Stock Market Seasonality Is Out of Season

Stock-Markets / Seasonal Trends Feb 03, 2016 - 04:42 PM GMTBy: Chris_Vermeulen

A “rally” attempt is underway. Stocks are continuing to rebound and all is well with the World? Or is it? With each passing day, the United States plummets deeper and deeper into a “black hole” of debt, of which it will be almost impossible to repay. At the time, of this writing the national debt is $18,939,663,109,937!

A “rally” attempt is underway. Stocks are continuing to rebound and all is well with the World? Or is it? With each passing day, the United States plummets deeper and deeper into a “black hole” of debt, of which it will be almost impossible to repay. At the time, of this writing the national debt is $18,939,663,109,937!

To put this into perspective, the national debt is so bad that if every citizen (including children) were to help pay it off, each one of us would have to contribute $58,652.00.

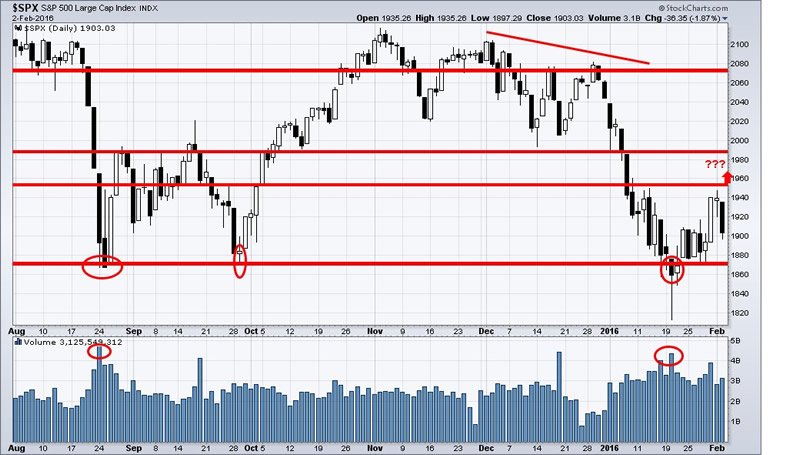

In the last couple of weeks, I have informed you of this “rebound” in the US Markets. Yesterday, February 2nd, 2016, a sharp fall in the markets was recorded.

Major support levels have held, perhaps slightly bent last month, but they did not break. Major support level of the SPX is 1880. If this support is breached, it may drop to 1861 before it rebounds. I do not see the SPX sustaining below 1880.

Markets are once again expected to bounce back.

I still have a bullish bias for the market, in fact if my analysis is correct it could last until March 24th.

But if we do get more downside from this current level it would create another wave of “Panic Selling” and we must hold above the low of January 20th, 2016 or it may be the start of the next bear market for large-cap stocks sooner than later.

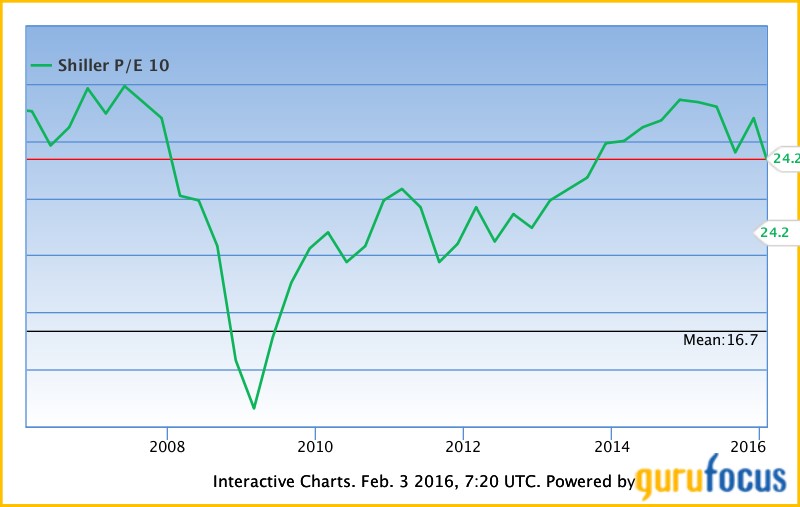

The U.S, Stock Markets have not reacted to any bad news, as of yet. The markets are at their fourth highest level of valuation, in history, according to the Shiller P/E Model. Professor Robert Shiller, of Yale University, invented the Schiller P/E to measure the markets’ valuation. The Schiller P/E is a more reasonable market valuation indicator than the P/E ratio, because it eliminates fluctuations of the ratio, caused by the variation of profit margins, during business cycles. There are only three other periods, in time, that these ratios occurred (1929, 2000, 2007) in with we measured similar readings when the market topped or should I say triggered market crashes and multi-year bear markets…

Short term I’m still bullish but the longer-term bias remains firmly BEARISH!

Get My Trading Forecasts and Trade Signals Today.

Join Us Today & Make 2016 Winning A Year For Your Trading Account: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.