Crude Oil Price Forecast 2016 As Good As It Gets

Commodities / Crude Oil Feb 04, 2016 - 10:53 AM GMTBy: Joseph_Russo

In observing the enormous triple digit percentage gains achieved amid Crude Oil's northward thrusts versus its debilitating double digit losses during its major spills, it becomes rather clear why market participants prefer buying low in a newly forming bull market vs. selling short at the onset of a bear market.

In observing the enormous triple digit percentage gains achieved amid Crude Oil's northward thrusts versus its debilitating double digit losses during its major spills, it becomes rather clear why market participants prefer buying low in a newly forming bull market vs. selling short at the onset of a bear market.

On a relative basis, in the not too distant future, a cyclical bottom will form and the long-term trend in Crude will reverse to the upside - providing bullish speculators with yet another rare opportunity at the chance of humongous triple digit upside returns.

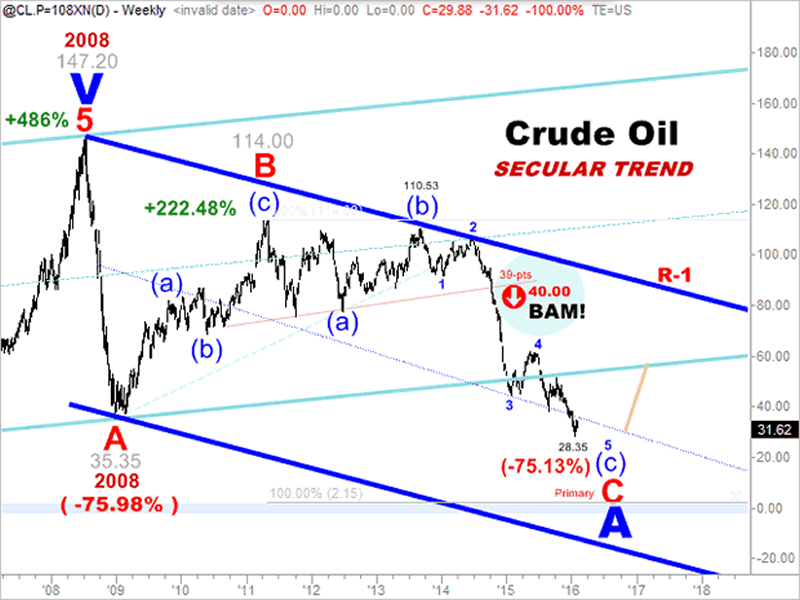

From an Elliott Wave perspective, the well-established secular trend dynamics in Crude Oil are rather clear. From a technical standpoint, this is as good as it gets.

Following a massive 486% run-up, and after cresting at its Cycle-Degree wave V in 2008, the sudden and devastating crash of 08' wiped-out 75% of Crude's value. By mid-2011, just two years later, cresting at only $114 per barrel in that go-round, Crude registered a primary degree B-wave advance north of 200% above its 2008 low of $35.35.

Thereafter, trading in a choppy sideways range through mid-2014, Crude has since succumbed to its primary C-wave decline, which has taken it down to fresh new lows and another 75% wipeout from its previous peak at $114.

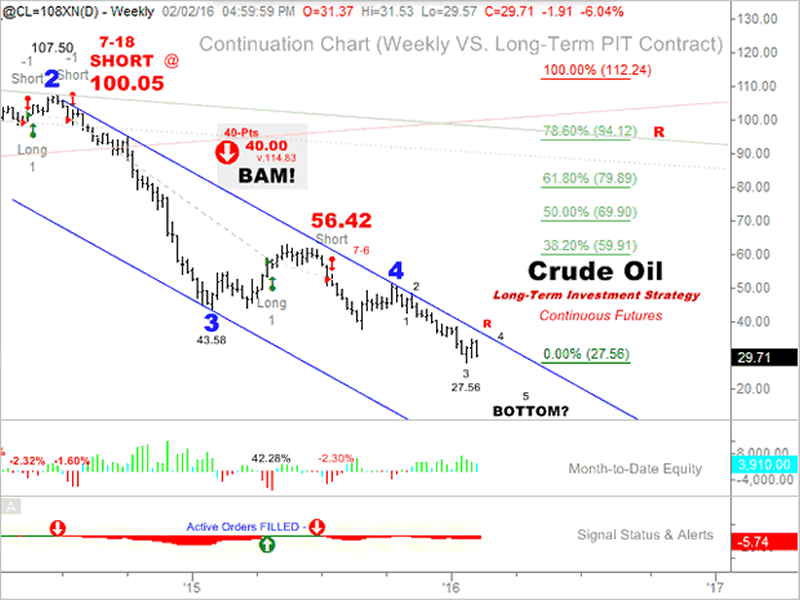

Since it is impossible to pinpoint and trade the precise tops and bottoms of each key pivotal Elliott Wave reversal, the only thing to do is attempt to trade and invest in the larger trends defined therein.

These rather elusive tradable-trends are quantifiably defined by a strict and specific set of conditional criteria that mathematically pre-determine when such trend changes are most likely to take place. Far from perfect, this trading and investment strategy is also as good as it gets - bar none.

Note how this prudent and unbiased investment strategy has automatically established both long and short positions, which are illustrated directly on the price bars over the last two years.

Also, note the resultant marginal losses and juicy percentage gains reflected in the lower month-to-date equity panel. The most recent short position established July 6, 2014 from a price of $56.42, as of the close on February 2, 2016 - is sporting another juicy gain north of 47%.

If you haven't noticed, we've pretty much stopped writing articles about the markets. Quite honestly, ... Click here to read the balance of this article.

The Long-Term Trend Monitor provides participants with unbiased guidance in this realm, and has an outstanding record of successfully navigating long-term market trends, especially at junctures such as these.

Until Next Time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2015 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.