"We have two years in reserve [to overcome the economic crisis] when social sentiments will be stable. There are still social protests, they are growing, but they aren't bursting into something out of control".

Until recent weeks, the Russian government had some basis to harbor hope that GDP, after contracting ~3.5 percent in 2015, would return to growth within this two year window. As late as Q3 2015, the IMF estimated that in 2016, GDP would grow, if only anemically at below 1 percent.

Recent crude price action, however, has dashed such hopes and instead has raised the prospect of a deeper and longer recession. In a "stress" test it conducted in November, the Russian Central Bank estimated that with Ural crude prices below $40 per barrel between 2016-2018, the Russian economy would contract five percent in 2016, inflation would run at 7-to-9 percent, and that these conditions "would also raise risks to inflation and financial stability.

Central Bank efforts to stabilize the Ruble and contain inflation are one reason the "stress" test results may prove prescient. The plunge in crude prices is preventing the Central Bank from easing monetary policy to stimulate the economy. Friday, January 29, it announced that it would keep its benchmark interest rate at 11 percent, to support the Ruble (which fell as low as ~R82.5/US$ last week before recovering to ~RUB75.5/US$ on January 29) and contain inflation. In its announcement, it noted that its next move could be to raise rather than lower the benchmark rate, were inflationary pressures to increase.

Facing crude prices below $30 per barrel, Russian Finance Minister Anton Siluanov in a January 16 television interview said Russia now faced a RUB 1.5 trillion budget deficit ($38.6 billion at the time of the interview) and that this would force the government to rework the budget it approved in December, which was based on $50 Ural crude prices. Reworking, according to Siluanov, will entail cutting RUB 500 million in spending (from which the military, national security, and agriculture would be exempted) and finding RUB 1 trillion in additional revenue.

Finding this RUB 1 trillion confronts the Russian government with unpalatable choices. Russia's sovereign wealth/reserve funds have been proposed as sources—but in September, Siluanov warned that they would be depleted in sixteen months.

The Russian government is also contemplating asset sales (including part of its stake in Rosneft and in VTB, a major bank), but such sales would provide one-time boosts to revenue and in any case would take time to organize. Borrowing is a possibility, since Russia's sovereign debt is low, but the Russian government can't access U.S. and European capital markets, closed to it due to U.S. and EU sanctions related to the conflict over Ukraine).

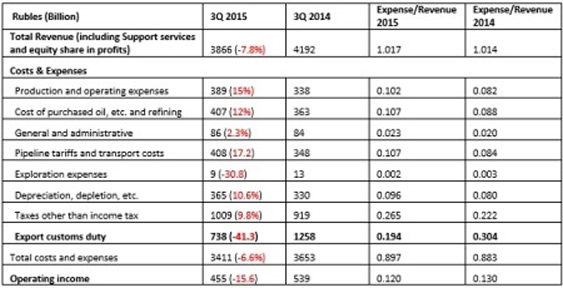

The Russian energy industry is also a target—and potentially a lucrative one, given the structure of Russian taxes on the industry. In 2015's first three quarters, for example, low crude prices decreased the revenues the Russian government collected in export customs duties from Rosneft, Russia's largest producer, by RUB 520 billion (RUB 1058 billion to RUB 738 billion), while taxes other than income taxes increased only RUB 80 billion, from RUB 919 billion to RUB 1009 billion).

It is therefore not surprising that in September, the Russian Finance Ministry attempted to increase the mineral extraction tax. Industry opposition and opposition from other Russian ministries—citing the negative impact on investment and output—forced it to back down (Venezuela is an example, admittedly extreme, of what happens when government raids on industry revenues to fund current operations squeezes investment). It proposed instead to slow down the planned decrease in crude export duty rate (from 42 percent to 36 percent. Also under consideration is a windfall profits tax on Russian energy exporters benefitting from the Ruble's depreciation.

Deteriorating Energy Industry Conditions

The situation of Russian energy producers is also difficult. The Telegraph (UK) in early January quoted Russia's deputy finance minister, Maxim Oreshkin, as telling TASS earlier this month that low crude prices could lead to "hard and fast closures in coming months." The article also said noted that in the key Soviet-era fields in western Siberia, the annual rate of depletion is averaging 8 percent to 11 percent, while new projects are being curtailed.

According to the Telegraph, Transneft, the Russian crude and product pipeline monopoly, estimated that Russian crude exports could decrease in 2016 by some 460,000 barrels per day, based on producer applications for pipeline capacity.

In an interview with TASS, the Russian news agency last week, Lukoil Vice President Leonid Fedun commented that Lukoil was unlikely to produce the one hundred million tons it produced in 2015. He also said that it made more economic sense to sell one barrel of oil for $50 than two barrels for $30.

Gazprom, Russia's natural gas giant, shows signs of stress. In recent weeks, it has instituted a series of cuts in investments. January 11, Reuters reported Gazprom cancelled one tender in December and three tenders in January for work on the construction of the Ukhta-Torzhok pipeline, a domestic key component of pipeline system which will transport natural gas directly to Germany through the Nord Stream II pipeline. According to Reuters, Gazprom Neft (of which Gazprom is the majority shareholder) recently terminated negotiations to acquire a 49 percent stake in Vietnam's Binh Son Refining and Petrochemical, a subsidiary of Vietnam's state-owned PetroVietnam.

A January 15 Reuters article quoted "sources close to Gazrpom" as saying that Chinese economic problems and low energy prices have reduced the volume of natural gas Gazprom expects to export to China via the Power of Siberia pipeline—the project on which Gazprom has bet its future—when it is completed. Given the already questionable economics of the Power of Siberia project, reduced volumes will intensify doubts about the project's financial viability and future (Putin Is Taking A Big Risk With China Gas Deals).

Overleveraged, Rosneft's Pain is Particularly Acute

The pain for Rosneft, the company which the Russian government hoped would gain the size necessary to compete on equal terms with Western oil majors, is particularly acute. As part of its effort to gain scale, the company in 2013 took on massive debt—$40 billion according to Reuters—to finance its acquisition of Russian competitor TNK-BP for $55 billion.

To help pay down debt, Rosneft, also in 2013, concluded an agreement with Chinese National Petroleum Corporation to supply 400 million metric tons of crude over twenty five years, under which Rosneft was entitled to receive prepayment equal to 30 percent of the contract's value (Rosneft received RUB 1027 billion in 2015 Q3).

At the end of Q3, Rosneft's net debt stood at $24 billion. Yet, Alexey Bulgakov, a fixed income analyst at Sberbank CIB estimates that Rosneft may already have accessed the maximum amount of cash it can under the deal, given the decline in price from ~$100-plus per barrel in 2013 to ~$30 per barrel now and the terms of the agreement. And, should crude prices remain at current levels, Rosneft likely cannot generate the cash to cover its investment, interest, and debt repayment obligations.

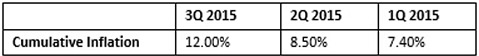

Russian government officials and energy producers argue that a depreciating Ruble has attenuated the impact of lower crude prices, since each US$ generates more Rubles, which is important given that the bulk of their expenses are in Rubles. This, however, isn't the only impact of a weak Ruble. It can also cause inflation, and this has been the case in Russia. The following table, from Rosneft's quarterly Management's Discussion and Analysis reports, provides the Russian Central Bank data for cumulative inflation over 2015's first three quarters:

For Rosneft, inflation has contributed to increased costs in all but one expense category compared to 2014's corresponding quarter (percentage change in red font in column 2 in the table below) and, because revenues declined in 2015, increased the ratio of that cost to revenue compared to the corresponding 2014 period (last two columns).

These two effects caused operating income through Q3 2015 to fall to RUB 455 billion from RUB 539 billion in 2014 (and, of course, in US$ terms, the value of the operating income decreased even more, since the respective average exchange rates were RUB 59.28/US$ and RUB 35.59/US$ in 2015 and 2014). In addition, if not for the 41.3 percent decrease in export customs duty—RUB 520 billion in absolute terms—operating income would have been negative RUB 65 billion through 3Q 2015 (RUB 455 billion minus RUB 520 billion).

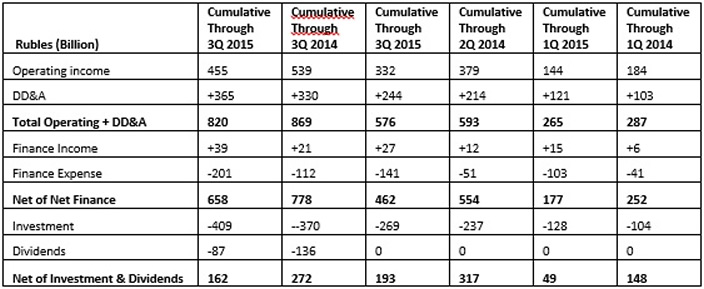

Reduced revenues and increased costs in 2015's first three quarters also reduced the amount of cash Rosneft generated to cover investment, dividends, and net finance expense (which includes interest paid, interest received, and operations with derivative financial instruments). The following table shows that the cash remaining after Rosneft's spending on net finance expense, investment, and dividends, after adding non-cash depreciation, depletion, and amortization expense back into operating income, declined significantly through three, six, and nine months of 2015 compared to 2014 in Ruble terms and, of course, even more in US$ terms given Ruble depreciation (RUB 59.28/US$ in 2015 versus RUB 35.59/US$ in 2014):

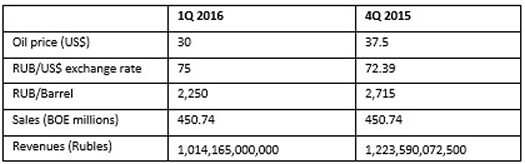

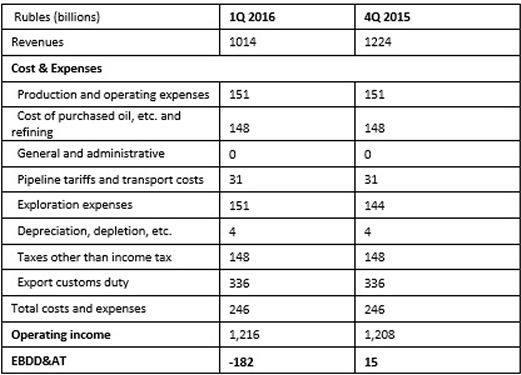

Given that average crude prices in Q4 2015 were substantially lower than in Q3 and that they likely will even lower in Q1 2016, Rosneft's financial operating results should also deteriorate substantially in these quarters. The following table projects Rosneft's revenues in Rubles in Q4 2015 and Q1 2016 using the Ruble's Q4 average US$ exchange rate and a guesstimate of the Ruble's Q1 US$ average exchange rate; an estimate of sales in volume terms, assuming output in 4Q 2015 continued to outpace 2014 levels by 2 percent and stayed constant in Q1 2016; and guesstimates of crude prices, taking into account Ural crude's discount to Brent, Rosneft's price competition in Europe with Saudi Arabia, and the impact on Rosneft prices in Europe and Asia from a prepayment agreement with Transneft that lowered its realized price per barrel (in Q1, Q2, and Q3, a reduction of RUB 200, RUB 40, and RUB 180 in Europe and RUB 170, RUB 350, and RUB 190 Rubles in Asia).

In the following table, 4Q costs are estimated using 4Q 2014 figures, multiplied by the percentage increase in costs in Q4 2015 from Q3 2015 (except for taxes and export custom's duty, which are the average quarterly cost in 2015).

This rough guesstimate of Rosneft's 4Q 2015 and 1Q 2016 performance suggests that the company will not generate sufficient cash to fund investment, dividends, and interest, and pay down debt.

From the Saudi Point of View

The Saudis and their Gulf Arab allies also have compelling reasons to consider production cuts to balance the global crude market and raise prices. They depend on revenues from crude and crude product exports as much as if not more so than the Russian government to fund government spending. Like the Russian government, they face serious domestic and international challenges—including wars and domestic tensions—that they counted on the export of crude and crude products to fund.

As a result of lost revenues and deteriorating budget numbers, the government are drawing on foreign currency and sovereign wealth resources, seeking to cut spending, including in such politically sensitive areas as subsidies for individuals and businesses, and to defer or cancel important investment projects (the UAE in recent days suspended the tender process for stage two of a project to build a 1,350 mile railroad from Kuwait the Indian Ocean along the Persian Gulf).

To raise revenue, they are introducing new taxes (such as on unoccupied land in Saudi cities) and contemplating asset sales (or which the Saudi plan to sell shares in Saudi Aramco and/or its downstream subsidiaries is a prime example).

OPEC dynamics are another important consideration. Other OPEC members—Venezuela, Algeria, Nigeria, Angola and Libya—repeatedly have called for output to be cut. In response, the Saudis have argued that OPEC cuts would be ineffective in the absence of simultaneous cuts from non-OPEC countries members. Were the Saudis and their Gulf Arab allies to reject a sincere Russian commitment to cut production, their credibility and authority within OPEC would suffer perhaps irreparable damage.

Also, for the Saudis, the plans to sell shares in Saudi Aramco and/or its downstream operations could play an important role. The price investors will be willing to pay for shares in these entities will depend on the value they place on the entities, and this value will depend on their assessment of the entities' management, strategy, and prospects. If, for example, potential investors believe that management, at the behest of the Saudi government, will sacrifice growth, profits, and dividends to achieve Saudi foreign policy goals through low prices, investors' interest might be tepid at best.

A Narrow Window of Opportunity for Russia for Coordinated Cuts

The Russians potentially enter any discussions with a weaker hand. The Saudis and their Gulf Arab allies probably can withstand lower prices longer than the Russians. Russia lacks the financial resources the Saudis and their Gulf Arab allies have at their disposal.

Their sovereign wealth funds and foreign currency reserves in absolute and per capita terms exceed Russia's, the value of their government owned energy assets are greater than the value of the Russian government's energy assets (which are already partially privatized), and Saudi Arabia and its Gulf Arab allies have access to international capital markets, whereas the Russian government, because of U.S. and EU sanctions, does not.

They also have the means to pressure Russia. The Saudis have spare capacity (according to the IEA have some '1.5~2.0 million barrels per day which they can bring on line within three months), while the Russians lack spare capacity. Finally, Russia's major energy companies report quarterly results, whereas with a few exceptions, Saudi and Gulf Arab energy companies do not. Thus, the Saudis have access to critical Russian microeconomic financial data, whereas the Russians do not have such access to Saudi and Gulf Arab data.

Possibly, if the Russian government believes its hand is weaker, it might consider it advisable to reach agreement expeditiously. After all, the Russian government should take into account that if Russian data during the first quarter shows declines in output and exports, as comments from Russian government and company officials cited above suggest might happen, and Q1 2015 financial reports show intensifying financial pressures on Russian energy companies, Saudis and their Gulf Arab allies might be tempted to decide to maintain pressure on prices and force Russia to absorb the cuts necessary to balance the global crude markets.

Article Source: http://oilprice.com/Energy/Energy-General/Russia-Cries-Dyadya-Uncle-Is-Saudi-Arabia-Listening.html

By Dalan McEndree for Oilprice.com

© 2016 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.