HUI Now Confirming Gold Price Move Higher

Commodities / Gold and Silver Stocks 2016 Feb 04, 2016 - 11:23 AM GMTBy: Dan_Norcini

The comatose mining stocks finally came to life today and showed signs of some determined buying, something that has been missing in the recent leg higher in the gold market.

The comatose mining stocks finally came to life today and showed signs of some determined buying, something that has been missing in the recent leg higher in the gold market.

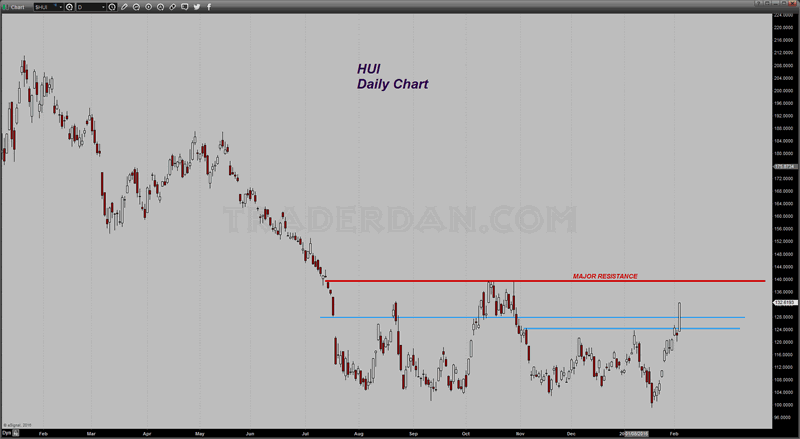

From a technical analysis perspective, the fact that they were able not only to breach that stubborn band of resistance near 125 which has kept them in check, but also managed to soar through the mid-July 2015 low near 128 is very impressive.

HUI Daily Chart

All that they need to do now is to take out 140 on a closing basis and we can say that they have bottomed out on a medium term basis. Short term they remain bullish now that they have bettered those two aforementioned resistance levels.

The reason I have not yet turned bullish on the miners on a medium term basis is because of the following medium-term chart.

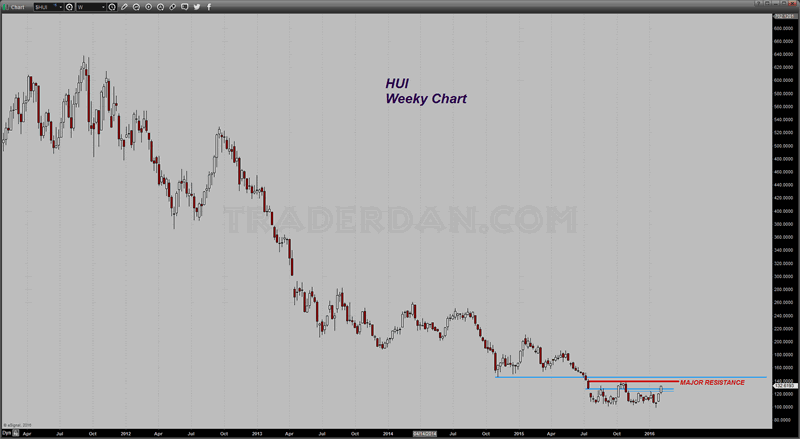

HUI Weekly Chart

As you can see when you pan out and take a bit of a longer term view, the current move higher in the HUI is not all that impressive. The HUI has not had a weekly close above that line marked "MAJOR RESISTANCE" since early July of last year. A close through that would turn me bullish on a medium term time frame especially if the close involved being above the October 2014 spike low near 145-146.

This rally may present an opportunity in the days ahead for those who are still holding an excessively lopsided position in the gold shares to whittle that down somewhat so that they can diversify and perhaps rebalance their portfolios. That being said, you would want to watch for some signs that the rally in gold has run its course, something which as of yet it has given no indication it is ready to do.

The big thing supporting the gold market at the moment is the turmoil in the foreign exchange markets which is resulting in massive deleveraging and unwinding of large positions in one direction, namely short most major currencies and long the US Dollar.

As the market comes to terms with the idea that the Fed is not going to make a move in their upcoming March meeting, the dial-back in interest rate differential expectations is forcing this repositioning. That of course is resulting in large scale US Dollar selling.

What is going to be incredibly fascinating to watch play out is the response from the European Central Bank and the Bank of Japan. Neither one of them can be the least bit pleased to see their respective currencies surging higher especially after both, but especially the BOJ, only just recently announced their displeasure with the Yen at current levels. We also know from the recent Mario Draghi remarks, that the ECB is incredibly frustrated with the lack of inflationary pressures across the Eurozone with Mr. Draghi repeatedly making a point of telling us all how their statisticians were going to have to lower their estimates for inflation for not only this year but also on out into 2017 and even 2018. The LAST THING they now want to see is the Euro at current levels.

This is really coming down to a battle or more properly a war, between speculative interests and those two Central Banks which have made it clear that a major component, if not the major component of their plans to combat deflation and stave off a sluggish growth model is by weakening their respective currencies. With specs repositioning and being forced out of existing short positions, the sheer size of the leveraged carry trades involving those two currencies, the Yen and the Euro, is going to make defeating this unwind quite a feat.

I know that the Bank of Japan is not afraid to take on the specs but when it comes to the ECB, that is entirely another different matter. Their resolve is always iffy for among currency traders they do not have near the respect that the mere mention of the BOJ engenders.

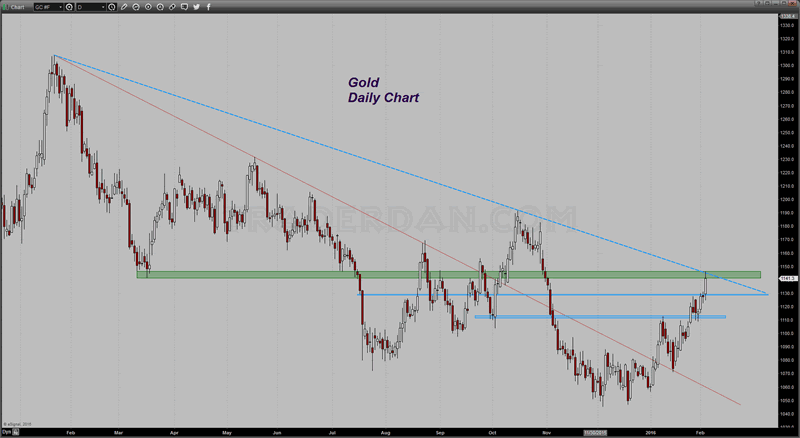

As far as gold itself goes, the metal has now run exactly to where the next chart level of resistance can be found.

Gold Daily Chart

Notice the downsloping trend line as it intersects with the lows made in March of last year. A push through this level will set up a legitimate shot at the October highs near $1190. Get through that and the medium term complexion of the gold chart will have changed.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.