Gold and Silver More 'Flight To Safety' Active February

Commodities / Gold and Silver 2016 Feb 03, 2016 - 06:55 PM GMTBy: Jesse

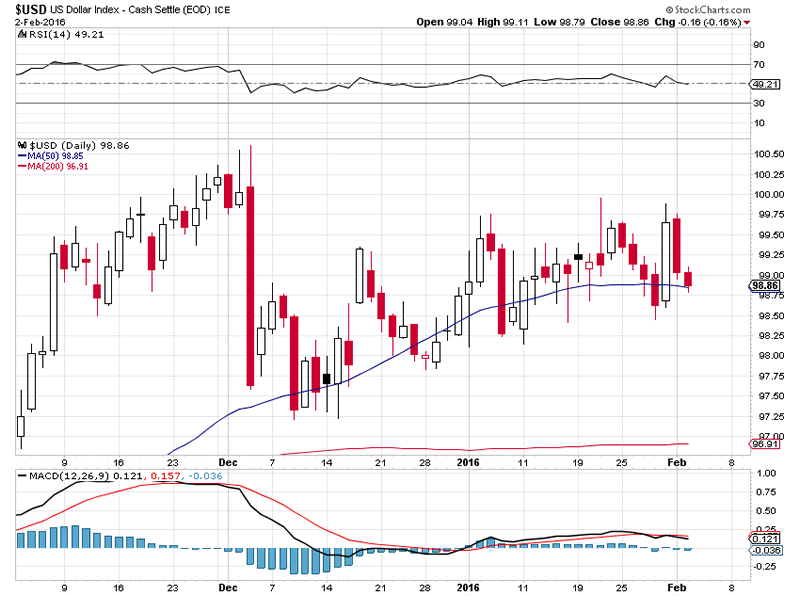

Gold showed some strength today in an add on to the flight to safety trade, even though there was a midday hit on price that was pure antics. The dollar moved lower and silver wallowed.

Gold showed some strength today in an add on to the flight to safety trade, even though there was a midday hit on price that was pure antics. The dollar moved lower and silver wallowed.

I posted an update to the NAV of Precious Metals Funds and Trusts today. Sprott has successfully absorbed the Central Gold Trust. It raised some cash and added substantially to their bullion and shares under management, so its a good deal for them. Let's see if time shows if it is a good deal for the trust unit holders.

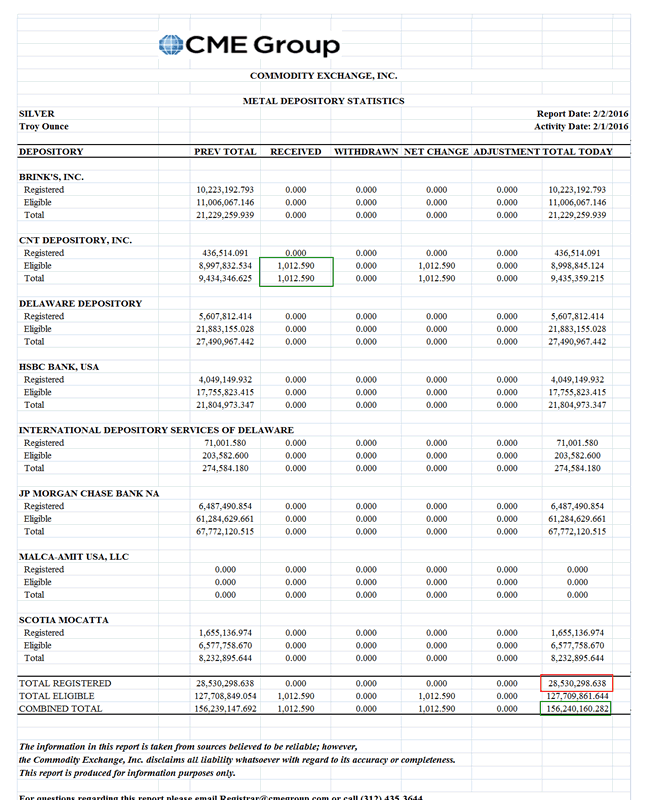

But that NAV report shows the gold/silver price ratio around 78, which is historically very high. This is I think one indication that this is a 'flight to safety' into gold for the moment.

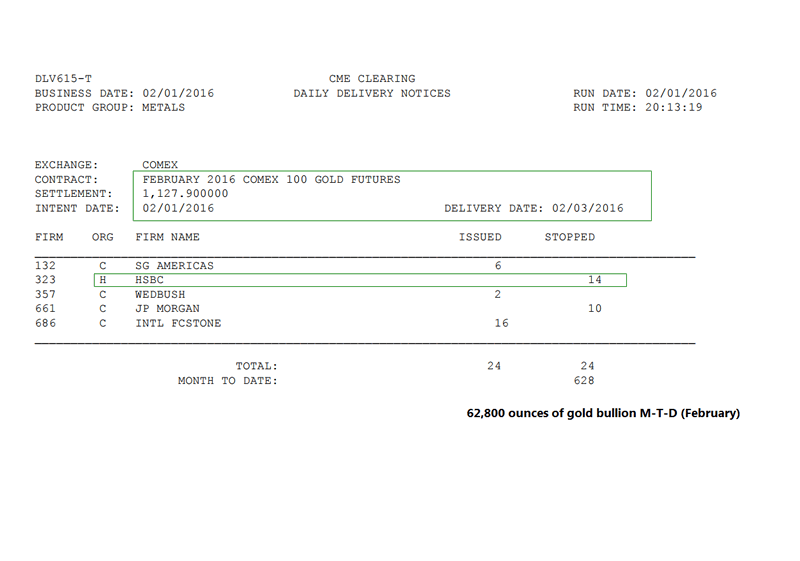

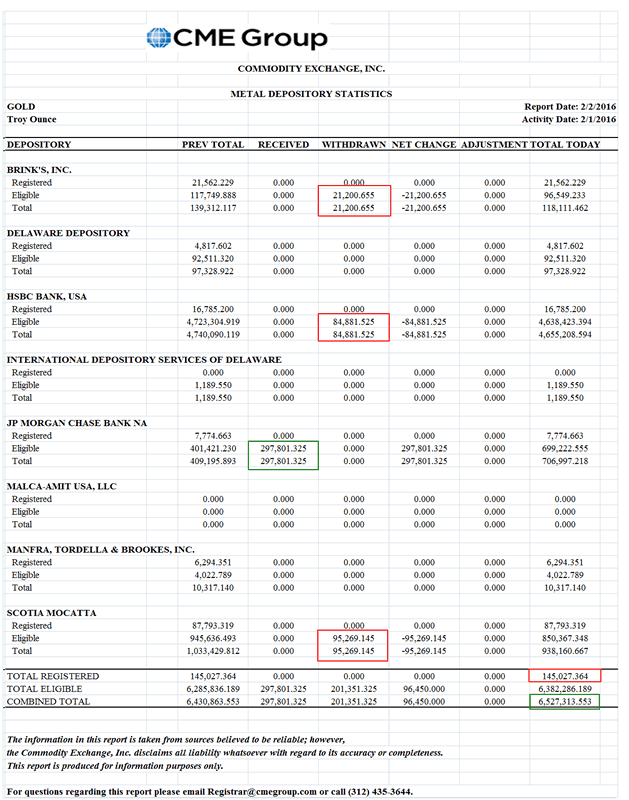

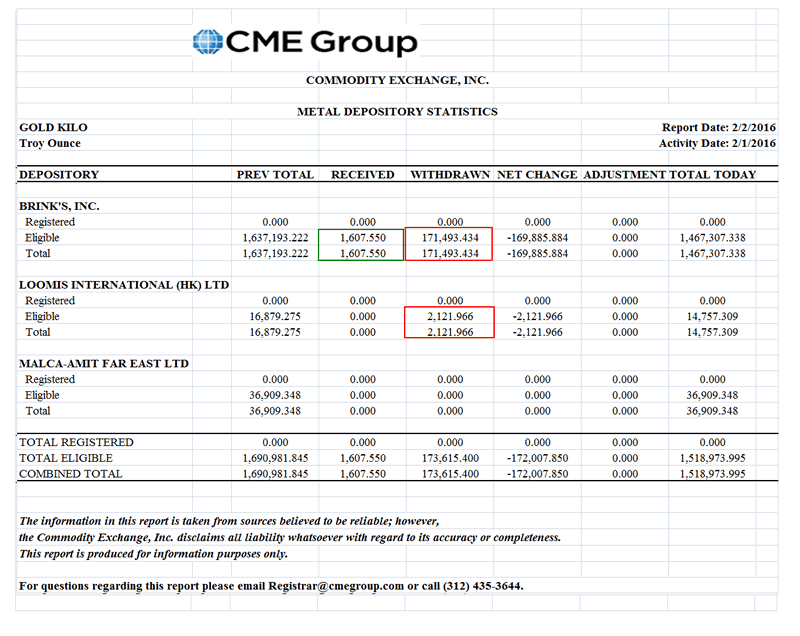

And February is an 'active month' for gold and that shows in the delivery report from The Bucket Shop which has seen 62,800 ounces of gold 'delivered' on the February contract so far.

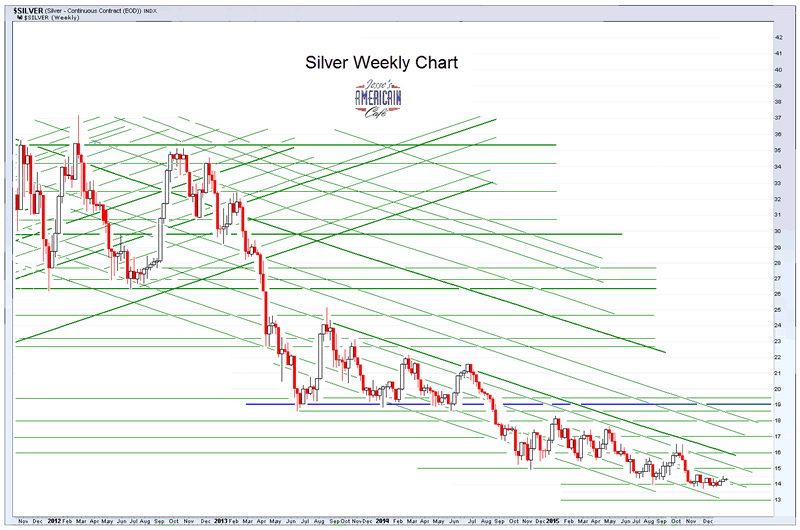

Silver has seen not nearly as much action, and the amount of registered for delivery silver bullion is now shockingly low as silver goes. I have high hopes for silver this year, but not while the precious metals are rallying as a safe haven.

But I would say that if I happened to hold any gold or silver bullion as a longer term holding, I would not have it in any unallocated form, or in storage associated with the Western metals trade. I can definitely see a short squeeze as a possibility, and as we learned from MF Global, possession is nine-tenths of the law.

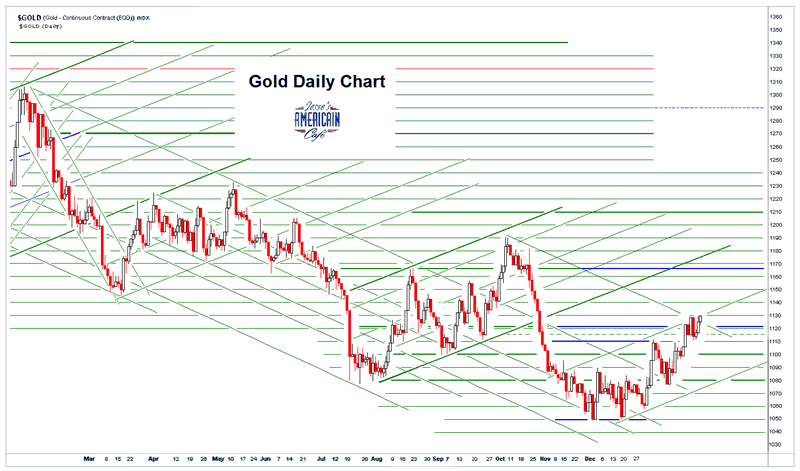

The 'cup and handle' formation for gold remains viable but not formed or activated.

As an aside, just by way of setting the level and not being too cryptic or misleading, my wife of 38 years has a stage IV colo-rectal cancer that at least for now has no cure. But they can control it, manage it somewhat, through surgery and chemotherapy, and they have been doing so for about five years. I have gotten to know the US healthcare system quite well. We have an excellent oncologist whom we just adore and a first class hospital in a large metropolitan area. This is why we are still here.

So on occasion I may be out of pocket, and there is no mystery to it. This is our life now. It is something we do, bearing up with the good and the ill, thanking all for His tender mercies. And I am with her every step of the way. I told her that I would be the day we first found out on a routine colonoscopy and they thought it was discovered early enough, but it was not.

What doctors do not understand about cancer even now is often a surprise to many. It is much better now than when my mother and father passed away from it some years ago, but it is still heavy on treatments which are expensive and non-specifically destructive.

And there are many different forms of cancer and they are not all the same. And each cancer can act differently and peculiarly from patient to patient, ebbing and flowing in their appearances, so many can get attracted to certain 'cures' that are correlated to a particular situation, a remission, but without genuine causation. The key factor seems to be to find a very good doctor in a very good and forward looking, patient oriented setting.

I also learned quite a bit more about prostate cancer lately, in addition to watching my father pass away from it ten years ago, but thankfully need to learn no more as it was good news. I will say that the biopsy for prostate cancer is surprisingly uncomfortable. And some of the misinformation floating about is also surprising, even among otherwise informed and intelligent people who again confuse anecdotal 'cures' with scientific cause and effect.

And this is just my impression, but too often research is being driven by private grants and money, and commercial incentives. I think the government is missing a huge opportunity here and for all the worst reasons.

I just wanted to put that issue on the table so you will understand my absences going forward as they occur. I don't need any real help on this, but your prayers are always welcome, always, as I remember you all, and I do.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2016 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.